‘Moon Knight’ Tops Global Demand Charts, But Reveals Limits Of Marvel TV As Disney+ Growth Engine [Parrot Analytics]

Disney+’s Moon Knight is another smash hit for the service, drawing 86.5x more audience demand than the average show globally since its March 30 debut, and ranking as the number one show in the world across all platforms every day since April 13.

Moon Knight first hit number one worldwide just eight days after launch (April 7), and is the fifth consecutive Disney+ Marvel series (out of five) to become the top show in the world within two weeks of launching.

While this is clearly good news for Disney+, a closer look at the data reveals a possible ceiling on the potential audience of any given Marvel live action series, calling into question their role as true growth engines for Disney+’s ambitious subscriber goals.

This data suggests that the MCU TV series serve more as a subscriber retention play as opposed to being a major driver of subscriber growth for Disney+ during a key turning point in the industry as Netflix begins to lose subscribers.

Disney+ thus needs to tap into additional IP in order to generate the kind of steady subscriber growth it needs to catch up to Netflix while also holding off the rise of the inevitable HBO Max and Discovery+ combo under Warner Bros. Discovery.

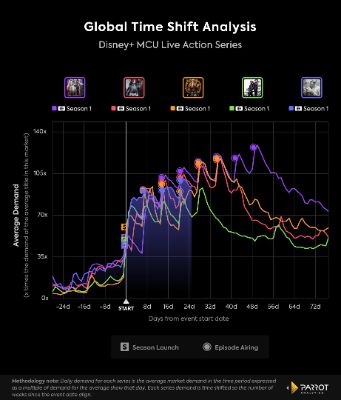

Global Time Shift Analysis: Marvel Live Action Series

- 25 days into their respective launches, Moon Knight (93.5x) is in the middle of the pack compared to its fellow Marvel originals, behind WandaVision (102.1x) and The Falcon and the Winter Soldier (94.6x), and ahead of Loki (90.6x) and Hawkeye (68.6x).

- These are all exceptional audience demand performances, but the remarkable similarity of each show’s global growth trend shows that Marvel is only servicing its built-in audience (which, to be fair, is massive), but not really bringing on new fans or subscribers who aren’t already bought into following the MCU.

- This suggests that MCU shows are more useful to Disney+ as a retention play, and are not growing subscribers beyond its dedicated base.

- Disney+ thus cannot rely on just Marvel to truly challenge Netflix as the dominant streaming service in global subscribers.

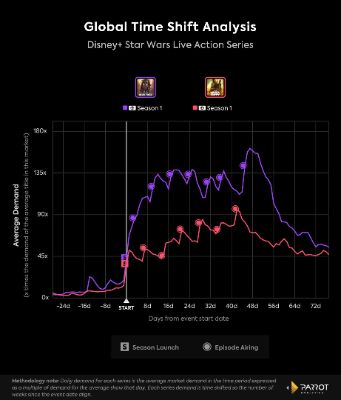

Global Time Shift Analysis: Stars Wars Live Action Series

- A look at the smaller sample size of Star Wars live action series reveals that one was clearly able to break out of the core fanbase.

- The Mandalorian launched as Disney+’s flagship original back in November 2019 and, with the help of Baby Yoda, was able to become one of the three most in-demand TV series Parrot Analytics has ever measured, peaking at 161.5x global demand following its season one finale.

- The Mandalorian was a key driver of Disney+’s remarkable early subscriber growth by drawing audience demand from outside the core Star Wars fanbase, which, while massive, is not big enough on its own to rival Netflix.

- The Book of Boba Fett debuted to more modest demand, but was able to significantly grow throughout the season, especially following the episodes which featured the main characters from The Mandalorian. Global demand for The Book of Boba Fett appears to be Star Wars’ audience base for its live action series.

- If Obi-Wan Kenobi is able to approach The Mandalorian’s global demand levels, then Star Wars could be a growth driver for Disney+ moving forward. If it’s closer to The Book of Boba Fett, Star Wars should be considered a powerful retention play ala Marvel.

Mindful Money: Winners At The Mindful Money Annual Ethical & Impact Investment Awards 2025

Mindful Money: Winners At The Mindful Money Annual Ethical & Impact Investment Awards 2025 MBIE: Gas Supply Reducing Faster And Sooner Than Previously Forecast

MBIE: Gas Supply Reducing Faster And Sooner Than Previously Forecast Natural Hazards Commission: International Markets Show Unprecedented Confidence In NZ’s Natural Hazards Insurance Scheme

Natural Hazards Commission: International Markets Show Unprecedented Confidence In NZ’s Natural Hazards Insurance Scheme  ASB Bank: ASB Business Survey - The Impact Of Trump's Tariffs, According To Kiwi Businesses

ASB Bank: ASB Business Survey - The Impact Of Trump's Tariffs, According To Kiwi Businesses University of Auckland: Will Robots Help Older People Stay Sharp?

University of Auckland: Will Robots Help Older People Stay Sharp? Electricity Authority: Authority Confirms New Next-Gen Switching Service; Proposes Multiple Trading Relationships For Consumers

Electricity Authority: Authority Confirms New Next-Gen Switching Service; Proposes Multiple Trading Relationships For Consumers