Card Payments In New Zealand To Rebound In 2021 With 10.3% Growth, Forecasts GlobalData

New Zealand’s card payments market is expected to rebound strongly in 2021 registering 10.3% growth, supported by the economic revival, rising consumer spending, and growing preference for contactless payments, forecasts GlobalData, a leading data and analytics company.

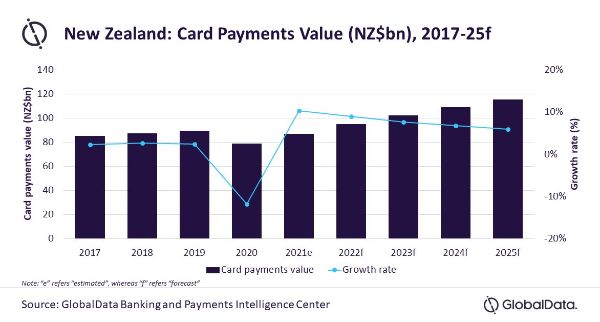

According to GlobalData’s Payment Cards Analytics, the value of card payments registered a decline of 11.8% in 2020 due to the COVID-19 pandemic. However, with gradual recovery in economic conditions and rise in consumer spending, the card payments market is set to grow by 10.3% to reach NZD87.0bn ($62.6bn) in 2021. This is anticipated to further increase at a compound annual growth rate (CAGR) of 7.4 % to reach NZD115.6bn ($83.2bn) in 2025.

Nikhil Reddy, Payments Senior Analyst at GlobalData, comments: “New Zealand is among the few nations globally that have been successful in combating the COVID-19, with 39 reported deaths, much less compared to developed markets such as Australia, Germany, and the UK. However, the government’s lockdown, travel, and social distancing measures resulted in reduced consumer spending affecting overall card payments. With the country now gradually moving towards normalcy, card payments are expected to revive quickly.”

The usage of contactless cards has been witnessing a gradual rise among Kiwi consumers, which is expected to support card payments’ growth. According to Payments NZ (a governance organization which manages payment and clearing systems in the nation), there was a 62% rise in contactless card transactions between 2018 and 2020, with contactless payments share of card payments increasing from 24% in 2018 to 27% in 2019 to 39% in 2020. Furthermore, limit for contactless payment was raised from NZD80 ($57.55) to NZD200 ($143.88) in April 2020.

To further boost cards payments, the New Zealand government is in the process of introducing a new law ‘Retail Payment System Bill’. The bill proposes reduction in interchange fee cap on consumer credit cards to 0.8%, and on contactless debit cards to 0.2% (to the maximum of NZD0.05 or $0.04). Once implemented, this will further push card payment acceptance among merchants.

Reddy concludes: “New Zealand is a matured payment card markets supported by its high banked population and strong payments infrastructure. Although the COVID-19 outbreak impacted the overall card payments market, the gradual rise in consumer spending along with rising preference for digital payments will help country’s card market rebound and continue its growth trajectory for the next few years.”

NZAS: New Zealand Association Of Scientists Awards Celebrate The Achievements Of Scientists And Our Science System

NZAS: New Zealand Association Of Scientists Awards Celebrate The Achievements Of Scientists And Our Science System Stats NZ: Retail Spending Flat In The September 2024 Quarter

Stats NZ: Retail Spending Flat In The September 2024 Quarter Antarctica New Zealand: International Team Launch Second Attempt To Drill Deep For Antarctic Climate Clues

Antarctica New Zealand: International Team Launch Second Attempt To Drill Deep For Antarctic Climate Clues Vegetables New Zealand: Asparagus Season In Full Flight: Get It While You Still Can

Vegetables New Zealand: Asparagus Season In Full Flight: Get It While You Still Can  Bill Bennett: Download Weekly - How would NZ telecoms cope with another cyclone

Bill Bennett: Download Weekly - How would NZ telecoms cope with another cyclone NZ On Air: Firm Audience Favourites Lead NZ On Air Non-Fiction Funding

NZ On Air: Firm Audience Favourites Lead NZ On Air Non-Fiction Funding