Cut The Card: 5 Ways Kiwis Are Reducing Credit Card Debt

News highlights:

- Spending limits, alerts and cutting up their card are ways Kiwis are doubling down on debt

- 19% have debt that will take up to 6 months to settle

- How to do a balance transfer

25 January 2023, New Zealand – Lingering debt is weighing on Kiwis, according to new research from global comparison site Finder.

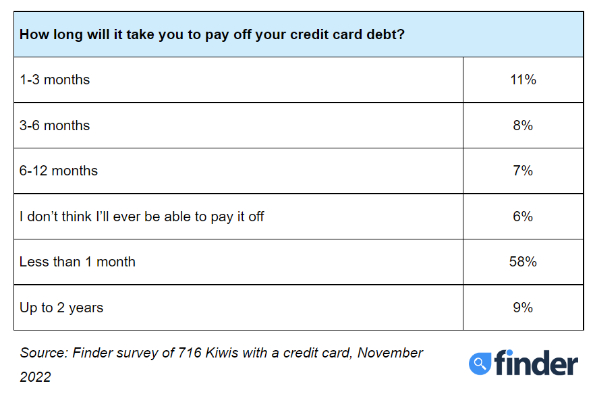

A nationally representative survey of 716 credit card-using Kiwis revealed it will take 1 in 5 (19%) up to 6 months to pay off their credit card debt.

The research found a further 7% will need between 6-12 months to settle their debt.

Almost 1 in 10 (9%) will take up to 2 years to become debt free, while a concerning 6% admit they don’t think they’ll ever be able to pay off their credit.

Angus Kidman, Finder’s editor at large in New Zealand, said many Kiwis are turning to credit cards as they struggle to cope with the rising cost-of-living.

“The ease of access to credit cards in New Zealand combined with the rising cost-of-living has made them a tempting option. Now many are struggling to pay off their credit card balances each month.

“Many credit card companies offer low introductory rates and even rewards programs that tempt consumers, but they also make it easy to rack up debt.

“As expenses continue to rise and interest rates increase, things are only set to get worse.”

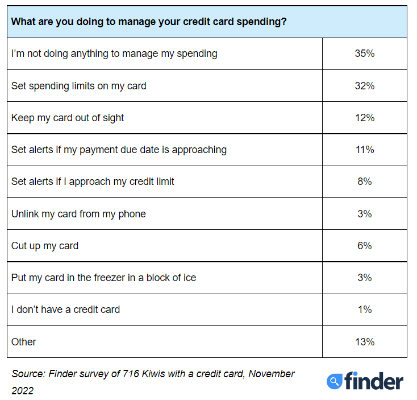

In order to manage their credit card spending, 64% of Kiwis are putting plans in place to stay on top of their budget.

Some (32%) have set spending limits on their card, while others (12%) have an ‘out of sight, out of mind’ approach to reduce their spending.

Just over 1 in 10 (11%) have set alerts for when their payment due date is approaching to avoid any late fees, while 8% have set an alert for when they are approaching their credit limit to avoid overspending.

Some have even taken to cutting up their card (6%) to avoid spending entirely.

Kidman said there are several ways to deal with credit card debt and regain financial stability.

“By understanding where your money is going each month, you can identify areas where you can cut back on expenses and redirect that money towards paying off your credit card debt.

“Creating a budget can help you prioritise your spending, so you can make sure that essential expenses, such as rent and groceries, are taken care of before you pay for non-essential items.”

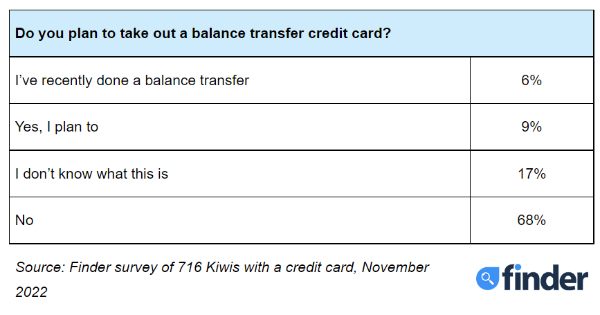

Nearly 1 in 10 (9%) plan to take out a balance transfer credit card to manage their debt, while 6% have already done so.

Kidman said consolidating your debt can help you save money on interest charges and make it easier to keep track of your payments.

“There are balance transfer credit cards that offer 0% or a low-interest rate on the transferred balance. That means you can concentrate on paying off that debt.

“Credit card debt can be overwhelming, but it is not insurmountable. By taking the necessary steps to reduce spending and consolidate debt you can regain control of your finances and break the cycle of debt,” Kidman said.

How to do a balance transfer:

Compare balance transfer offers.

Use Finder’s table to compare offers and see how much you could save.

Apply for a new card.

Read the requirements, gather your documents and request the balance transfer during the application.

Activate your new card.

When you receive the card, activate it by phone or internet banking (and start making repayments).

Close your old account.

You are not required to close your old account, but it's usually a good idea to help you stay out of debt.

Consumer NZ: This Mother’s Day, Give The Gift Of Scam Protection And Digital Confidence

Consumer NZ: This Mother’s Day, Give The Gift Of Scam Protection And Digital Confidence NZ Airports Association: Airlines And Airports Back Visa Simplification

NZ Airports Association: Airlines And Airports Back Visa Simplification Netsafe: Statement From Netsafe About Proposed Social Media Ban

Netsafe: Statement From Netsafe About Proposed Social Media Ban The Reserve Bank of New Zealand: 2024 General Insurance Stress Test Results Published Today

The Reserve Bank of New Zealand: 2024 General Insurance Stress Test Results Published Today  Worldline: School Holidays And Long Weekends Change Regional Spending Patterns In April

Worldline: School Holidays And Long Weekends Change Regional Spending Patterns In April Stats NZ: Livestock Numbers Fall Over The Last 10 Years While Area Planted In Fruit Increases

Stats NZ: Livestock Numbers Fall Over The Last 10 Years While Area Planted In Fruit Increases