Waikato Card Spending Down 18%

Bank of New Zealand (BNZ) card spending data released today shows the COVID-19 Alert Level 3 lockdown in Waikato is impacting economic activity in the region.

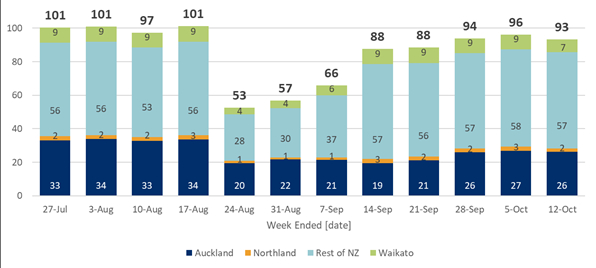

BNZ Chief Economist, Paul Conway, says, “Waikato has seen a significant drop in card spending with the move to Alert Level Three across much of the region, falling 18 per cent below pre-lockdown levels in the seven days to Tuesday 12 October.

The decline is consistent with the changes seen in Auckland and Northland, both also at Alert Level 3, where spending is down 21% and 18% respectively compared to be before lockdown. Cumulatively, the reduced activity in the upper North Island means national spending has fallen 7% below pre-lockdown levels.

Conway says, “This will no doubt put pressure on local business, but overall, the impact of these declines would be far greater if it wasn’t for the rest of the country now spending at a rate four per cent higher compared to before the Delta lockdown.

“This is encouraging given the flow-on effects from the hard lockdown in Auckland, Northland, and Waikato, and not to mention the ongoing restraints on spending caused by the Level Two,” says Conway.

“Prior to the Delta lockdown, card spending in the Waikato made up nine per cent of total spending in New Zealand. However, Auckland made up 33 per cent of total card spending, meaning Alert Level Three restrictions in New Zealand’s largest city are still the biggest constraint on total spending.

“Although the drop in spending due to the Delta lockdown hasn’t been as severe as in our nationwide lockdown last year, we are starting to see some early signs that the recovery may not be as strong as in 2020.

“This is not just about recovering from the impacts of the Delta lockdown. Consumer spending usually increases strongly from this time of year in the run up to Christmas. With uncertainty around the spread of Delta and its impacts, economic activity over the festive season could prove disappointing for some,” says Conway.

PSGR: Has MBIE Short-Circuited Good Process In Recent Government Reforms?

PSGR: Has MBIE Short-Circuited Good Process In Recent Government Reforms? The Reserve Bank of New Zealand: RBNZ’s Five Year Funding Agreement Published

The Reserve Bank of New Zealand: RBNZ’s Five Year Funding Agreement Published Lodg: Veteran Founders Disrupting Sole-Trader Accounting in NZ

Lodg: Veteran Founders Disrupting Sole-Trader Accounting in NZ New Zealand Airports Association: Airports Welcome Tourism Marketing Turbocharge

New Zealand Airports Association: Airports Welcome Tourism Marketing Turbocharge Ipsos: New Zealanders Are Still Finding It Tough Financially; Little Reprieve Expected In The Next 12 Months

Ipsos: New Zealanders Are Still Finding It Tough Financially; Little Reprieve Expected In The Next 12 Months NZ Telecommunications Forum - TCF: Telecommunications Forum Warns Retailers About 3G Shutdown

NZ Telecommunications Forum - TCF: Telecommunications Forum Warns Retailers About 3G Shutdown