Hospitality Sector Spending Takes Gradual Steps Up In March As Border Rules Change

As several changes to New Zealand’s border rules came into effect in March, spending in the Hospitality sector rose gradually but steadily across the nation.

Data released by Worldline today

shows that spending through Hospitality merchants increased

steadily over the last four weeks of March. However, the

monthly total of nearly $700m was still down 16.3% on March

last year, when lockdowns were not in effect and COVID case

numbers were low.

“There remains evidence of tough trading conditions amongst the merchants that transact through Worldline in New Zealand but there are encouraging pockets of recovery, and Hospitality especially is one of these,” says the company’s Head of Data, George Putnam.

Putnam notes that on March 4th, fully vaccinated New Zealanders and others with Immigration eligibility were able to enter the country from anywhere around the world without the need to isolate, then from March 19th, most other travellers could enter New Zealand without the need to enter Managed Isolation and Quarantine (MIQ).

“As international travel rules continue to ease further in the months ahead, the yardstick will be how well businesses are doing relative to pre-COVID levels,” says Putnam.

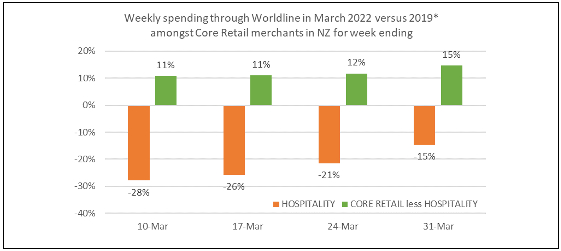

“Hospitality spending was down on pre-COVID levels by 26% in March, but the gap between 2019 and 2022 narrowed significantly during the month, with Hospitality spending in the last week of the month narrowing to a 15% decline. This is a promising development.”

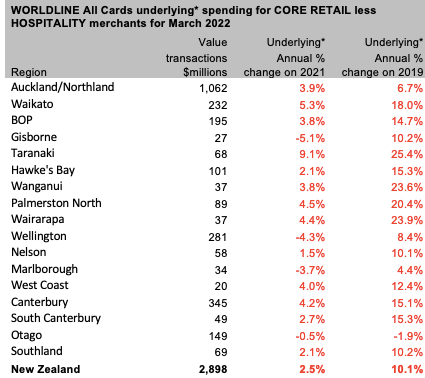

Meanwhile, spending in the rest of the core retail sector reached $2.9B in March, which is up 2.5% on last year, and up 10% on pre-COVID levels. However, as Putnam notes, the patterns can be markedly different for groupings of merchants.

“There is a wide mix of merchants within the non-hospitality core retail merchants and a wide range of experiences as well. For example, the group of merchants selling hardware, appliance, furniture etc. experienced 23% more spending relative to March 2019,” he says.

“Likewise, spending is up amongst groups such as pharmacies (+45%) and recreational goods merchants (+3%). However, in contrast, spending is below 2019 levels amongst groups of booksellers (-5%), clothing (-20%) and footwear (-30%) merchants.”

Putnam notes the regional pattern is also mixed.

Outside of the hospitality sector, Otago (-1.9%) recorded spending below pre-COVID levels, the Auckland / Northland, Wellington and Marlborough regions each saw modest three-year growth and the remaining regions grew at or above the national average.

The highest three-year growth was in Taranaki (+25.4%). Of particular note in March, storm-ravaged Gisborne was down 5.1% on last year, but still 10.2% up on March 2019, pre-COVID.

Canterbury Museum: Mystery Molars Lead To Discovery Of Giant Crayfish In Ancient Aotearoa New Zealand

Canterbury Museum: Mystery Molars Lead To Discovery Of Giant Crayfish In Ancient Aotearoa New Zealand Ngā Pae o te Māramatanga: Māori Concerns About Misuse Of Facial Recognition Technology Highlighted In Science

Ngā Pae o te Māramatanga: Māori Concerns About Misuse Of Facial Recognition Technology Highlighted In Science Retail NZ: Retailers Call For Flexibility On Easter Trading Hours

Retail NZ: Retailers Call For Flexibility On Easter Trading Hours WorkSafe NZ: Worker’s Six-Metre Fall Prompts Industry Call-Out

WorkSafe NZ: Worker’s Six-Metre Fall Prompts Industry Call-Out PSGR: Has MBIE Short-Circuited Good Process In Recent Government Reforms?

PSGR: Has MBIE Short-Circuited Good Process In Recent Government Reforms? The Reserve Bank of New Zealand: RBNZ’s Five Year Funding Agreement Published

The Reserve Bank of New Zealand: RBNZ’s Five Year Funding Agreement Published