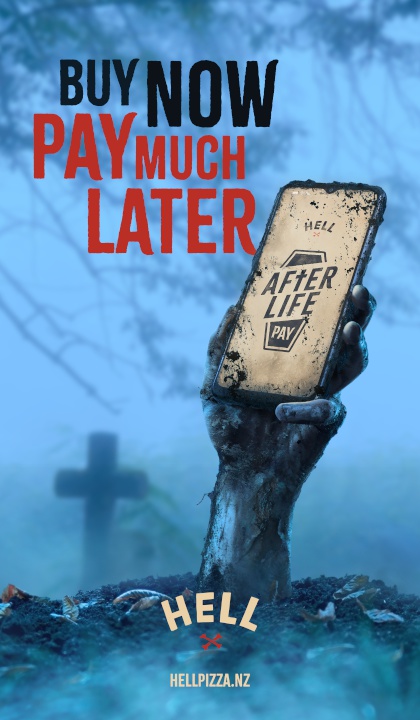

Pay From The Grave - HELL Takes Aim At ‘buy Now Pay Later’ Schemes

As the heat turns up on ‘buy now pay later’ schemes trapping a growing number of Kiwis in spirals of debt, HELL is launching AfterLife Pay, where customers don’t have to pay for their pizza until they’re dead, with no late fees or penalties.

Customers will be eligible for AfterLife Pay, with those chosen invited to sign a real amendment to their wills, allowing the cost of their pizza to be collected upon death. No interest or fees will apply, and the agreement is legally binding.

Ben Cumming, CEO of HELL, says AfterLife Pay came about after they were approached by buy now pay later (BNPL) providers who wanted HELL to offer the service to its customers.

“We’re seeing a growing number of people using the schemes to buy essential items like food, and we think it’s taking it a step too far when you’ve got quick service restaurants like ours being asked to offer BNPL for what is considered a treat - especially when you consider people are falling behind in their payments and 10.5 per cent of loans in NZ are in arrears,” he says.

This week, Australia’s federal government announced it would regulate the BNPL industry to avoid financial abuse by the lending schemes. However, while the New Zealand government has announced it will also regulate the industry - applying the Credit Contracts and Consumer Finance Act 2003 to the sector - final regulations are yet to be confirmed, including the proposal that affordability assessments only be carried out for purchases that are $600 or higher.

“An investigation from Consumer NZ describes the schemes as ‘addictive’ and says being approved is easier than getting a credit card - when you add in the late fees and penalties, people can get into debt fast. We don’t think people should do this for their pizza - we would prefer they purchase HELL within their financial means,” Cumming says.

Initially a trial, anyone interested in AfterLife Pay can apply, with 666 people then selected; the offer has also been extended to 666 people in Australia. They will then sign an online legally binding agreement, amending their will, for the total of their chosen order.

Cumming says pizza is one of the simple joys of life, and AfterLife Pay means people can get their fix without having to dip into the bank account immediately.

“AfterLife Pay is a light-hearted campaign that reinforces HELL’s stance on buy now pay later schemes - you can have your pizza and eat it too without any pesky late fees or penalties”.

You can apply for AfterLife Pay here and read the scheme’s terms and conditions. Applications are open from today.

https://img.scoop.co.nz/media/pdfs/2305/Hell_AfterLife_Pay_Codicil_to_will.pdf

About HELL

Established in Wellington in 1996, HELL pizza has grown to become one of New Zealand's most infamous and well-known brands, with 77 franchises throughout New Zealand and more than 1,200 staff. Behind the irreverent brand, HELL focuses on quality products at good value, offering Kiwi consumers an ethical option in convenience foods and specialising in catering carefully for all dietary requirements. In 2015 HELL was the first NZ company to offer free-range pizzas, and in 2020 launched carbon-neutral deliveries, offsetting the more than 1 million deliveries it makes each year. HELL supports a range of causes - including the New Zealand Book Awards for Children and Young Adults and IHC's Project Active and is an active member of the local communities in which it operates.

Antarctic Heritage Trust: NZ-made ‘Cutting-Edge’ VR Experience Tours The UK

Antarctic Heritage Trust: NZ-made ‘Cutting-Edge’ VR Experience Tours The UK Brian Gaynor Business Journalism Initiative: Brian Gaynor Initiative Business Journalism Funding Award Moves To Rolling Applications

Brian Gaynor Business Journalism Initiative: Brian Gaynor Initiative Business Journalism Funding Award Moves To Rolling Applications  Inland Revenue: Fifth Anniversary Of The SBC Loans - Time To Repay

Inland Revenue: Fifth Anniversary Of The SBC Loans - Time To Repay Te Runanga o Ngati Hinemanu: First Marae Based Fresh Water Testing Science Lab Grand Opening 16-17 May 2025

Te Runanga o Ngati Hinemanu: First Marae Based Fresh Water Testing Science Lab Grand Opening 16-17 May 2025 Raise Communications: NZ Careers Expo Kicks Off National Tour Amid Record Unemployment

Raise Communications: NZ Careers Expo Kicks Off National Tour Amid Record Unemployment Hugh Grant: How To Build Confidence In The Data You Collect

Hugh Grant: How To Build Confidence In The Data You Collect