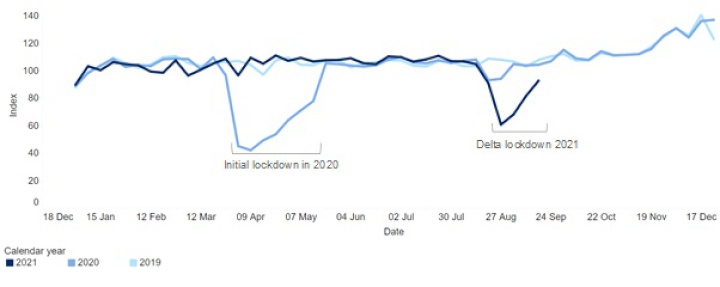

Consumer Card Spending Climbing Out Of Delta Lockdown

New data from Bank of New Zealand (BNZ) shows card spending is heading back towards pre-delta lockdown levels. Spending on BNZ credit, debit and Eftpos cards has bounced back over the last three weeks and is now 14 per cent below the pre-delta lockdown average.

BNZ Chief Economist, Paul Conway, says, “The drop in card spending caused by the delta lockdown is well on the way to recovery. With Auckland now in Level 3 we would expect further improvements over the coming weeks.

“Card spending hasn’t taken as big a hit as it did during the initial lockdown in 2020, reflecting less time with all of the country in level 4, greater confidence that employment will hold up, and more widespread use of digital tools to work and shop from home,” says Conway.

“From an economic perspective, it’s encouraging to see that we are getting through this. However, there is risk that the economy may not rebound as strongly as last year as restrictions are lifted, especially if the Delta variant throws us another curveball,” he says.

Total BNZ card spending (indexed)

As an aid to policymakers and businesses, BNZ will continue to publish insights from high-frequency data on how the economy is tracking through lockdown and beyond. Further reports are scheduled for next week on differences in card spending by product category across regions and online vs in-person.

Inland Revenue: Fifth Anniversary Of The SBC Loans - Time To Repay

Inland Revenue: Fifth Anniversary Of The SBC Loans - Time To Repay Te Runanga o Ngati Hinemanu: First Marae Based Fresh Water Testing Science Lab Grand Opening 16-17 May 2025

Te Runanga o Ngati Hinemanu: First Marae Based Fresh Water Testing Science Lab Grand Opening 16-17 May 2025 Raise Communications: NZ Careers Expo Kicks Off National Tour Amid Record Unemployment

Raise Communications: NZ Careers Expo Kicks Off National Tour Amid Record Unemployment Hugh Grant: How To Build Confidence In The Data You Collect

Hugh Grant: How To Build Confidence In The Data You Collect Tourism Industry Aotearoa: TRENZ 2026 Set To Rediscover Auckland As It Farewells Rotorua - The Birthplace Of Tourism

Tourism Industry Aotearoa: TRENZ 2026 Set To Rediscover Auckland As It Farewells Rotorua - The Birthplace Of Tourism NIWA: Students Representing New Zealand At The ‘Olympics Of Science Fairs’ Forging Pathway For International Recognition

NIWA: Students Representing New Zealand At The ‘Olympics Of Science Fairs’ Forging Pathway For International Recognition