Credit Crunch: 47% Of Card Holders Face Debt Burden

News highlights:

56% of gen Z and millennials are stressed about their debt

The average credit card balance was $5,973 in September

How to reduce credit card debt

2 November 2022, New Zealand – Kiwis are struggling to pay their credit card bills, according to new research from global comparison site Finder.

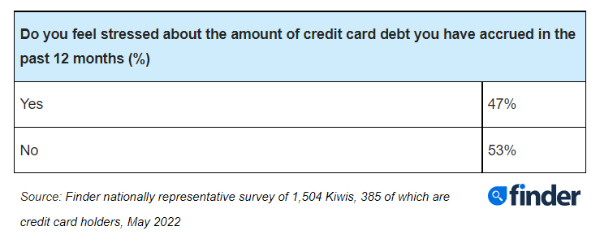

A nationally representative survey of 1,504 Kiwis, 385 of which are credit card holders, found nearly half (47%) feel stressed about the amount of credit card debt they have accrued in the past 12 months.

Finder’s research shows a whopping 56% of gen Z and millennials are suffering credit card debt stress, compared to 45% of gen X and 34% of baby boomers.

Angus Kidman, Finder’s editor-at-large in New Zealand, said many Kiwis are finding their credit card debt level challenging.

“There is rising pressure on households from the debt load accumulated during the pandemic.

“This is made worse by the rising cost of living – everything costs more so it's hard to find more to pay off that balance.”

The average credit card balance in New Zealand in September was $5,973, according to the Reserve Bank of New Zealand.

The standard credit card interest rate sits at 19.8%.

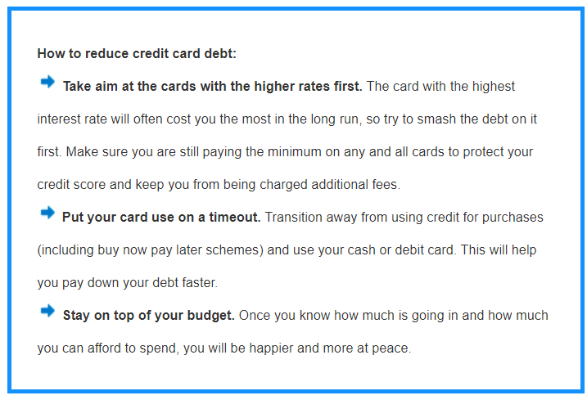

Kidman said paying off credit card debt can seem tough but it’s doable when you know your options.

“The best thing you can do is build a repayment plan to get rid of the debt.

“Work out how much you can regularly afford to repay. Remember you need to be paying more than the minimum repayment to actually reduce your total.

“The more the better – even an extra $10 will have an impact.”

Kidman urged those struggling with their credit card debt to consider if a balance transfer is right for them.

“A 0% balance transfer means every dollar you pay comes off the balance, rather than going towards interest charges.

“There are also options to pay off your debt at 1.99% for 24 months or at 5.95% for the life of the balance.

“Cutting outstanding debt is a crucial step consumers can take to reduce financial stress.

“If you’re really struggling, call your credit card provider and let them know. Your provider can help you work out an affordable repayment plan – if you go bankrupt, no-one wins!”

Waipa Networks: Cambridge Is Open For Business With $45M Energy Boost

Waipa Networks: Cambridge Is Open For Business With $45M Energy Boost Master Plumbers Gasfitters and Drainlayers NZ: New Consumer NZ Test Reveals Danger Of Unregulated Online Plumbing Products

Master Plumbers Gasfitters and Drainlayers NZ: New Consumer NZ Test Reveals Danger Of Unregulated Online Plumbing Products Mindful Money: Winners At The Mindful Money Annual Ethical & Impact Investment Awards 2025

Mindful Money: Winners At The Mindful Money Annual Ethical & Impact Investment Awards 2025 MBIE: Gas Supply Reducing Faster And Sooner Than Previously Forecast

MBIE: Gas Supply Reducing Faster And Sooner Than Previously Forecast Natural Hazards Commission: International Markets Show Unprecedented Confidence In NZ’s Natural Hazards Insurance Scheme

Natural Hazards Commission: International Markets Show Unprecedented Confidence In NZ’s Natural Hazards Insurance Scheme  ASB Bank: ASB Business Survey - The Impact Of Trump's Tariffs, According To Kiwi Businesses

ASB Bank: ASB Business Survey - The Impact Of Trump's Tariffs, According To Kiwi Businesses