AT&T Earnings: ‘Peacemaker’ And ‘Euphoria’ Maintain HBO Max’s 2021 Momentum Heading Into 2022 [Parrot Analytics]

As AT&T reports earnings while waiting to finalize the sale of WarnerMedia to Discovery, Inc., global and US demand for HBO branded originals are surging, following a high growth 2021 for the HBO Max platform.

HBO Max’s Peacemaker was the top digital original TV series in the world on January 21 and 22, with 69.5x more demand than the average show worldwide. It finished just ahead of Netflix’s The Witcher (67.7x) and Disney+’s The Book of Boba Fett (66x), both of which are available on services with a significantly larger subcriber bases.

Furthermore, the return of HBO’s Euphoria - led by Zendaya, by far the most in-demand actress in the US - has launched that show into the top five among US audiences. In the two weeks since debuting its second season on January 9th, Euphoria has been 47.8x more in-demand that the average show in the US, and has ranked as high as the third-most in-demand series in the US across all platforms.

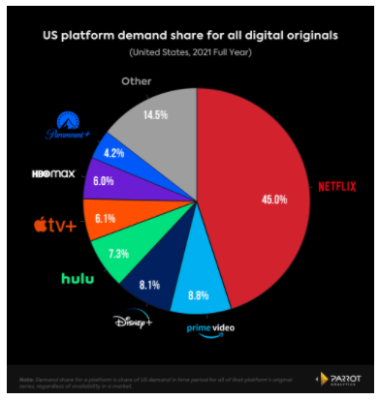

This breakout start to 2022 comes on the heels of a massive 2021 for the HBO Max platform, which was the fastest growing major streaming service in terms of US digital original demand share, outpacing the growth of rivals such as Disney+ and Apple TV+.

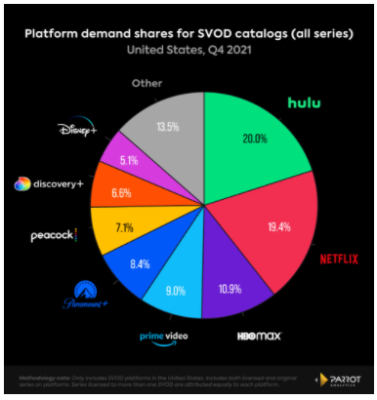

In total on-platform demand share, HBO Max is in a solid third place with US audiences, behind only Hulu and Netflix. This is crucial because consumer surveys suggest Americans are willing to pay for three to four streaming services in an increasingly crowded market. A theoretical combination of HBO Max and Discovery+ would put the new entity within striking distance of Netflix and Hulu as the US leader in audience demand for on-platform content.

In just over 18 months of existence, HBO Max has established itself as the home for a wide range of highly in-demand content targeting diverse audience segments, putting itself in position to be a leading competitor in the US and global streaming race heading into 2022 and beyond.

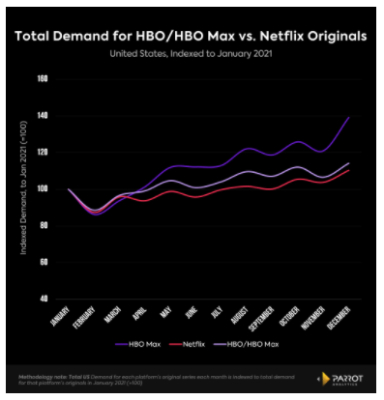

HBO Max Originals outpacing HBO and Netflix Originals in total demand growth

- From January to December 2021, the total demand for HBO Max Originals grew 39.2%.

- This was significantly higher than the total demand for Netflix Originals, which increased by 10.3% over the same time.

- Meanwhile, the combined demand for both HBO and HBO Max Originals was 14.2% - showing that HBO Max has become a major growth engine for HBO branded content.

- This is important because demand for original content is a key leading indicator of subscriber growth, suggesting that Max Originals played a primary role in getting HBO’s total subscriber count up to 73.8 million by the end of 2021.

United States On-Platform SVOD Demand Share - Q4 2021

- HBO Max is in a solid third place when it comes to on-platform demand, which includes all of the HBO programming, licensed content, and Max Originals.

- The combination of new Max Originals with more established HBO content such as Succession, Euphoria, and Curb Your Enthusiasm has allowed HBO Max to establish itself as one of the must-have streaming services for US consumers.

- With consumer surveys showing most Americans are willing to pay for three to four SVOD subscriptions, appearing in the top three or four in this chart is crucial for a streaming service’s long term viability as a premiere player in the US streaming market.

- If HBO Max and Discovery+ (6.6%) combined their catalogs following their expected merger, their combined demand share of 17.5% would be closer to that of Netflix (19.4%) and Hulu (20%) than the rest of the streaming pack.

United States Digital Original Demand Share - Full Year 2021

- While HBO Max was still behind many of its rivals in demand share for original content, the platform saw the strongest year-on-year growth of any of the major streamers in 2021.

- HBO Max’s US demand share for originals grew 86.4% vs. 2020 (3.2% to 6.0%). Disney+ was next in annual growth, up 49.7% (5.4% to 8.1%), with Apple TV+ growing 38% (4.4 to 6.1%).

- Netflix’s US demand share hit a record low in 2021, finishing the year at 45% - a 10.8% year-on-year decline vs 2020 (50.5%).

- The 2.8 percentage point gap between sixth place HBO Max and second place Amazon Prime Video for the full year shows how truly competitive and mature the US streaming market has become.

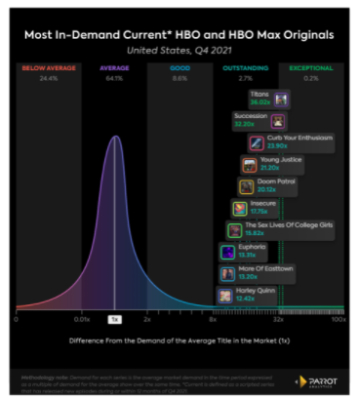

Top HBO Max & HBO Originals - United States, Q4 2021

- In Q4 2021, Max Originals accounted for three of the top five, and five of the top ten most in-demand current HBO branded scripted series (current = shows that released new episodes during or within 12 months of Q4 2021).

- The DC Universe shows stand out in this chart, which makes sense given superhero series are one of the most in-demand subgenres in the US.

- Nevertheless, Max Original and breakout comedy The Sex Lives of College Girls has also emerged as one of the most in-demand series available on HBO Max, ranking higher than even Euphoria and Mare of Easttown for the full quarter. (Euphoria of course rose significantly higher upon releasing new episodes in early 2022).

Top HBO Max Originals - United States, Q4 2021

- A look at the top current scripted Max Originals reveals a far more diverse lineup of original programming.

- While superhero shows still dominate the top five, other series in the top ten such as The Sex Lives of College Girls, Sex And The City spinoff And Just Like That… and The Other Two reveal that HBO Max is actively catering more to female audiences, something HBO has historically not done well.

- Disney+ has relied almost exclusively on Marvel and Star Wars series to increase demand and subscriptions for its service. This has helped drive up subscriber counts over the last two years, but all of their most in-demand shows are catering to effectively the same audience.

- Max Originals on the other hand form a more eclectic group, with science-fiction, comedy, and children’s series all appearing alongside superhero shows in the platforms most in-demand original content. Thus, HBO Max is successfully going after a wider audience, which could set it up better for sustainable long term growth.

Advertising Standards Authority: ASA 2024 Annual Report - Strengthening Consumer Protections With Effective Ad Self-Regulation

Advertising Standards Authority: ASA 2024 Annual Report - Strengthening Consumer Protections With Effective Ad Self-Regulation IRANZ: Budget Reaction – Time To Back Science With Long-Term Investment

IRANZ: Budget Reaction – Time To Back Science With Long-Term Investment Better Taxes for a Better Future: Budget Of Austerity Piles On Least Well-Off, Misreads Public Mood

Better Taxes for a Better Future: Budget Of Austerity Piles On Least Well-Off, Misreads Public Mood Nicola Gaston, The Conversation: NZ Budget 2025 - Science Investment Must Increase As A Proportion Of GDP For NZ To Innovate And Compete

Nicola Gaston, The Conversation: NZ Budget 2025 - Science Investment Must Increase As A Proportion Of GDP For NZ To Innovate And Compete Maritime Union of New Zealand: Maritime Union Condemns Threatened Job Losses On Aratere Ferry

Maritime Union of New Zealand: Maritime Union Condemns Threatened Job Losses On Aratere Ferry Science Media Centre: Proposed Increase To Glyphosate Limits – Expert Reaction

Science Media Centre: Proposed Increase To Glyphosate Limits – Expert Reaction