Small Business Sales Fall For First Time Since 2021 Auckland Lockdown

Xero, the global small business platform, today released its Xero Small Business Index for the September 2023 quarter, which showed small business sales fell, while jobs growth remained strong.

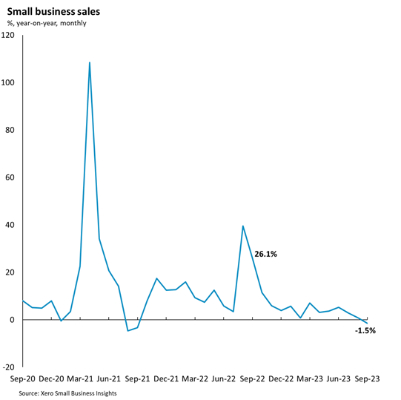

Sales fell 1.5% year-on-year (y/y) in September 2023, the first monthly decline in sales since September 2021, when Auckland small businesses were under Covid-19 lockdown restrictions.

Overall sales averaged 0.7% y/y for the September quarter, down from the average of 4.3% y/y in the first half of 2023.

By region, the weakest average sales growth in the September 2023 quarter was Taranaki (-3.9% y/y), Waikato (-2.3% y/y), and Manawatu-Whanganui (-1.2% y/y). These declines were offset by sales growth in Hawke’s Bay (+5.4% y/y), Auckland (+1.7% y/y) and Otago (+1.5% y/y).

Xero Country Manager, Bridget Snelling said September’s weak sales growth is disappointing but not unexpected given the challenging economic climate - with high interest rates, persistent inflation and weak sales.

“Sales are inconsistent across the country, with some regions facing more challenging times than others. Customers don’t have much leftover to spend buying from small businesses once they’ve covered household and utility expenses, and it’s clear this is having a real impact on sales.”

Over the three months to September, only three sectors reported positive average monthly sales growth; hospitality (+1.4% y/y), other services* (+1.4% y/y) and construction (+0.1% y/y).

Alternatively, sales in agriculture were down 5.4% y/y, potentially reflecting the broader slowdown in the international economy impacting exports of New Zealand's agricultural goods.

Furthermore, retail trade was down 2.6% y/y as high interest rates and the cost-of-living crisis continued to impact Kiwi household spending.

Global sales comparison

New Zealand sales growth is now a significant step behind Australia, which delivered a steady 5.5% y/y growth in September 2023.

New Zealand sales growth also dropped slightly behind the United Kingdom, which had +1.1% y/y growth over the same period.

“It’s clear we’re sitting in the middle of the pack when you look at the latest data coming out of North America, with the US experiencing a 7.7% drop and Canada a 5.6% drop in June 2023.

“With our new Government focused on the economy and bringing down inflation, it will be interesting to see how this impacts the country’s small business sales over the next quarter,” says Snelling.

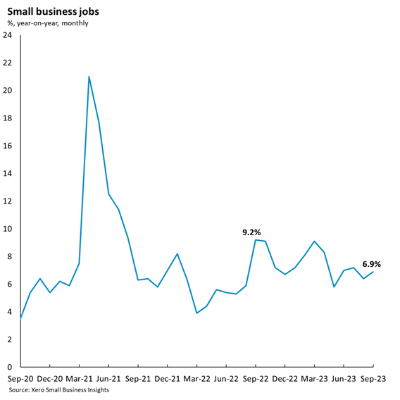

Job growth continues to strengthen year-on-year

Despite weak sales results, jobs growth remained strong with a 6.9% y/y rise in September 2023.

“It’s good to see that despite the drop in sales, small business owners across every industry and region remain eager to hire talent, with jobs growth averaging 6.8% y/y for the September 2023 quarter,” says Snelling.

“This rebound in employment following the pandemic is both consistent and impressive, as small businesses continue to compete with large businesses for talent. However if sales continue to trend downwards, this fast pace jobs growth could be difficult for small businesses to sustain.”

Other services* (+11.0% y/y), manufacturing (+7.5% y/y) and hospitality (+7.2% y/y) had the strongest jobs growth in the September 2023 quarter, with agriculture (+3.4% y/y) tracking as the weakest industry over this period.

By region, tourism-focused Otago (+8.3% y/y) led jobs growth for the September 2023 quarter, followed by Canterbury (+7.8% y/y) and Auckland (+7.7%). Alternatively, Waikato reported the smallest jobs growth out of all the regions, but still had a strong result of 5.2% growth compared to this time last year.

Wage growth below 2022 peaks, late payments steady

Wages rose 3.5% y/y in September, with an average growth of 3.4% y/y in the September 2023 quarter. This was down from the most recent peak of 6.5% in November 2022 and the average of 5.4% last year.

“Although small businesses may welcome this drop in wage increases, wage growth still remains below inflation. This puts small businesses in a vulnerable position as real wages are falling, meaning small business sales could remain under pressure.”

The hospitality sector (+4.2% y/y) had the largest wage rise in the September 2023 quarter, while agriculture continued to lag behind other industries with only 2.3% y/y growth during the same period.

Furthermore, Kiwi small businesses were paid on average 6.0 days late in September 2023, and 6.4 days in the September 2023 quarter.

Across sectors, the longest late payment times in the September quarters were seen in manufacturing (8.3 days), followed by real estate (7.1 days).

Small businesses in agriculture (4.6 days) and construction (5.5 days) saw the shortest late payment periods.

Small businesses need more support

“The drop in small business sales is a concerning factor which shouldn’t be overlooked.

“It’s clear the road ahead remains challenging for our small businesses as inflation, interest rates and the cost of living stay top of mind. That’s why it’s crucial to keep supporting them wherever possible and shop local when we can.

“We also encourage small business owners to look into the digital tools available, which have been carefully designed to help manage cashflow and streamline operations to improve productivity.”

For further information on the Xero Small Business Insights September quarter metrics, please refer to the XSBI New Zealand update. To find out more about how the Xero Small Business Index is constructed, see the methodology.

*Other services include a range of personal services such as hairdressers, beauty, funeral and religious services.

NIWA: Students Representing New Zealand At The ‘Olympics Of Science Fairs’ Forging Pathway For International Recognition

NIWA: Students Representing New Zealand At The ‘Olympics Of Science Fairs’ Forging Pathway For International Recognition Coalition to End Big Dairy: Activists Protest NZ National Dairy Industry Awards Again

Coalition to End Big Dairy: Activists Protest NZ National Dairy Industry Awards Again Infoblox: Dancing With Scammers - The Telegram Tango Investigation

Infoblox: Dancing With Scammers - The Telegram Tango Investigation Consumer NZ: This Mother’s Day, Give The Gift Of Scam Protection And Digital Confidence

Consumer NZ: This Mother’s Day, Give The Gift Of Scam Protection And Digital Confidence NZ Airports Association: Airlines And Airports Back Visa Simplification

NZ Airports Association: Airlines And Airports Back Visa Simplification Netsafe: Statement From Netsafe About Proposed Social Media Ban

Netsafe: Statement From Netsafe About Proposed Social Media Ban