Paramount Global continues to face the same fundamental issues as its fellow legacy media conglomerates: how to balance declining but still profitable linear businesses with scaling a flagship streaming service that is deep in the red.

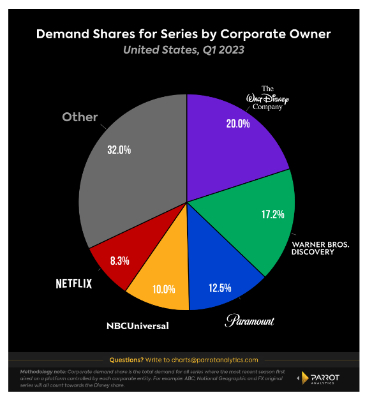

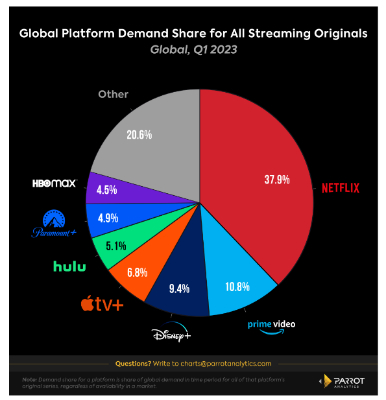

In terms of demand for and value of its content, here is how Paramount Global and Paramount+ stack up in some key measures of audience demand as of Q1 2023:

- Paramount Global US Corporate Demand Share: 12.5%, 3rd place

- Paramount+ US Total Catalog Demand Share: 9.2%, 6th place

- Paramount+ US Originals Demand Share: 6.0% (record high), 7th place

- Paramount+ Global Originals Demand Share: 4.9% (record high), 6th place

Paramount+ continues to rise in both streaming original and on-platform demand share, but the service has not fully leveraged Paramount Global’s valuable library into a top tier general entertainment streaming service in terms of demand and subscribers.

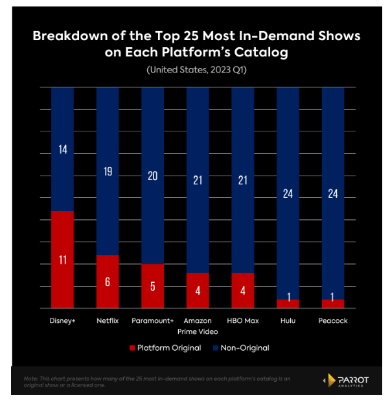

Of the 25 most in-demand shows available to US consumers on Paramount+ in Q1 2023, 21 were owned or produced in house — hinting at the value of the CBS and Nickelodeon catalogs in particular. However, of those 21 series, only seven were exclusively available on Paramount+, meaning a majority of the platform's top 25 most in-demand series are unlikely to be major subscriber acquisition or retention drivers.

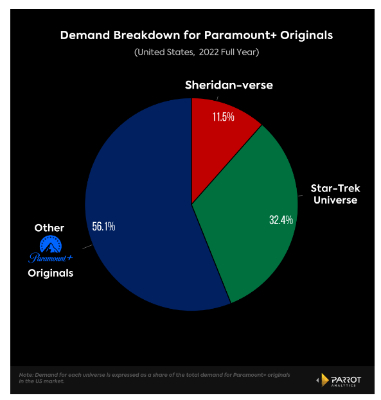

Of the above top 25, five were Paramount+ Originals — all five either Star Trek or Taylor Sheridan series. In fact, Star Trek and Taylor Sheridan series made up a combined 43.9% of the audience demand for all Paramount+ Originals with US audiences in 2022. Expanding these franchises must be a key strategy for Paramount+ moving forward.

Paramount+ has been one of the fastest growing major streamers in the last two years in both audience demand share and subscribers, but it is still far behind the industry leaders. It’s hard to see how the platform can fully scale without Paramount Global clawing back the streaming rights of its high value linear library, led by CBS procedurals, Nickelodeon content, and Yellowstone. But scaling this way would mean giving up hundreds of millions of dollars in licensing revenue at a time when Wall Street values profits over subscriber growth.

Corporate Demand Share: US, Q1 2023

- Corporate demand share can assess which companies have the most valuable content to license. This analysis can effectively help value a conglomerate’s legacy and library content in aggregate.

- As it has since the Warner Bros. Discovery merger went through in April 2022, Paramount Global remains in third place in this category, ahead of NBCUniversal and Netflix.

- Paramount Global’s corporate demand share sat at 12.5% in Q1 2023, up from 12.0% in Q4 2022.

- This chart shows the benefits of potential M&A activity in the near future. While broadcast networks would complicate a potential union with NBCUniversal, Paramount Global and Warner Bros. Discovery would combine for 29.7% corporate demand share, dwarfing Disney’s 20.0%.

Streaming Originals Demand Share: Global, Q1 2023

- Paramount+ hit new record highs of demand share for streaming originals in both the US and worldwide in Q1 2023.

- Globally, Paramount+ hit 4.9% in Q1 2023, a record. Since the March 2021 rebrand, Paramount+’s global original share has grown from 3.2% to 4.9%. Paramount+ is in sixth place globally, ahead of HBO Max (4.5%) and just behind Hulu (5.1%).

- Since rebranding as Paramount+ in Q 2021, Paramount+’s US originals demand share has grown from 3.8% to 6.0%. With US audiences, the platform sits just behind HBO Max (6.1%), and is a few new hit series away from overtaking Hulu (7.0%).

Paramount+ Franchise Demand

- What content has been driving Paramount+'s demand share and subscriber growth? It has largely been original series from two franchises: Star Trek and the unofficial ‘Taylor Sheridan Universe.’

- The two franchises accounted for 43.9% of the US demand for Paramount+ Originals in 2022.

- Expanding these universes should be an essential component of Paramount+’s growth strategy.

- The Taylor Sheridan universe is a rare commodity: a truly home grown streaming era franchise that did not come from pre-existing IP.

- Sheridan’s Tulsa King achieved exceptional global demand in Q1 2023, putting it in the top 0.2% of all TV series across all platforms worldwide. This validates Paramount’s investment in Taylor Sheridan, and suggests that the international appeal of Sylvester Stallone remains strong.

- While these two franchises have little audience overlap, they should both do a good job of retaining their core fanbases as Paramount+ subscribers, a necessity for any major competitor as the streaming era enters its next phase.

Top 25 Breakdown: Originals vs Non-Originals

- While demand for original content drives subscription growth, library content is key for customer retention, an increasingly crucial element of all streaming strategies as the market matures and consumers are offered more choice and easier ways to cancel than ever.

- This chart shows why library content is so important as a subscriber retention driver for majors SVODs, showing how reliant most streamers are on TV series that aren't platform originals.

- Paramount+ is doing a better job of promoting its original series than most of its competitors.

- In Q1 2023, Peacock (Poker Face) and Hulu (The Orville) had just one original each in their 25 most in-demand on platform series.

Hugh Grant: How To Build Confidence In The Data You Collect

Hugh Grant: How To Build Confidence In The Data You Collect Tourism Industry Aotearoa: TRENZ 2026 Set To Rediscover Auckland As It Farewells Rotorua - The Birthplace Of Tourism

Tourism Industry Aotearoa: TRENZ 2026 Set To Rediscover Auckland As It Farewells Rotorua - The Birthplace Of Tourism NIWA: Students Representing New Zealand At The ‘Olympics Of Science Fairs’ Forging Pathway For International Recognition

NIWA: Students Representing New Zealand At The ‘Olympics Of Science Fairs’ Forging Pathway For International Recognition Coalition to End Big Dairy: Activists Protest NZ National Dairy Industry Awards Again

Coalition to End Big Dairy: Activists Protest NZ National Dairy Industry Awards Again Infoblox: Dancing With Scammers - The Telegram Tango Investigation

Infoblox: Dancing With Scammers - The Telegram Tango Investigation Consumer NZ: This Mother’s Day, Give The Gift Of Scam Protection And Digital Confidence

Consumer NZ: This Mother’s Day, Give The Gift Of Scam Protection And Digital Confidence