Paramount Earnings: Momentum Building For Showtime And Paramount+ As Industry Leaders Falter [Parrot Analytics]

As Paramount Global (née ViacomCBS) reports its first earnings under its new name, Parrot Analytics has tracked surging demand for both original and exclusive-licensed content on Paramount+, which, combined with several breakout Showtime originals, could create a potent and highly in-demand bundle in the race for streaming supremacy.

In recent quarters we have highlighted the massive gap between Paramount Global’s healthy corporate demand share and Paramount+’s lackluster rankings in streaming original and on-platform demand share, along with the corresponding need for Paramount Global to pull back its most in-demand content from competitors if it wants to truly compete in the space.

The data from Q1 2022 suggests Paramount is well on its way to fixing these issues and becoming a serious streaming player, at a critical time in the industry as Netflix begins to shed subscribers and lose market value.

Paramount Global is now in third place in corporate demand share with US consumers. Despite its parent company’s wealth of in-demand content, Paramount+ still finds itself in seventh place in US demand share for streaming originals.

While this ranking is less than ideal, Paramount+’s share in this category is growing, sitting at 5.0% in Q1 2022 - up 31.6% versus Q1 2021 (3.8%). This is a good sign because demand for original content is a key leading indicator of subscriber growth for SVODs.

When it comes to demand for on-platform content, Paramount+ has steadily been on the rise. As of Q1 2022 it accounts for 8.3% of on-platform demand in the US - jumping up into fourth place, its highest ever ranking, ahead of Amazon Prime Video (7.6%) and Peacock (7.4%).

More important than just moving up the rankings, the data suggests Paramount+ is getting better at drawing in demand for its own originals and exclusive content. In Q2 2021, 46% of the demand for content on Paramount+ was for non-exclusive licensed content - that is, series that could also be found elsewhere and thus are not likely to retain subscribers. As of Q1 2022, that figure was down to 37%.

Perhaps the most positive sign for Paramount Global was Showtime’s excellent quarter. Showtime is the best counter offer that Paramount Global has to FX on Hulu and HBO on HBO Max.

Showtime’s surprise breakout hit Yellowjackets peaked as the 10th most in-demand series in the US across all platforms in January. The highly anticipated Dexter: New Blood finished the quarter with 19.6x more demand than the average show in the US. Longtime staple Billions showed it still has the ability to move audiences and hold subscribers. As the sixth season of the show dropped, Billions averaged 34.8x more demand than the average show in the US during Q1 2022 - good enough to be in the top 0.2% of all shows with US audiences.

These are just the kinds of exclusive premium original series that draw in new subscribers to a streaming service or bundle, and help those assets scale.

Paramount Global must now better promote Showtime alongside Paramount+’s originals and other key offerings, such as live sports and exclusive movies, in order to build and market a full service streaming bundle that will capture and maintain audiences’ attention for the long haul.

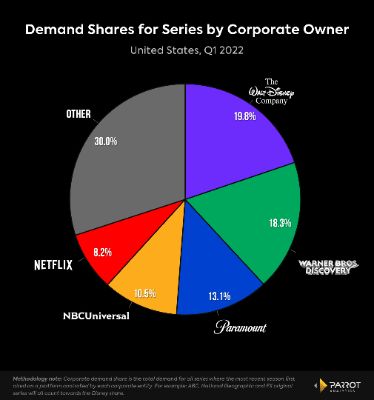

Corporate Demand Share - United States, Q1 2022

- Corporate demand share assesses the long-term viability of the top media companies as they look to consolidate their original content’s availability exclusively onto their own platforms.

- After maintaining second place in the category for years, Paramount Global is now in a distant third place following the merger of Warner Bros. Discovery.

- Paramount still remains well ahead of its closest legacy media competitor, NBCUniversal.

- This chart shows that Paramount nevertheless has the fundamental assets to create a top three streaming offering for US consumers.

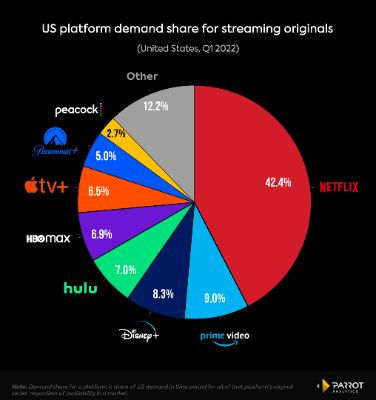

Streaming Originals Demand Share - United States, Q1 2022

- Paramount+ remains near the bottom of the major streaming services when it comes to demand for original content, but it is on the rise.

- In Q1 2022, Paramount+ hit its highest originals demand share in over two years.

- The service hovered between 3.4% and 3.9% share from Q2 2020-Q3 2021, while other services like HBO Max, Disney+ and Apple TV+ rapidly grew.

- In Q1 2022, Paramount+ was up to 5.0%, a 13.6% increase vs Q4 2021 (4.4%), and a 31.6% increase vs Q1 2021 (3.8%).

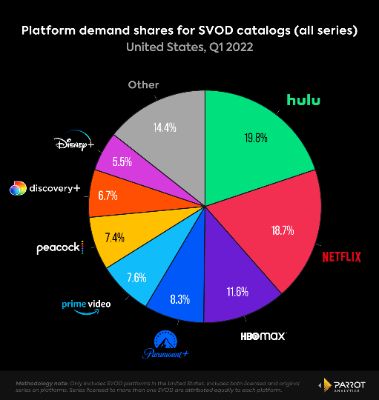

On-Platform Demand Share - United States, Q1 2022

- The on-platform demand share data is a good barometer of which streaming services have the goods to serve as a default entertainment home for consumers - i.e. which service people reflexively turn on when they just want something to watch.

- Paramount+ jumped ahead of Amazon Prime Video last quarter to become the fourth most in-demand service with US consumers for total on platform content. Just three quarters ago Paramount+ was in sixth place in this category.

- Moving from sixth to fourth is a big deal because many consumers claim they will consistently pay for only three or four streaming services. Therefore getting into that top three or four can mean the difference between being deemed essential in the eyes of consumers, or being cut from the budget.

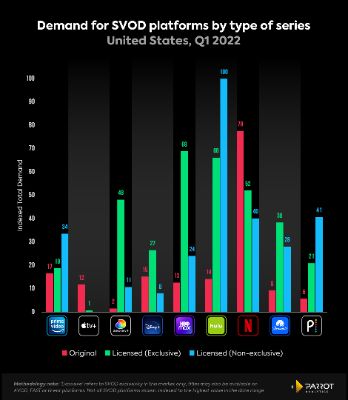

Demand Breakdown Per Platform - United States, Q1 2022

- In Q2 2021, 46% of the demand for content on Paramount+ was non-exclusive licensed, aka series that are also available on other services and thus are less likely to make someone need or want to keep subscribing.

- This figure is down to 37% in Q1 2022, suggesting Paramount is doing a better job of clawing back it’s original content, and making sure the most in-demand content on the platform is exclusive - meaning it drives more people to actually sign on and stay on.

EDS: Oceans Symposium Highlights Need To Establish Independent Oceans Commission

EDS: Oceans Symposium Highlights Need To Establish Independent Oceans Commission Antarctic Heritage Trust: NZ-made ‘Cutting-Edge’ VR Experience Tours The UK

Antarctic Heritage Trust: NZ-made ‘Cutting-Edge’ VR Experience Tours The UK Brian Gaynor Business Journalism Initiative: Brian Gaynor Initiative Business Journalism Funding Award Moves To Rolling Applications

Brian Gaynor Business Journalism Initiative: Brian Gaynor Initiative Business Journalism Funding Award Moves To Rolling Applications  Inland Revenue: Fifth Anniversary Of The SBC Loans - Time To Repay

Inland Revenue: Fifth Anniversary Of The SBC Loans - Time To Repay Te Runanga o Ngati Hinemanu: First Marae Based Fresh Water Testing Science Lab Grand Opening 16-17 May 2025

Te Runanga o Ngati Hinemanu: First Marae Based Fresh Water Testing Science Lab Grand Opening 16-17 May 2025 Raise Communications: NZ Careers Expo Kicks Off National Tour Amid Record Unemployment

Raise Communications: NZ Careers Expo Kicks Off National Tour Amid Record Unemployment