Warner Bros. Discovery remains one of the top two content leaders in the entertainment industry, but as Wall Street reassesses the metrics of success for streaming, the company and its platforms’ futures remain in doubt.

Audience demand data on the content side paints a very bright picture for WBD. The company as a whole is in second place in corporate demand share (17.9%), just behind Disney (19.8%). HBO Max leads the SVOD industry in on-platform demand for movies, and is in third place in on-platform demand for TV series. Disney is the only other company with entrants in the top three in each of these categories.

However, WBD’s stock is down about 50% since it officially merged in April. Loaded with a substantial amount of debt, CEO David Zaslav and CFO Gunnar Wiedenfels are attempting to cut $3 billion. Their efforts have stirred confusion and doubt internally, in the creative community, and among consumers.

Just six months after Discovery and WarnerMedia officially merged, many in the industry assume the new company is already for sale, which couldn’t legally happen until Q2 2024. We are certainly not above this M&A speculation, and our corporate demand data shows the benefits of a future WBD merger or sale to fellow legacy media giants NBCUniversal or Paramount Global.

WDB’s removal of about 60 titles from HBO Max as part of the aforementioned cuts had a demonstrable negative impact on the platform’s TV demand share. Each of the shows removed had relatively low demand individually, but as a whole they still accounted for roughly the same audience demand as Game of Thrones.

Even with the drop, HBO Max is still in a solid third place in on-platform TV demand share. But, HBO Max’s demand share cannot be shrinking if WBD intends to leverage its crown jewel asset into entertainment industry dominance.

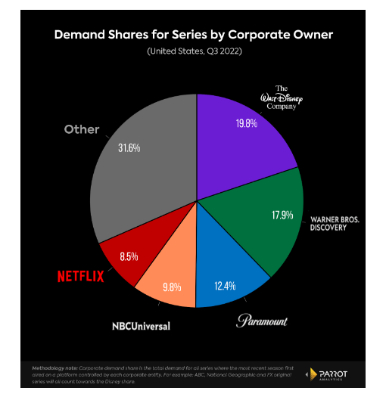

US Corporate Demand Share - Q3 2022

- Corporate demand share assesses the long-term viability of the top media companies as they look to consolidate their original content’s availability exclusively onto their own platforms.

- Warner Bros. Discovery (17.9%) maintained its solid hold on second place in this category in Q3 2022. The company does pose a legitimate threat to Disney (19.8%) as the dominant media and entertainment company for TV demand with US audiences.

- However, in the absence of

merger activity, corporate demand share shifts at a glacial

pace. In order to overtake Disney, WBD would likely have to

sell itself or merge with a competitor.

- A theoretical combination of WBD and Paramount Global would have a corporate demand share of 30.3%, which would lead Disney by a staggering 10.5%.

- A theoretical combination of WBD and NBCUniversal would account for more than a quarter of US demand for TV content. Its 27.7% share would dwarf Disney’s 19.8%.

- Neither of these mergers or acquisitions would require the sale of a broadcast network, potentially making them more palatable to investors and regulators.

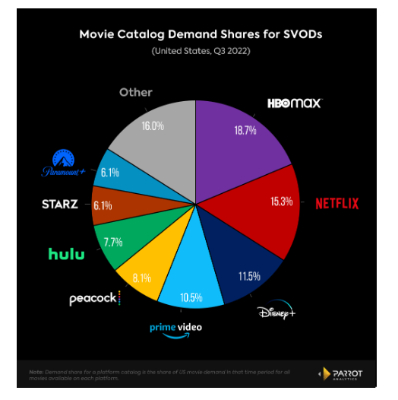

On-Platform Movie Demand Share - United States, Q3 2022

- As movies become more integral to the strategies and success of streamers and cross platform entertainment conglomerates, it is crucial to measure the state of play with this type of content, along with TV series.

- This is Parrot Analytics’ first ever look at the total on-platform demand share for movies available on the major streamers, which reveals a highly competitive market with four different streamers over 10% share.

- HBO Max has the highest US market share (18.7%) of any major SVOD when it comes to audience demand for movies, despite having just the third highest supply share (12.5%). Netflix (16.5%) and Amazon Prime Video (13.2%) have a higher supply share, but lower demand share. This suggests HBO Max is doing a better job than its competitors at licensing and producing movies that its audience actually wants.

- This over-performance could be one result of former WarnerMedia CEO Jason Kilar’s ‘Project Popcorn.’ This controversial initiative delivered Warner Bros’ 2021 film slate to HBO Max US subscribers the same day they were released in theaters, effectively conditioning US consumers to seek out HBO Max for new movies.

- This demand data measures all movies available on each major platform — originals, licensed exclusives, and licensed non-exclusives. Total on-platform share charts serve as a valuable proxy of which platform can become a consumer’s default home for a certain type of content.

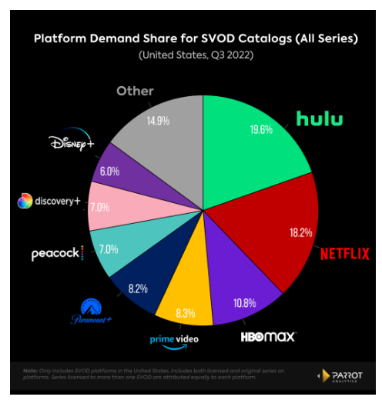

On-Platform TV Demand Share - United States, Q3 2022

- House of the Dragon was a massive success for HBO Max in Q3 2022. It was the number one or two show worldwide every day from its debut in August through the end of October, and it also caused a resurgence of audience demand for the original Game of Thrones.

- Despite this, HBO Max saw a significant drop off in on-platform demand share in Q3 2022, moving from 11.5% in Q2 to 10.8% in Q3.

- Considering HBO Max’s quarterly on-platform share only fluctuated between 11.5% and 11.9% from Q4 2021 to Q2 2022, it is likely that this sizable drop-off was a result of the platform removing about 60 underperforming titles as part of the broader WBD budget cuts. These titles had roughly the same cumulative audience demand as Game of Thrones.

- That said, even with the drop off, HBO Max has been a top three performer in this category for over a year. This matters because surveys suggest consumers are willing to pay for three to four streaming services. Securing a top three ranking is thus crucial for a platform’s long term viability as a standalone streaming service.

Trademe: Trash To Treasure - Kiwi Make The Most Of Unwanted Christmas Gifts

Trademe: Trash To Treasure - Kiwi Make The Most Of Unwanted Christmas Gifts  Financial Markets Authority: FMA Seeks Clarity From High Court On Use Of Eligible Investor Certificates In Wholesale Investment Sector

Financial Markets Authority: FMA Seeks Clarity From High Court On Use Of Eligible Investor Certificates In Wholesale Investment Sector Scion: Scion’s Novel Internship Model Connects Talent With Industry

Scion: Scion’s Novel Internship Model Connects Talent With Industry Financial Markets Authority: Westpac Admits To Misleading Representations That Resulted In $6.35m In Overcharges

Financial Markets Authority: Westpac Admits To Misleading Representations That Resulted In $6.35m In Overcharges Bill Bennett: Download Weekly - Review Of 2024

Bill Bennett: Download Weekly - Review Of 2024 Bill Bennett: One NZ scores worldwide first as Starlink direct-to-mobile launches

Bill Bennett: One NZ scores worldwide first as Starlink direct-to-mobile launches