As Warner Bros. Discovery reports its first earnings call of 2024, CEO David Zaslav is grappling with fundamental questions shaping the entire media and entertainment industry's future, such as how to:

- Leverage premium linear assets to a streaming-first present and future

- Properly price, package and distribute live sports

- Grow profits in DTC after productions ramp back up

- Develop franchise IP

- Consider M&A options

This central question looms large: can WBD successfully navigate its solo voyage against giants like Netflix and Disney, or will consolidation with another legacy media player be the end game?

Streaming Subs Down, Profits Up

Adding Discovery content onto the rebranded Max platform in May 2023 may have created a four quadrant service, but it has not led to the subscriber growth that WBD execs hoped for, with global streaming subscribers shrinking in both Q2 and Q3 of 2023.

Max is still in the top tier of streamers by total on platform demand (all movies and TV series available), but it is a distant third place to Netflix and Disney in global subscribers, with no immediate path to break out of that position.

Even though it lost subscribers during that time, WBD turned a profit in its DTC segment for two quarters in row — helped by the lack of production costs forced by the Hollywood labor strikes. Growing profits here will be crucial as WBD looks to pay down $45B in debt on the books. But will the slowdown of new content cause subs to take a further hit?

HBO Production Delays

HBO will always be the crown jewel of WBD — or any future corporate daddy that may take over in the coming years — and the Max platform is more reliant on demand for cable-originating content than any other major platform.

This is exactly the kind of content that was the most heavily impacted by the recent work stoppage. House of the Dragon will debut its second season this summer, but new seasons of zeitgeist defining hits The Last of Us, Euphoria and The White Lotus won’t arrive until 2025.

The performance of True Detective: Night Country should reassure WBD execs worried about prolonged gaps between new episodes of marquee series. Demand for the latest season grew 80% with global audiences compared to season three (which aired in 2019), and 167% with US audiences.

While that level of audience demand growth may prove to be an outlier, it shows HBO can grow audiences despite multi-year gaps in new seasons. However, WBD will still need to keep audiences engaged in its ecosystem until those HBO series come back. The company hopes a new approach to sports streaming will be part of the answer.

"Spulu" and NBA rights

WBD is placed at the center of two high profile media stories for the rest of the year — the NBA’s media rights renewal and the upcoming sports streamer joint venture with Disney and Fox, nicknamed “Spulu” until further notice.

Fundamentals of the sports bundle have yet to be unveiled. Most importantly: what will the price be? Will it replace Max’s ‘Bleacher Report Sports Add-On’? Will this be a better value than Hulu+Live TV or YouTube TV? Do consumers actually want something like this? Expect analysts to focus here on today’s call.

With the meeting of the sports media minds at the NBA All-Star Game in the rearview window, the league is likely to finalize its highly anticipated media rights deal in the coming months.

WBD is a front runner to maintain a good portion — it’s hard to imagine Inside The NBA anywhere besides TNT — but how much of its former inventory is split up between a tech-backed streamer and possibly NBC remains to be seen. Most importantly: how much will WBD and Disney be willing to pay to renew? The answer to this question will shape the future of linear TV for the next decade and beyond.

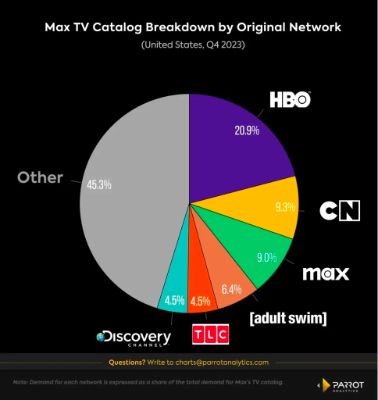

Max Catalog Breakdown

- Max serves as the first-run platform for HBO’s renowned legacy series, new releases, and original content created specifically for streaming. HBO network content accounts for approximately 21% of the demand for Max’s TV catalog, with Max originals contributing another 9%.

- Max enriches its offerings by including content from several subsidiary networks, such as Cartoon Network, Adult Swim, TLC and Discovery Channel, collectively accounting for 25% of the platform’s television demand.

- This chart also highlights the massive reliance the Max platform has on series that originate on its cable channels. In fact, 76% of the demand for content on Max is from cable-originating series. The platform with the next highest percentage of cable-originating demand is Disney+, with 53%.

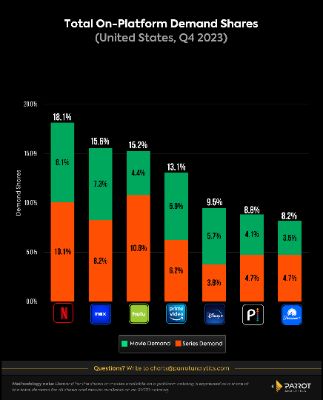

On-Platform Demand Shares

- While demand for original content drives subscription growth, library content is key for customer retention, an increasingly crucial element of all streaming strategies as consumers have more choice and easier ways to cancel than ever.

- Max in Q4 2023 stood higher than HBO Max did one year ago (14.2% in Q4 2022), but that wasn’t enough to vault it ahead of Netflix, and it’s less than half a percentage point ahead of third place Hulu.

- Once Hulu (15.2%) and Disney+ (9.5%) are combined, the fully operational Disney streamer should easily top both Netflix and Max when it comes to total on-platform demand for content.

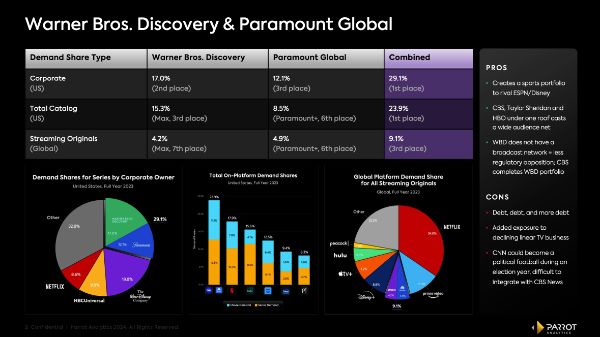

M&A Cheat Sheet: WBD and Paramount

- News broke in December that these company’s principals had met and discussed merging. Wall Street did not respond kindly, and both stocks are down double digits since that report came out.

- However, as Paramount’s value continues to shrink, this may be its best option that doesn’t include selling the company for parts.

- If Paramount were acquired and its sports rights added onto the Spulu offering, this would significantly boost the value of a standalone sports streamer, bringing in CBS Sports (i.e. more NFL games) into the fold.

- While Zaslav built his business on cable, it’s unclear whether he has the stomach to further expose his company to the shrinking linear TV business.

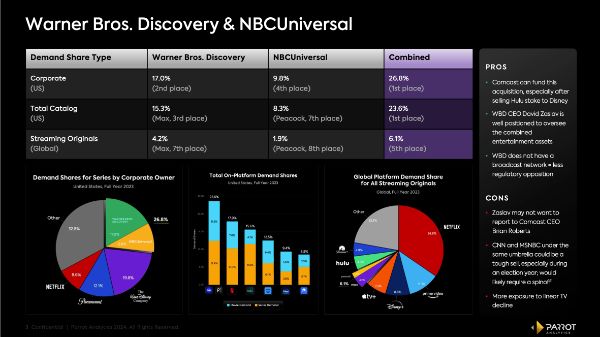

M&A Cheat Sheet: WBD & NBCU

- A hypothetical combination of these companies makes sense from a scale perspective — it would leapfrog Disney as the number one media company in corporate demand share and a combination of Max and Peacock would jump ahead of Netflix as the top platform in total catalog demand share.

- While WBD’s lack of a broadcast network could make this hypothetical deal more palatable than others, one major hurdle is dealing with CNN. It’s hard to imagine CNN and MSNBC/NBC News all under the same umbrella, and the possibility could incur heavy regulatory and political opposition.

- While WBD CEO David Zaslav is well positioned to lead an entertainment company like this, it remains to be seen whether he would be willing to report to Comcast CEO Brian Roberts.

Greenpeace: Taranaki - Greenpeace Activists Stop Unloading Of Palm Kernel Sourced From Indonesian Rainforests

Greenpeace: Taranaki - Greenpeace Activists Stop Unloading Of Palm Kernel Sourced From Indonesian Rainforests Seafood New Zealand: Seafood Situation Saved By A Sausage - New Plymouth Locals Innovate, Using Crayfish Bait

Seafood New Zealand: Seafood Situation Saved By A Sausage - New Plymouth Locals Innovate, Using Crayfish Bait Takeovers Panel: Takeovers Panel Convenes Meeting To Inquire Into The Acquisition Of Shares In NZME Limited

Takeovers Panel: Takeovers Panel Convenes Meeting To Inquire Into The Acquisition Of Shares In NZME Limited WorkSafe NZ: Conveyor Belt Death-Trap Was A Danger In Plain Sight

WorkSafe NZ: Conveyor Belt Death-Trap Was A Danger In Plain Sight Commerce Commission: 2degrees Fined $325,000 For Misleading Claims About ‘Free’ Aussie Business Roaming

Commerce Commission: 2degrees Fined $325,000 For Misleading Claims About ‘Free’ Aussie Business Roaming  Natural Hazards Commission: Hub Launched To Empower Architects And Engineers To Build Above Code

Natural Hazards Commission: Hub Launched To Empower Architects And Engineers To Build Above Code