The Rise Of Fin-fluencers: 44% Of Gen Z Investors Get Money Tips On Social Media

News highlights:

- Nearly half of gen Z investors get their advice from social media

- Female investors are 3 times more likely to seek advice from their partner

- How to start investing

21 September 2022, New Zealand – Social media is the number one source of investing advice among young adults in New Zealand, according to new research from global comparison site Finder.

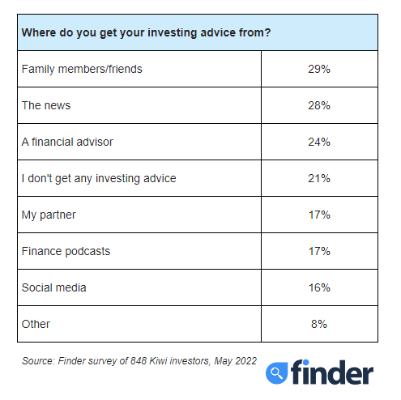

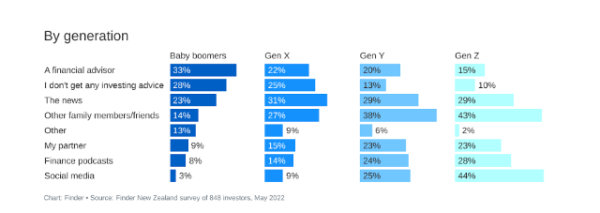

A Finder nationally representative survey of 1,504 Kiwis – 848 of which invest in the share market – found nearly half (44%) of gen Z investors get their share trading tips online.

In close second place came family and friends, with 43% of gen Z investors seeking advice from their loved ones.

Kylie Purcell, investing expert at Finder, said fin-fluencers are an inevitable byproduct of the ‘hustle culture’ that has manifested online.

“Social media is full of fin-fluencers purporting to know which stocks are going to be the next big thing, but they often have no formal training in finance.

“In many cases they are actually trying to sell products such as an ebook or online course.”

Finder’s research found a quarter of millennials (25%) admit to seeking investing tips online, compared to just 9% of gen X and 3% of baby boomers.

Baby boomers are more likely to get their investing advice from a financial advisor (33%), or to simply not seek out any advice at all (28%).

Purcell encouraged investors to take what they hear online with a grain of salt.

“The same goes with your circle of friends or that finance podcast you love to listen to.

“Despite what you might hear online, there’s no trick to get rich quick. Investing slowly over the long term, in a diversified group of stocks, is often considered a lower-risk way to build your wealth.”

Female investors (27%) are three times more likely to seek advice from their partner compared to men (9%). Male investors are more likely to tune into the news (32% compared to 22%) or hire a financial adviser (26% compared to 21%).

Purcell said online share trading platforms had made it easier for Kiwis to invest.

“You don’t need thousands of dollars to get started.

"As with all investments, it pays to do your research and don't invest money that you can't afford to lose," Purcell said.

How to start investing:

Start small.

You don’t need a lot of money to start. If you haven’t got much in your bank account, micro-investing apps are a great way to invest with your spare change. If you buy a coffee for $4.60 for instance, these apps will round the cost to $5 and invest the remaining $0.40 in the fund of your choice. Popular share trading apps like Sharesies, Hatch and Stake all have micro-investing options.

Keep it simple.

Most of us don’t have the time to be tracking market movements on a day-to-day basis. Unless you want to be a full-time day trader, it’s best to keep things simple. Exchange traded funds (ETFs) are a great way to get a diversified portfolio of shares without having to invest in hundreds of individual stocks, so you can spread your risk and save on the extra trading fees.

Don’t worry about bulls and bears.

The stock market is always moving around, but if you’re investing for the long term, these day-to-day movements are nothing to worry about. The news is a great place to learn about which companies and which markets are doing well, but don’t overload yourself with information that’s only going to stress you out. Focus on growing your long-term wealth and it won’t matter whether we’re in a bull market or a bear market.

GNS Science: Bioshields Could Help Slow Tsunami Flow

GNS Science: Bioshields Could Help Slow Tsunami Flow Transport and Infrastructure Committee: Inquiry Into Ports And The Maritime Sector Opened

Transport and Infrastructure Committee: Inquiry Into Ports And The Maritime Sector Opened Netsafe: Netsafe And Chorus Power Up Online Safety For Older Adults

Netsafe: Netsafe And Chorus Power Up Online Safety For Older Adults RBNZ: 10 Cent Coin With King Charles III Image Now In Production

RBNZ: 10 Cent Coin With King Charles III Image Now In Production NZALPA: Safety Improves From AKL Incident Learnings

NZALPA: Safety Improves From AKL Incident Learnings NIWA: Antarctic Footprint Clean-up Challenges - How A Remote Antarctic Base Clean-up Protected One Of Earth’s Clearest Lakes

NIWA: Antarctic Footprint Clean-up Challenges - How A Remote Antarctic Base Clean-up Protected One Of Earth’s Clearest Lakes