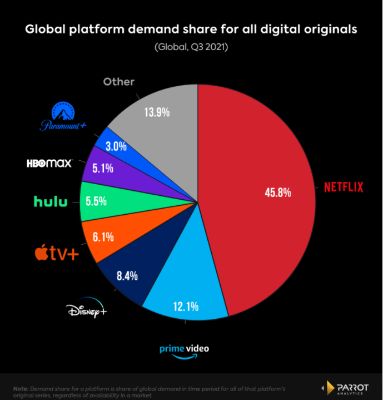

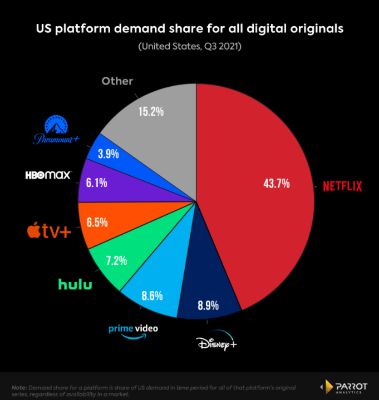

For the third straight quarter, Netflix’s share of global and US demand for digital originals has hit a record low, down to 45.8% globally, and 43.7% in the US. In Q2 2021, Netflix was at 48.3% globally, and 46% in the US.

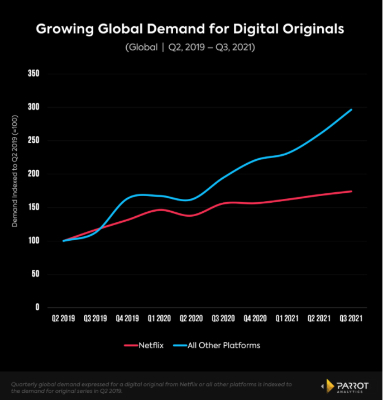

The total global demand for Netflix originals did grow 3.3% compared to Q2 2021, and is up 74% since Q2 2019.

However, global demand for original content from Netflix’s competitors grew 14.3% in Q3 2021, and is up 196% since Q2 2019 - before competitors like Disney+, HBO Max, and Apple TV+ entered the market.

This matters because demand for original content is a key leading indicator of subscriber growth, so Netflix may be able to grow its subscriber base while its dominant position in the market continues to erode.

The streaming pie is growing even if Netflix’s slice is shrinking.

Global Demand for Original Content - Netflix vs. Competitors

Netflix’s loss of demand share is a reflection of increased competition in the streaming market, and the success of the newer streamers in carving out a niche with global and US audiences. Saturation was always going to hit the US market faster, while Netflix is still a more key product for global audiences.

US and global demand for Disney+ and Apple TV+ continue to grow on the back of live action Marvel series and Ted Lasso, respectively.

Apple TV+ now has the fourth largest share of demand for original content worldwide, while Disney+ has moved into second place in the United States for the first time ever, jumping ahead of longtime number two Amazon Prime Video.

Netflix had a relatively quiet summer, but a string of September international releases including new seasons of La Casa De Papel and Sex Education as well as, of course, the debut of Squid Game do give the platform and its shareholders something to smile about heading into Tuesday’s earnings report.

Note on 'Squid Game'

Squid Game has been the number one show in the world across all platforms every day from September 26-October 16 (the last available reporting day for this analysis).

Since launching on September 17, Squid Game has been 84.4x more in-demand than the average show worldwide, peaking at 108x global demand on October 4.

That said, since Squid Game debuted on September 17 and had very little pre-release demand, any significant impact the show has on Netflix’s demand share or subscriber count will likely be reflected in Q4.

Q3 2021 Streaming Original Demand - Global

- Netflix's global share dropped another 2.5% in Q3 compared to Q2, ending with 45.8% of the global share for Q3. Netflix is down 7.7% compared to Q3 2021 (53.5%).

- On the back of Loki, Disney+ gained a full 1.1% share versus Q2, slowly cutting into Amazon Prime Video’s second place status.

- Disney+’s Q3 2021 global demand share (8.4%) was 180% higher than Q3 2020 (3%).

- Perhaps most surprisingly, Apple TV+ (6.1%) leap frogged Hulu (5.5%) to land in fourth place in global digital original demand share, largely due to high demand for the second season of Ted Lasso.

- Apple TV+’s slice of global streaming pie for digital original series has gone up 75% compared to Q3 2020 (3.5%).

Q3 2021 Streaming Original Demand - United States

- Once again, Netflix continues to drop to new lows in the US as well, with 43.7% digital original demand share in Q3 - dropping 2.3% vs last quarter, and 7.3% points since Q3 2021 (51%).

- For the first time ever, Disney+ (8.9%) is the second most in-demand US streaming platform for original content, leaping ahead of Amazon Prime Video (8.6%).

- This is a huge milestone for the nearly two year old platform, which has dominated the first three quarters of the entertainment world with a steady release of Marvel TV series.

- Apple TV+ (6.5%) moved ahead of

HBO Max (6.1%) in Q3 largely due to Ted Lasso being such a

huge hit.

- (Note this data only considers HBO Max originals, not linear HBO shows like The White Lotus, Mare of Easttown, or Game of Thrones)

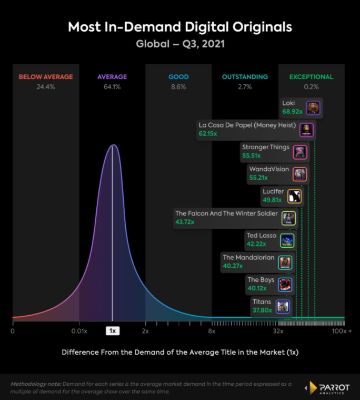

Q3 2021 Most In-Demand Digital Originals - Global

- Disney+ had the number one digital original series in the world for the quarter, Loki, which had 68.9x more demand than the average show worldwide during Q3 2021.

- Disney+ had the most series of any streaming platform in the global top ten - #1 Loki (68.9x), #4 WandaVision (55.2x), #6 Falcon And The Winter Soldier (43.7x), and #8 The Mandalorian (40.3x).

- Netflix still had three of the top five, including #2 La Casa De Papel (62.2x), #3 Stranger Things (55.5x) and #5 Lucifer (49.8x).

- La Casa De Papel and Lucifer released new episodes during the quarter, but Stranger Things hasn’t released a new season since July 2019. Its remarkable staying power suggests it will once again dominate global audience demand once its fourth season is released in 2022.

- Apple TV+’s Ted Lasso performed admirably - it was the 7th most in-demand digital original globally, earning 42.2x more demand than the average show worldwide.

- Superhero series from Amazon - #9 The Boys (40.1x) - and HBO Max - #10 Titans (37.8x) rounded out the global top ten. The genre has continually proven to be key to platforms looking for a highly in-demand tentpole series to draw audiences in.

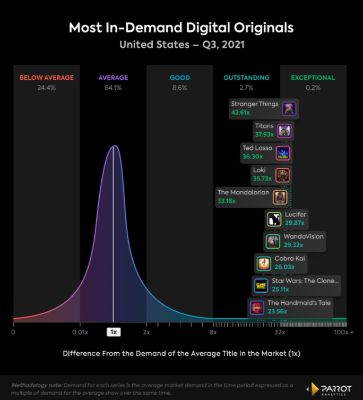

Q3 2021 Most In-Demand Digital Originals - United States

- Netflix did have the number one digital original with US audiences in Q3, with Stranger Things earning 42.6x more demand than the average series in the US. Two other Netflix originals made it in the top ten - #6 Lucifer (29.9x) - which released its final episodes in September, and #8 Cobra Kai (26x).

- Disney+ had four of the top ten digital original series in the US - #4 Loki (35.7x), #5 The Mandalorian (33.2x), #7 WandaVision (29.3x), and #9 Star Wars: The Clone Wars (25.1x).

- HBO Max’s Titans was the second biggest digital original in the US, with 37.9x. It premiered its 3rd season this quarter.

- Apple TV+’s Ted Lasso (36.3x) jumped up to become the third most in-demand digital original for the quarter, while Hulu’s The Handmaid’s Tale (23.6x) rounded out the top ten.

Bill Bennett: Download Weekly - How would NZ telecoms cope with another cyclone

Bill Bennett: Download Weekly - How would NZ telecoms cope with another cyclone NZ On Air: Firm Audience Favourites Lead NZ On Air Non-Fiction Funding

NZ On Air: Firm Audience Favourites Lead NZ On Air Non-Fiction Funding Insurance and Financial Services Ombudsman: Woman Gets $40k More After Disputing Insurer’s Decision

Insurance and Financial Services Ombudsman: Woman Gets $40k More After Disputing Insurer’s Decision BNZ: A Quarter Of Older NZers Fear Going Online Due To Scam Concerns

BNZ: A Quarter Of Older NZers Fear Going Online Due To Scam Concerns University of Auckland: Scientists Develop Tool To Monitor Coastal Erosion In Fine Detail

University of Auckland: Scientists Develop Tool To Monitor Coastal Erosion In Fine Detail Oji Fibre Solutions: OjiFS Proposes To Discontinue Paper Production At Kinleith Mill

Oji Fibre Solutions: OjiFS Proposes To Discontinue Paper Production At Kinleith Mill