AML Transaction Monitoring Essentials

Anti-money laundering compliance requires the detection of unusual customer activity. This article discusses what this means in practice.

Activity Analysis

Without the ability to detect when a client's activity is unusual or suspicious, a business will be unable to meet regulatory expectations. That is why ongoing monitoring of client activity is the primary purpose of anti-money laundering laws.

The sophistication of monitoring systems will depend on the nature, size and complexity of a business, as well as the volume of client activity. If a business has medium to large volumes of transactions and no dedicated transaction monitoring system, regulatory risk is high.

Know Your Customer Profiling

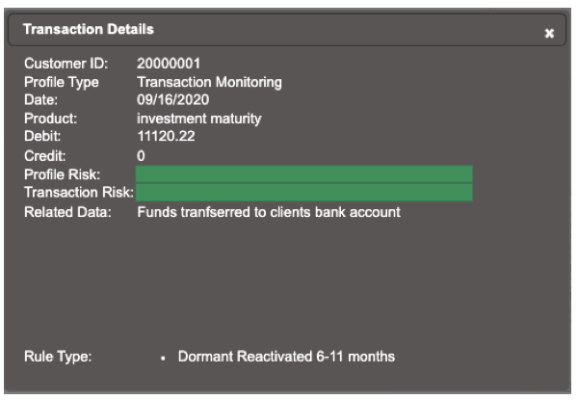

Integration of KYC and transaction monitoring tools at time of client on-boarding level streamlines AML compliance This saves time and increases efficiency by enabling AML Compliance Officers to have all relevant data at their fingertips for making informed determinations and reducing the time to analyse.

Alert Handling

Management of transaction alerts should be prioritised by risk status. Anti-Money Laundering Compliance Officers can then focus on the most important alerts.

Case Management

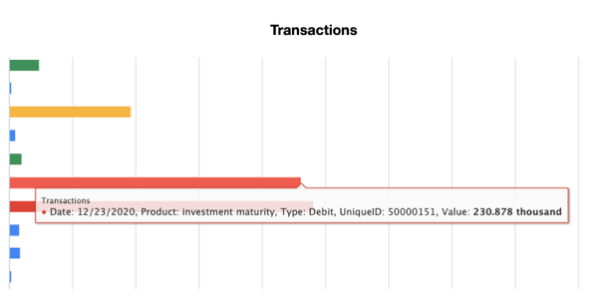

Case Management is the tool used to evidence what happens after an alert is detected. Client activity and alerts requiring escalation should be managed with a system that organises data without clutter. Viewing client activity in heat maps provides instant knowledge by utilising data visualisation.

Management Reporting

Management have a responsibility to understand the status of anti-money laundering compliance. A system that can provide one-click reporting for informing management and boards significantly reduces human resourcing which in turn reduces compliance costs.

Products and Services

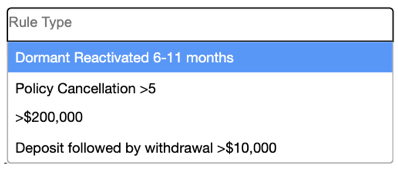

All products and services should be analysed for ML/FT risks and rated based on the individual risk characteristics. Compliance Officers will be in a better position to set ongoing monitoring rules and automate management reporting.

Flexibility

A business should be able to readily develop a transaction rule without the need for IT involvement. Threshold of rules may need updating to reflect the current economic environment or information provided by AML Supervisors. By allowing an Anti-Money Laundering Compliance Officer to work independently from IT involvement will ensure a transaction solution remains up-to-date.

Automated Workflows

Transaction monitoring needs to be a frictionless journey. An AML transaction monitoring system requires ability to automated rule alerts and prioritise alerts.

Informed Decision Making

A common problem with AML transaction monitoring is the silo of data in separate systems. This increases the analysis times, impacts on human resourcing and creates regulatory risk for ageing alerts. To prevent these issues occurring, a transaction alerts should contain all relevant data connected to that activity.

NZALPA: Safety Improves From AKL Incident Learnings

NZALPA: Safety Improves From AKL Incident Learnings NIWA: Antarctic Footprint Clean-up Challenges - How A Remote Antarctic Base Clean-up Protected One Of Earth’s Clearest Lakes

NIWA: Antarctic Footprint Clean-up Challenges - How A Remote Antarctic Base Clean-up Protected One Of Earth’s Clearest Lakes Hugh Grant: Can A Meme Coin Become A Real Payment Solution?

Hugh Grant: Can A Meme Coin Become A Real Payment Solution? Imported Motor Vehicle Industry Association: EV Battery Fires Expose New Zealand Regulatory Gap

Imported Motor Vehicle Industry Association: EV Battery Fires Expose New Zealand Regulatory Gap  Electricity Authority: Electricity Authority Welcomes Plan To Empower Consumers And ‘Make NZ More Electric’

Electricity Authority: Electricity Authority Welcomes Plan To Empower Consumers And ‘Make NZ More Electric’ Pamu Farms: New Zealand Farm Dog Genetic Study Shows Top Five Health Risks

Pamu Farms: New Zealand Farm Dog Genetic Study Shows Top Five Health Risks