Netflix Originals Dominate Q4, But HBO Max, Disney+, And Apple TV+ Cut Into Netflix's Market Share [Parrot Analytics]

Netflix’s global and US digital original demand shares hit record lows yet again in Q4 2021, although the resurgence of its international original content - led by Squid Game and La Casa De Papel - helped keep the losses much smaller than in previous quarters in 2021.

In the US, Netflix’s demand share was virtually the same in Q4 (43.6%) vs Q3 (43.7%). Globally, Netflix went from 45.8% in Q3 to 45.4% in Q4.

Nevertheless, at the beginning of 2020, Netflix’s global share sat at a much more lofty 55.7%. What has changed in the last two years?

From Q2 2020 to Q4 2021, Apple TV+, Disney+, and HBO Max combined have grown from 10.6% to 20.6% global digital original demand share, while Netflix dropped from 55% to 45.4%. Therefore, Apple TV+, Disney+, and HBO Max account for virtually all of Netflix’s losses in global demand share for original content over the last two years.

While the world’s leading streamer faces more intense competition than ever heading in 2022, Netflix’s strategy of building out its own franchises while doubling down on international and foreign-language content looks like the right way to hold off the competition. By pursuing this, Netflix accounted for four of the top five digital originals with global audiences in Q4 2021.

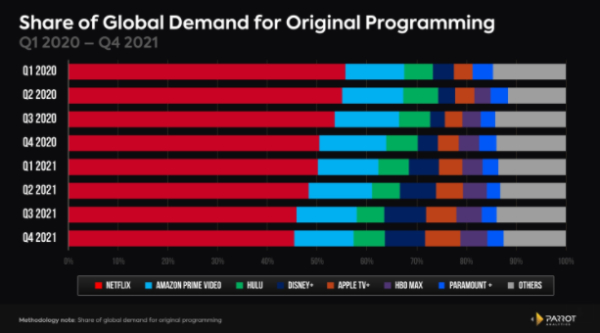

Quarterly Global Digital Original Demand Share: Q1 2020-Q4 2021

- This chart shows the steady decline in Netflix’s global digital original demand share over the last two years - as well-funded upstarts from the world’s largest entertainment and tech companies entered the fray - and reveals which streamers are most responsible for cutting into Netflix’s dominant position.

- While Amazon Prime Video, Hulu and Paramount+ (previously CBS All Access) have fluctuated during this time, Apple TV+, HBO Max, and Disney+ have steadily grown.

- In Q2 2020, Apple TV+ (3.9%), Disney+ (3.4%) and HBO Max (3.3%) accounted for a combined 10.6% of global demand share for digital originals. In Q4 2021, they accounted for a combined 20.6%, a full 10 percentage point increase.

- Meanwhile, Netflix went from 55% global demand share in Q2 2020 to 45.4% in Q4 2021, a loss of 9.6 percentage points. In other words, the gains made by Apple TV+, Disney+, and HBO Max more than account for all of Netflix’s losses in global demand share for original content over the last two years.

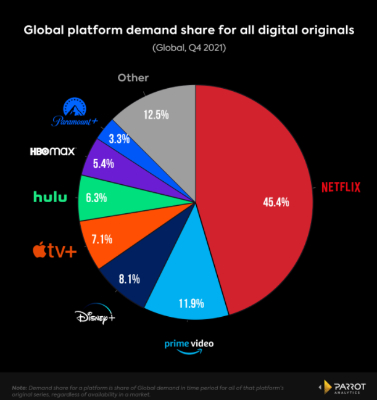

Global Digital Original Demand Share: Q4 2021

- Netflix fell to 45.4% from 45.8% in Q3 2021, a modest dip in demand share compared to previous recent quarters.

- Netflix was at 50.4% in Q4 2020, meaning a majority of its losses in demand share occurred during the first three quarters of the year.

- Apple TV+ and Hulu saw sizable gains in Q4 2021. On the back of Ted Lasso, Foundation, and See, among others, Apple TV+ grew to 7.1% in Q4 from 6.1% in Q3, while Hulu jumped up to 6.3% from 5.5% with breakout hits like Only Murders in the Building and Dopesick.

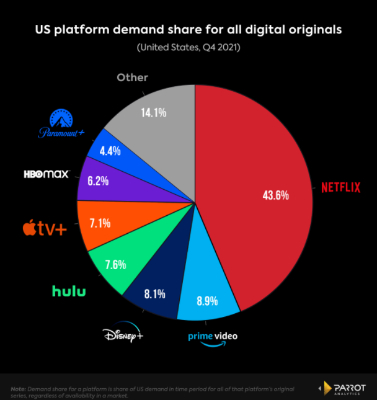

United States Digital Original Demand Share: Q4 2021

- In the US, Netflix only dropped 0.1 percentage points in Q4 (43.6%) vs Q3 (43.7%).

- Netflix was at 48% in Q4 2020, and 48.1% in Q1 2021, so the majority of its demand share loss came in Q2 and Q3, as rival streamers ratcheted up their original content releases during the spring and summer, such as the Disney+ Marvel shows and Apple TV+’s Ted Lasso.

- In Q4 Prime Video jumped back ahead of Disney+ into second place, largely off the popularity of fantasy adaptation The Wheel of Time. This does bode well for later in 2022 when the streamer launches its highly anticipated Lord of the Rings: The Rings of Power series.

- What’s striking in the US is the stiff competition to become Netflix’s primary competitor for original content. Only 2.7 percentage points separate second through sixth place.

- This matters because consumer surveys show most Americans are willing to pay for three to four streaming services. Since demand for original content is a key leading indicator for subscriber growth, getting toward the top half of this group is essential for the long term viability of these services.

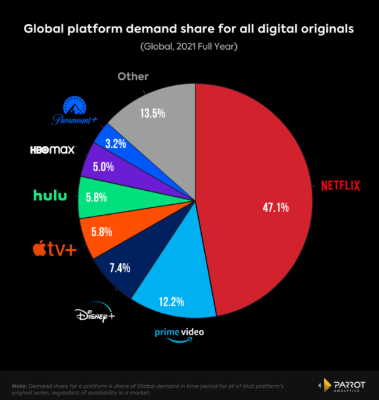

Global Digital Original Demand Share: Full Year 2021

- 2021 was a record low for Netflix’s global digital original demand share, with 47% - the first time ever that Netflix fell to below a majority of the global market share for a full year.

- In 2020, Netflix’s share of demand for its originals was 53.5%. Its 2021 demand share is a 12% decrease from 2020.

- Disney+, Apple TV+ and HBO Max were the biggest year-on-year winners. Disney+’s global demand share grew 107% vs 2020 (3.6% to 7.4%), Apple TV+’s share grew 49.3% (3.9% to 5.8%), and HBO Max’s share grew 37.7% (3.6% to 5.0%).

- The more established Amazon Prime Video (down 3%), Hulu (down 7.7%) and Paramount+ (down 8.4%) saw modest drops year-on-year.

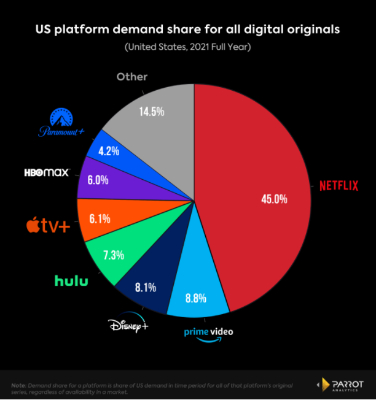

United States Digital Original Demand Share: Full Year 2021

- Netflix’s US demand share also saw a record low in 2021, finishing the year at 45% - a 10.8% year-on-year decline vs 2020 (50.5%).

- The 2.8 percentage point gap between sixth place HBO Max and second place Amazon Prime Video for the full year shows how truly competitive and mature the US streaming market has become.

- The largest demand share growth in the US market was also among the Disney-Apple-HBO trio. In the US, HBO Max had the stronger year on year demand share growth, up 86.4% vs 2020 (3.2% to 6.0%). Disney+ was next, up 49.7% (5.4% to 8.1%), with Apple TV+ growing 38% (4.4 to 6.1%).

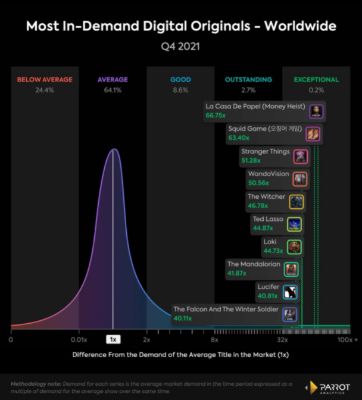

Most In-Demand Digital Originals - Worldwide: Q4 2021

- Netflix

accounted for four of the top five digital originals

worldwide in Q4 2021, and five of the top ten:

- #1 La Casa De Papel released its final batch of episodes on December 3, and was 66.8x more in-demand than the average show worldwide for the quarter.

- #2 Squid Game (63.4x) launched towards the end of Q3, and became a surprise global sensation, growing its audience demand for weeks after launch and maintaining exceptional levels of demand throughout Q4.

- Promotions for season four of Stranger Things helped make it the third most in-demand series with global audiences for the quarter, with 51.3x global demand.

- The Witcher season two launched to exceptional demand on December 17, and it was the fifth most demanded digital original for the quarter with 46.8x.

Tātaki Auckland Unlimited: Iconic Auckland Eats 2025 Top 100 Dishes Revealed After Record Number Of Nominations

Tātaki Auckland Unlimited: Iconic Auckland Eats 2025 Top 100 Dishes Revealed After Record Number Of Nominations Hugh Grant: What Is Cloud Migration And How Does It Work

Hugh Grant: What Is Cloud Migration And How Does It Work Property Council New Zealand: Hiwa Recreation Centre Takes Top Award At 2025 Property Industry Awards

Property Council New Zealand: Hiwa Recreation Centre Takes Top Award At 2025 Property Industry Awards Great Journeys New Zealand: Scenic Plus Winter Menu Launched

Great Journeys New Zealand: Scenic Plus Winter Menu Launched Tourism New Zealand: Tourism New Zealand Invites The World To Find Their 100% Pure New Zealand In New Global Campaign

Tourism New Zealand: Tourism New Zealand Invites The World To Find Their 100% Pure New Zealand In New Global Campaign Bill Bennett: Comcom warns 2degrees over satellite marketing

Bill Bennett: Comcom warns 2degrees over satellite marketing