Paramount Global is a top three player when it comes to Corporate Demand Share with US audiences, but the company’s valuable catalog has yet to translate into a top tier streaming service.

Paramount+, now with Showtime, has shown steady growth over the last two years, but it still lags the industry frontrunners in key areas of audience demand share and topline subscriber numbers.

On the bright side, Parrot Analytics’ Content Valuation data suggests the conglomerate has the goods to sharply increase its licensing revenue by dipping into its high-value catalog.

While the licensing strategy of Paramount's corporate predecessors in the late 2010s has often come under fire (Exhibit A: Yellowstone on Peacock), that exact move to mint money now is increasingly desirable on Wall Street.

Paramount Global’s path to long term viability will likely involve:

- Leveraging its linear assets to become a leading content arms dealer.

- Domestically, build up Paramount+ with Showtime with a loyal subscriber base focused around kids content, live sports and news, the Star Trek franchise, and the Taylor Sheridan universe.

- Internationally, utilize SkyShowtime partnership with NBCUniversal to split costs and generate higher ROI for streaming efforts.

As global and US SVOD subscriber growth tapers off throughout the industry, Paramount Global is in a prime position to supply the kind of subscriber retention-driving content — such as CBS's proven hit sitcoms and procedurals — all the major players will need.

But this very strategy points to the conundrum facing all of today’s industry leaders: how to balance increasing revenue without diluting the long term prospects of a flagship streaming service?

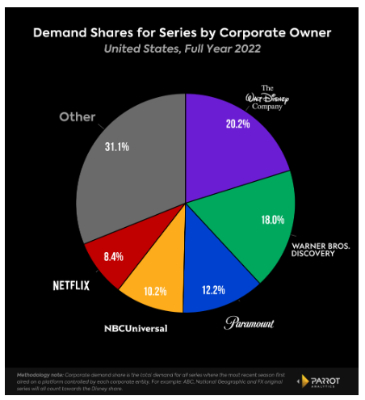

Corporate Demand Share: US, 2022

- Corporate demand share assesses the long-term prospects of media companies as they look to consolidate their original content’s availability exclusively onto their own platforms.

- However, with Wall Street’s mandate to focus back on profits, this view of the entertainment landscape can also be used to assess which companies have the most valuable content to license out, rebooting one of the original revenue streams in the TV business. It can effectively help value a conglomerate’s legacy and library content in aggregate.

- While still in the top three,

Paramount Global is trending down in this category, losing

more corporate demand share than any of the top five media

companies in 2022 vs. 2021:

- Netflix: 7.7% to 8.4% (+0.7%)

- Disney: 20.1% to 20.2% (+0.1%)

- NBCUniversal: 10.8% to 10.2% (-0.6%)

- Warner Bros. Discovery: 18.9% (WarnerMedia + Discovery) to 18.0% (-0.9%)

- Paramount Global: 13.4% to 12.2% (-1.2%)

- This data shows that Paramount Global stands to derive significant revenue from its library content by licensing out its most in-demand series.

- Recent Parrot Analytics Content Valuation data revealed that Criminal Minds — a CBS catalog staple — on Netflix was targeting a significantly higher number of at-risk churn customers than the average title, making it a high-value series to Netflix.

- Info like this can be used by CBS and Paramount Global to renegotiate licensing deals and increase revenue at a time when Wall Street is demanding profits over subscriber growth at all costs.

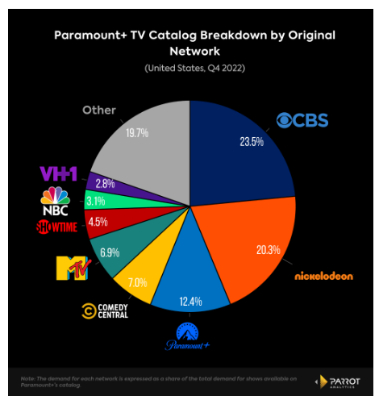

Paramount+ TV Demand by Original Network: US, Q4 2022

- A breakdown of audience demand by original network shows how important Paramount Global’s linear networks are to Paramount+.

- TV series debuting on CBS (23.5%), Nickelodeon (20.3%), and Comedy Central (7.0%) accounted for a majority of the audience demand for all series on Paramount+ in the US in Q4 2022. Paramount+ Originals made up 12.4% of the total demand for TV series available on the platform.

- Nickelodeon accounting for one fifth of the total demand for TV content available on Paramount+ points to the importance of children’s content in Paramount Global’s long term strategy.

- While

Paramount+ has grown steadily, it still has a ways to go to

catch up to more in-demand streamers such as Netflix,

Disney+, and HBO Max. For the full year 2022, this is how

Paramount+ fared in some key categories of audience

demand:

- US TV Catalog Demand Share: 8.3%, 5th place

- US Total Catalog Demand Share: 7.9%, 6th place

- US Movie Catalog Demand Share: 7.2%, 6th place

- Global Streaming Originals Demand Share: 4.2%, 7th place

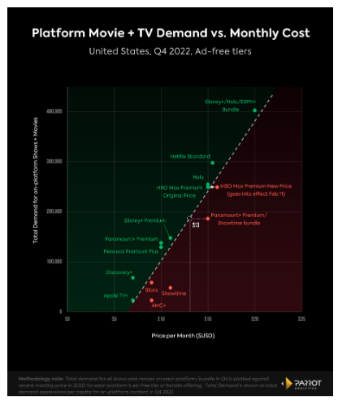

Fair Price for Paramount+ With Showtime

- The key question consumers ask themselves when presented with yet another SVOD: is this one worth it?

- Parrot Analytics data reveals that most major streaming services are slightly underpriced when plotting the overall popularity of their catalogs against the ad-free monthly subscription cost in the US.

- Showtime as a standalone SVOD was being sold for $11/month. Our analysis shows that based on the level of audience demand for the platform’s catalog, a fair price was closer to $7.50/month, suggesting consumers were overpaying by about 50%.

- The Paramount+ and Showtime bundle is slightly overpriced at $15/month. With the two services combined, we estimate a fair price around the $13/month mark.

- Overall, consolidating Showtime onto Paramount+ is a move in the right direction. The combined platform is a much more attractive proposition for the consumer, and will make it more likely for Paramount Global to scale its flagship streaming service.

- Paramount+ has successfully leveraged the Star Trek and Taylor Sheridan franchises for subscriber growth, and the combined platform will attempt to build out Showtime franchises in Billions and Dexter.

Demographic Data: Showtime & Paramount+ Originals

- A breakdown of demographic data for the audiences of Paramount+ and Showtime Originals shows how the two will complement one another on the combined service, Paramount+ with Showtime.

- Paramount+ Originals — highlighted by the Star Trek franchise, and the ever-expanding Taylor Sheridan universe — have a distinct lean towards an older, male audience.

- Showtime Originals — such as Dexter and Yellowjackets — while also leaning older, draw a much more heavily female audience.

- Together, these original series will provide a relatively balanced audience when it comes to gender, but Paramount+ will need to look elsewhere to bring in a younger audience.

Canterbury Museum: Mystery Molars Lead To Discovery Of Giant Crayfish In Ancient Aotearoa New Zealand

Canterbury Museum: Mystery Molars Lead To Discovery Of Giant Crayfish In Ancient Aotearoa New Zealand Ngā Pae o te Māramatanga: Māori Concerns About Misuse Of Facial Recognition Technology Highlighted In Science

Ngā Pae o te Māramatanga: Māori Concerns About Misuse Of Facial Recognition Technology Highlighted In Science Retail NZ: Retailers Call For Flexibility On Easter Trading Hours

Retail NZ: Retailers Call For Flexibility On Easter Trading Hours WorkSafe NZ: Worker’s Six-Metre Fall Prompts Industry Call-Out

WorkSafe NZ: Worker’s Six-Metre Fall Prompts Industry Call-Out PSGR: Has MBIE Short-Circuited Good Process In Recent Government Reforms?

PSGR: Has MBIE Short-Circuited Good Process In Recent Government Reforms? The Reserve Bank of New Zealand: RBNZ’s Five Year Funding Agreement Published

The Reserve Bank of New Zealand: RBNZ’s Five Year Funding Agreement Published