Westpac New Zealand Announces Solid Financial Result

Strong momentum in the economy has contributed to a solid full year financial result for Westpac New Zealand (Westpac NZ)[i].

Acting Chief Executive Simon Power said COVID-19 was causing significant strain and uncertainty for parts of the community but economic activity in the year leading up to the latest outbreak had been very strong.

“The Delta variant poses serious health and financial challenges and we’re committed to helping customers who have been affected. Looking to the horizon, we’re optimistic increasing vaccination rates will reduce the impact of the virus on New Zealanders’ health and the economy.”

Westpac NZ’s financial results released today for the 12 months ended 30 September 2021 showed a 56% increase in cash earnings[ii] compared with the same period last year, underpinned by a significant improvement in expected loan impairments.

“Last year we increased our lending provisions to $657m to reflect the economic outlook from expected COVID-19 impacts. The economy has performed better than expected and, as such, our lending provision levels have reduced to $525m, representing 0.6% of our total lending portfolio.”

There was a 9% lift in core earnings on the prior comparative period, arising from growth in lending and deposit volumes and a 3bps increase in Net Interest Margin to 2.00%, partially offset by increased spending on risk and regulatory compliance activities.

Mr Power said first home buyers were very active in a buoyant housing market.

“It’s extremely satisfying that we’ve been able to help first home buyers to purchase 6,598 homes during the reporting period – a lift of 24% on the prior comparable period.”

Mr Power said Westpac NZ’s balance sheet was in good shape, and the bank was well placed to support households, businesses and the agri sector.

“Interest rates have edged up slightly but remain at historically low levels and our customer-focused lending approach factors in the possibility of interest rate rises when we calculate a borrower’s ability to service debt.”

Together Greater

Mr Power said he was proud of the way Westpac NZ team members had supported customers in what had been an unpredictable and often stressful year.

“Our employees’ dedication to their customers is evidenced by the thousands of proactive outbound calls made by our branch teams, and the well-attended online seminars organised for business customers.

“This approach is at the heart of our major brand advertising campaign - ‘Together Greater’ – which reflects the ethos of the bank. Our team of 5000 employees is committed to supporting our customers and New Zealand through the many big challenges we face.”

Mr Power said Westpac NZ had embraced the idea through its encouragement of employees to get vaccinated against COVID-19.

“When it comes to vaccination there is strength in numbers. That’s why we’ve offered staff two half-days of special leave to get their jabs, and have engaged with other businesses on this important topic.”

Sustainability and innovation

Mr Power said Westpac NZ had worked hard to deliver innovative and sustainable solutions.

“We know that financial tools can help to drive positive change when it comes to tackling problems like climate change, and that’s what we’re focussed on delivering.

“Just last week we signed an $85m Sustainability-Linked Loan with Pāmu, New Zealand’s largest farming business, that incorporates emissions reduction targets that will be validated against global best practice.”

Westpac NZ had also signed Australasia’s first ever Social Loan[iii] in alignment with international sustainable finance principles, Mr Power said.

“That loan will allow Te Pūkenga, New Zealand’s umbrella organisation for polytechnics and institutes of technology, to offer better learning and employment opportunities to thousands of New Zealanders.

“We were also extremely proud to release our first climate risk report[iv] looking at our exposure to climate-related financial risk, with a focus on sea level rise. It was the first report of its type from a New Zealand bank and we’ll be releasing our second annual report shortly.”

Mr Power said customers would also benefit from Westpac NZ’s approach to innovation as more and more customers chose to bank digitally.

“Digital banking continues to

increase in popularity, with 76% of customers now using

Westpac One online banking. We also farewelled cheques this

year and worked with former broadcaster Judy Bailey to

communicate the benefits of alternative forms of payment to

our customers.”

Key Financials

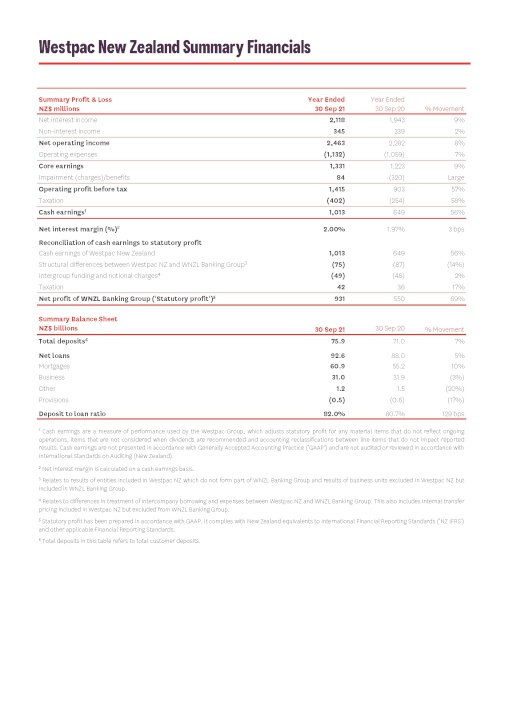

(All comparisons are for the 12 months ended 30 September 2021 versus the same period last year)

- Cash earnings of $1,013m, up 56%

- Core earnings of $1,331m, up 9%

- Net operating income of $2,463m, up 8%

- Operating expenses of $1,132m, up 7%

- Net impairment benefit of $84m, compared with an impairment charge of $320m in the previous comparative period

- Net interest margin 2.00%, up 3 basis points

Mortgages have grown 10% and customer deposits have grown 7% for the year ending 30 September 2021.

Fix, Simplify, Perform

Mr Power said Westpac NZ had continued focussing on its strategy of Fix, Simplify, Perform.

“A good example of simplification is the sale of the New Zealand life insurance business, Westpac Life, which was announced in July.

“Subject to various approvals being obtained, Fidelity Life will acquire Westpac Life from Westpac Group for NZ$400m, and as part of the transaction a 15-year life insurance distribution arrangement with Westpac New Zealand Limited (WNZL) will be entered into.”

Mr Power noted funds under management in the Westpac KiwiSaver Scheme[v] increased by 14% year-on-year, to $9.1 billion as at 30 September 2021. The average Westpac KiwiSaver Scheme balance increased 16% over the same period to $23,717, buoyed by continued strong market performance.

“It was a big year for our KiwiSaver team. We were delighted we were once again appointed as a KiwiSaver default provider in May, and then we announced a range of significant fee reductions in July, including the blanket removal of the annual $12 administration fee.

“Risk, regulation and technology continue to be a strong strategic focus and we’ve prioritised independent reviews of our liquidity risk management and risk governance, as required by the Reserve Bank of New Zealand.”

Supporting New Zealand

Mr Power said Westpac NZ’s focus on ‘Together Greater’ was demonstrated through its continued support of customers and communities.

“It was fantastic to raise more than $1 million again for the rescue helicopters through our annual Chopper Appeal. Our relationship with rescue helicopters goes back nearly 40 years, and sits at the heart of our identity as an organisation.”

Westpac NZ’s focus on keeping Kiwis safe in the outdoors also resulted in the distribution of more than 3,000 ‘Westpac Rescue Rashies®’ to young swimmers, said Mr Power.

“Each rash-vest can be zipped open at the front to reveal CPR instructions, putting information where parents and guardians need it most. If the worst happens, a Rescue Rashie enables adults to offer assistance while they wait for an ambulance or a rescue helicopter.”

Mr Power said Westpac NZ had continued its recent focus on greater gender equity by releasing the ‘Sharing the Load’ report[vi], which looked at how Kiwi families split domestic responsibilities and how greater sharing of the load at home could benefit families and the economy.

“As an employer we then asked ourselves how we could support our employees to live more balanced lives. As a result we introduced changes to our leave entitlements, including five days of paid Wellbeing Leave each year, and Partner’s Leave for new parents who are not the primary caregiver,” Mr Power said.

Mr Power noted there had been changes to the leadership of WNZL in 2021.

“We said goodbye to David McLean, who retired as Chief Executive in June after contributing enormously in his 22 years with Westpac. We look forward to welcoming his successor, Catherine McGrath, later this month.

“Our highly respected Board Chair, Jan Dawson, also retired after more than six years in the role, and more than 10 years as a director. She has been replaced as Chair by Pip Greenwood.”

About Westpac NZ

Westpac NZ has been serving New Zealanders since 1861 and is today one of the country’s largest full-service banks with more than 1.3 million customers.

We provide banking, wealth and insurance products and services for consumer, business and institutional customers in New Zealand.

[i] Westpac New Zealand is a division of Westpac Banking Corporation. Westpac New Zealand includes, but is not limited to, Westpac New Zealand Limited, Westpac Life-NZ-Limited and BT Funds Management (NZ) Limited. The financial results of Westpac New Zealand Limited will be available in the Westpac New Zealand Limited Disclosure Statement, with a reconciliation between the two results also provided in the Westpac New Zealand Summary Financials section of this media release.

[ii] Cash earnings are a measure of performance used by the Westpac Group, which adjusts statutory profit for any material items that do not reflect ongoing operations, items that are not considered when dividends are recommended and accounting reclassifications between line items that do not impact reported results. Cash earnings are not presented in accordance with Generally Accepted Accounting Practice (‘GAAP’) and are not audited or reviewed in accordance with International Standards on Auditing (New Zealand).

[iii] https://www.westpac.co.nz/about-us/media/innovative-social-loan-to-improve-education-outcomes-for-new-zealanders/

[iv] https://www.westpac.co.nz/about-us/media/westpac-nz-releases-first-climate-risk-report/

[v] BT Funds Management (NZ) Limited is the scheme provider and issuer and Westpac New Zealand Limited is a distributor of the Westpac KiwiSaver Scheme. A copy of the product disclosure statement for the Westpac KiwiSaver Scheme is available from any Westpac branch in New Zealand or by visiting www.westpac.co.nz

[vi] https://www.westpac.co.nz/about-us/sustainability-community/our-people-communities/sharing-the-load/

Nicola Gaston, The Conversation: NZ Budget 2025 - Science Investment Must Increase As A Proportion Of GDP For NZ To Innovate And Compete

Nicola Gaston, The Conversation: NZ Budget 2025 - Science Investment Must Increase As A Proportion Of GDP For NZ To Innovate And Compete Maritime Union of New Zealand: Maritime Union Condemns Threatened Job Losses On Aratere Ferry

Maritime Union of New Zealand: Maritime Union Condemns Threatened Job Losses On Aratere Ferry Science Media Centre: Proposed Increase To Glyphosate Limits – Expert Reaction

Science Media Centre: Proposed Increase To Glyphosate Limits – Expert Reaction Electricity Authority: Welcomes Plan For Boosting Consumer-Supplied Flexibility

Electricity Authority: Welcomes Plan For Boosting Consumer-Supplied Flexibility University of Auckland: How Can Finance Be Harnessed For Good?

University of Auckland: How Can Finance Be Harnessed For Good? Michael Ryan, The Conversation: NZ Budget 2025 - Economic Forecasting Is Notoriously Difficult, But Global Uncertainty Is Making It Harder

Michael Ryan, The Conversation: NZ Budget 2025 - Economic Forecasting Is Notoriously Difficult, But Global Uncertainty Is Making It Harder