Disney Leads Corporate Demand Share As Disney+ Moves Into Second Place For Original Content [Parrot Analytics]

As Disney reports its latest round of earnings, Parrot Analytics has found that despite an expected downturn in subscriber growth for Disney+ and Hulu, the company remains at or near the top of the industry in many key demand data metrics:

- The Walt Disney Company is in first place in Corporate Demand Share

- Disney+ is now the second most in-demand platform for original series with US audiences

- Disney is in second place in overall

demand for original children’s content

- Considering Disney has been competing in the children’s content space since the Calvin Coolidge administration, coming in second place here could be perceived as a let down

- Disney+ and Hulu originals accounted for five of the six most in-demand new series released in the US last quarter

- Disney+ accounted for four of the ten most in-demand digital original series with both US and worldwide audiences last quarter

Disney will need to eventually expand beyond its slate of Marvel and Star Wars series to bring in new subscribers and drive long term growth for Disney+.

That said, its current strategy of doubling down on its beloved established IP, while supporting more prestige original programming on Hulu, has yielded successful results so far.

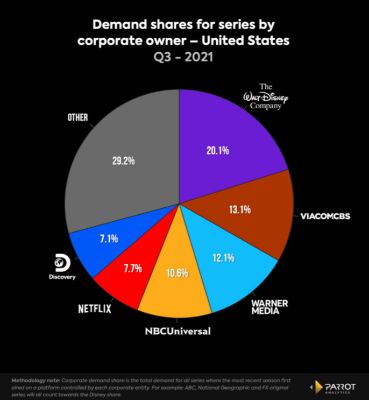

Corporate Demand Share - United States, Q3 2021

(Click here for more details on how we calculate Corporate Demand Share)

- Disney remains far and away the top media conglomerate in the United States when it comes to corporate demand share - a consolidation of original demand where platforms are combined based on their corporate parent to show where audience attention is ultimately going.

- Disney’s 20.1% share last quarter was well ahead of second place ViacomCBS (13.1%).

- Disney’s share is larger than the combined share of WarnerMedia and Discovery (12.1% + 7.1% = 19.2%), whose merger may close as early as H1 2022.

- Collectively, the 6 largest media corporations control almost three quarters of US demand for TV series. 27.4% of audience attention goes to originals from other platforms.

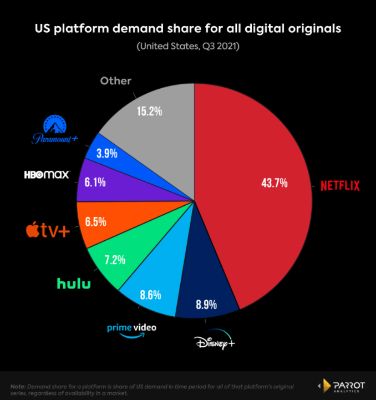

Streaming Original Demand Share - United States, Q3 2021

- Disney+ became the second most in-demand streaming service for original content with American audiences for the first time ever last quarter with 8.9% share, leaping over longtime second place holder Amazon Prime Video 8.6%).

- This is a remarkable feat for a streaming service just shy of its second anniversary, while Amazon Prime Video has been producing original content since 2013.

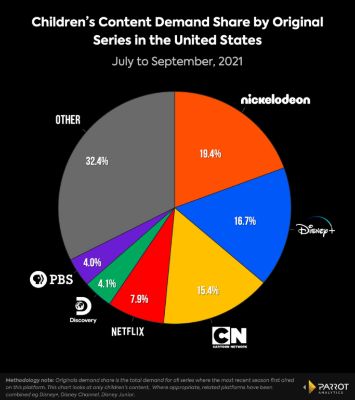

Original Demand Share for Children’s Content - United States, Q3 2021

(Click here for more details on how we calculate Originals Demand Share)

- Disney has emerged as one of the ‘big three’ in demand for original children’s content, with 16.7% demand share for the last quarter.

- Disney trails Nickelodeon (19.4%), but is slightly ahead of Cartoon Network (15.4%).

- The children’s content space is getting increasingly competitive, as Netflix (7.9%) is making inroads against the aforementioned much more established companies, and Moonbug just sold for nearly $3 billion.

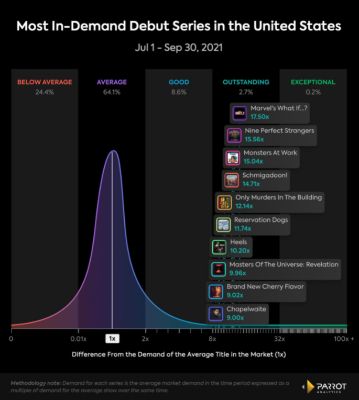

Most In-Demand New Series - United States, Q3 2021

(Only includes new series that premiered between July 1 and September 30, 2021)

- Disney’s streaming services did well in releasing new shows that earned high demand with American audiences.

- Disney+'s Marvel’s What If…? was the most in-demand new series that debuted last quarter from Jul 1-Sep 30, with 17.5x more demand than the average show in the US over that time frame. Fellow animated hit Monsters At Work was number three with 15x.

- New Hulu/FX on Hulu titles performed well, with Nine Perfect Strangers (15.6x) in second place, Only Murders In The Building (12.1x) in fifth, and Reservation Dogs (11.7x).

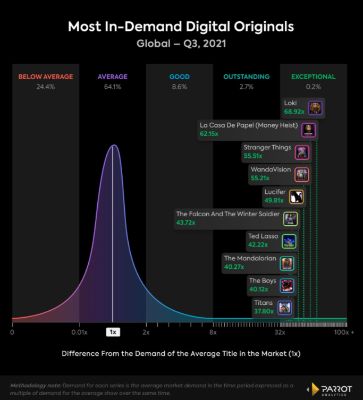

Most In-Demand Digital Originals - Global, Q3 2021

- Disney+ had the number one digital original series in the world for the quarter, Loki, which had 68.9x more demand than the average show worldwide during Q3 2021.

- Disney+ had the most series of any streaming platform in the global top ten - #1 Loki (68.9x), #4 WandaVision (55.2x), #6 Falcon And The Winter Soldier (43.7x), and #8 The Mandalorian (40.3x).

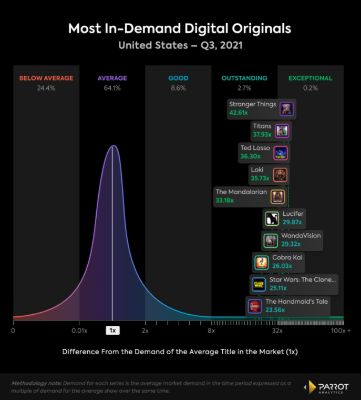

Most In-Demand Digital Originals - United States, Q3 2021

- Netflix did have the number one digital original with US audiences in Q3, with Stranger Things earning 42.6x more demand than the average series in the US. Two other Netflix originals made it in the top ten - #6 Lucifer (29.9x) - which released its final episodes in September, and #8 Cobra Kai (26x).

- Disney+ had four of the top ten digital original series in the US, more than any other service - #4 Loki (35.7x), #5 The Mandalorian (33.2x), #7 WandaVision (29.3x), and #9 Star Wars: The Clone Wars (25.1x).

- Fellow Disney-owned streamer Hulu’s The Handmaid’s Tale (23.6x) rounded out the top ten.

Property Council New Zealand: Hiwa Recreation Centre Takes Top Award At 2025 Property Industry Awards

Property Council New Zealand: Hiwa Recreation Centre Takes Top Award At 2025 Property Industry Awards Great Journeys New Zealand: Scenic Plus Winter Menu Launched

Great Journeys New Zealand: Scenic Plus Winter Menu Launched Tourism New Zealand: Tourism New Zealand Invites The World To Find Their 100% Pure New Zealand In New Global Campaign

Tourism New Zealand: Tourism New Zealand Invites The World To Find Their 100% Pure New Zealand In New Global Campaign Bill Bennett: Comcom warns 2degrees over satellite marketing

Bill Bennett: Comcom warns 2degrees over satellite marketing Transpower: Major Electricity Development For Western Bay Of Plenty A Step Closer

Transpower: Major Electricity Development For Western Bay Of Plenty A Step Closer Alcohol Beverages Council: Turning The Tide - New Zealanders Unite To Curb Harmful Drinking

Alcohol Beverages Council: Turning The Tide - New Zealanders Unite To Curb Harmful Drinking