Housing Market Continues To Defy Expectations

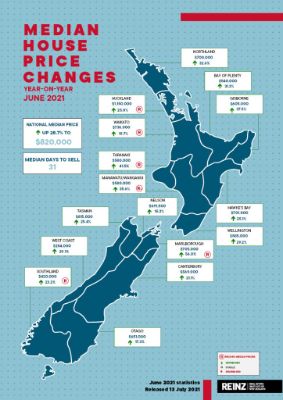

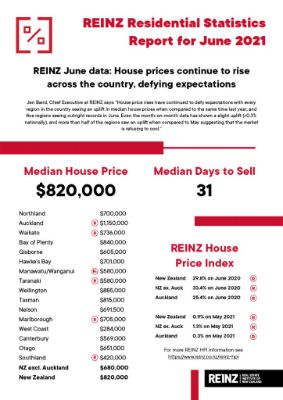

Median prices for residential property across New Zealand increased by 28.7% from $637,000 in June 2020 to $820,000 in June 2021.

Additionally, 5 out of 16 regions reached new record median prices, 1 region saw an equal record and 20 districts reached new record median highs.

The median house price for New Zealand excluding Auckland increased by 25.9% from $540,000 in June last year to $680,000 in June 2021.

Auckland’s median house price increased by 25.0% from $920,000 in June 2020 to $1,150,000 in June 2021 – another new record for Auckland. Additionally, Manukau City ($1,070,000), Rodney District ($1,194,000) and Waitakere City ($1,065,000) reached new record median prices.

In addition to Auckland, 4 other regions reached record median prices and 1 region was a record equal. They were:

- Waikato: with a 19.7% increase from $615,000 in June 2020 to $736,000 in June 2021. Additionally, Matamata-Piako District ($665,500), Taupo District ($730,000), Waikato District ($785,000) and Waitomo District ($420,000) all reached record median highs

- Taranaki: with a 41.5% increase from $410,000 in June 2020 to $580,000 in June 2021

- Marlborough: with a 56.0% increase from $452,000 in June 2020 to $705,000 in June 2021

- Southland: with a 23.2% increase from $341,000 in June 2020 to $420,000 in June 2021

- Manawatu/Wanganui: with a 35.6% increase from $427,600 in June 2020 to record equal high of $580,000 in June 2021.

Jen Baird, Chief Executive at REINZ says house price rises have continued to defy expectations with every region in the country seeing an uplift in median house prices when compared to the same time last year, and five regions seeing outright records in June.

“Even the month-on-month data has shown a slight uplift (+0.3% nationally), and more than half of the regions saw an uplift when compared to May suggesting that the market is refusing to cool.

“Once more, we’re seeing this story echoed by some very strong results in the REINZ House Price Index (HPI), which again reached a new high on the index. Every region saw an uplift in HPI values compared to the previous month – and the three months prior – suggesting that the market will hold strong for a few more months yet.

“Those buyers hoping for a bargain over winter might be disappointed, and today’s data really points to how important it is to address the housing supply issues we have,” she continues.

“We’ve talked about FONFA (the fear of not finding anything) before, but with less than 14,000 properties available for sale, this is becoming a real issue across parts of the country – especially when houses are selling as quickly as they are at the moment,” points out Baird.

Century 21 New Zealand owner Derryn Mayne says low listings remain the biggest problem for agents and buyers alike. However, potential sellers need to seriously consider getting onto the market sooner rather than later.

“With strong buyer demand, strong sales prices, and few competing listings, this winter could prove stronger than next summer, particularly if interest rates start going up,” says Mayne.

She says real estate agents have reported a bounce – four months after Government and Reserve Bank policies started to take effect to try to cool the housing market.

July’s REINZ & Tony Alexander Real Estate Survey was recently released. It revealed a net 53% of agents continue to feel that prices are rising in their area, compared to 32% last month. At the same time, a gross 60% feel that FOMO (fear of missing out) remains a factor for buyers – up from 51%.

Mayne says that Treasury’s forecast back in May of house price growth falling to 0.9% by June 2022 is looking increasingly unlikely.

Highest number of houses sold in a June month for 5 years

The number of residential properties sold in June across New Zealand increased by 6.2% when compared to the same time last year (from 6,913 to 7,345) – the highest for a June month for 5 years.

For New Zealand excluding Auckland, the number of properties sold decreased by 4.0% when compared to the same time last year (from 4,769 to 4,579) – the lowest for a June month in 2 years.

In Auckland, the number of properties sold in June increased by 29.0% year-on-year (from 2,144 to 2,766) – the highest for the month of June in 15 years.

In June, 6 regions out of 16 saw annual increases in sales volumes. In addition to Auckland, regions with increases were:

- Northland: +16.1% (from 174 to 202 – 28 more houses) – the highest for a June month in 5 years

- Taranaki: +9.6% (from 178 to 195 – 17 more houses) – the highest for a June month in 5 years

- Tasman: +7.8% (from 64 to 69 – 5 more houses) – the highest for a June month in 3 years

- Nelson: +2.7% (from 75 to 77 – 2 more houses)

- Canterbury: +7.8% (from 952 to 1,026 – 74 more houses) – the highest for a June month in 15 years.

Regions with the biggest annual decrease in sales volumes were:

- Hawke’s Bay: -23.0% (from 243 to 187 – 56 fewer houses) – the lowest for a June month in 7 years

- Southland: -22.7% (from 203 to 157 – 46 fewer houses)

- Gisborne: -18.5% (from 54 to 44 – 10 fewer houses) – the lowest for a June month in 7 years.

“Despite the reintroduction of the LVRs just a few months ago and the 23 March announcements to try and cool the property market, June saw the highest number of properties sold across the country in a June month for 5 years highlighting the underlying strength in the market,” says Baird.

“Reports from agents around the country are that there are still good numbers of attendees at auctions and open homes; and that both first time buyers and investors are still relatively active in the market.

“Again, much of the national growth has been driven by the Auckland picture, but the market hasn’t seen the full winter slow down we normally expect,” points out Baird.

“Looking forward, we would expect sales volumes to continue at a solid level for the next couple of months unless we see any significant changes in the underlying fundamentals,” concludes Baird.

REINZ HPI shows house values reach new high in June

The REINZ House Price Index (HPI) for New Zealand, which measures the changing value of property in the market, again increased 29.8% year-on-year to 3,844 a new high on the index. This was the highest annual percentage increase in the HPI that we’ve seen since records began and is the thirteenth consecutive month that we’ve seen a new high, showing the continued strength of the market.

The HPI for New Zealand excluding Auckland showed house price values increased 33.4% from June 2020 to 3,904 in June 2021, a new high on the index and the highest percentage increase since records began.

Auckland’s house price values increased 25.4% year-on-year to 3,767 a new record high.

All regions bar Gisborne/Hawke’s Bay reached new highs on the index.

In June, Manawatu/Wanganui had the highest annual growth rate in house price values with a 48.7% increase to a new record index level of 5,049. The first region in the country to cross the 5,000 mark meaning that the value of houses in Manawatu/Wanganui have increased by more than 400% since 2003.

In second place was Wellington with a 42.8% increase and in third place was Bay of Plenty with a 35.0% annual increase in house price values. Both regions saw the largest increase in annual house price values since records began.

Median days to sell lowest for a June month since June 2016

In June, the median number of days to sell a property nationally decreased 15 days from 46 to 31 when compared to June 2020, the lowest for a June month since 2016.

For New Zealand excluding Auckland, the median days to sell decreased by 12 days from 42 to 30, the lowest median days to sell for a June month since 2005.

Auckland saw the median number of days to sell a property decrease by 22 days from 54 to 32, the lowest for the month of June in 5 years.

Eight regions across the country had a median number of days to sell of 30 or less – the first time we’ve seen this in a June month since records began.

Properties in Southland have sold at the fastest rate of any region in New Zealand, with the median number of days to sell at 25 – the fastest that properties have sold in a June month since 2007. Also of note, was the West Coast which saw properties sell 61 days faster than in June 2020 – at 35 days it was the fastest that properties have sold in a June month since 2005.

For the second month in a row, Gisborne had the highest days to sell of any region at 41 days – the only region with a median days to sell in excess of 40 days.

Highest percentage of NZ homes sold by auction for a June month since records began

June saw more than a quarter of all properties sold by auction (26.9%) up from 10.7% in June 2020. This is the highest percentage of auctions for a June month since records began, highlighting that auction rooms are still not showing the usual signs of a winter slowdown.

New Zealand excluding Auckland saw 17.8% of properties sold by auction, up from 6.2% in June last year – the highest percentage of auctions for a June month since records began.

Auckland had the highest percentage of auctions across the country with 41.9% of properties selling under the hammer (1,160) up from 20.9% (448) at the same time last year. This was the highest percentage for a June month in 5 years.

Bay of Plenty had the second highest percentage of auctions in New Zealand with 37.8% (164) properties sold under the hammer in June up from 12.4% in June 2020 (55 properties). June saw the highest percentage of auction sales in a June month since we began keeping records on method of sale back in September 2005.

Gisborne was close behind in third place with 34.1% (15) properties sold under the hammer – down from 46.3% (25) in June last year. This was the first time since January 2020 that Gisborne wasn’t in the top two when it came to percentage of auctions.

Also of note were Canterbury with 28.2% (289) properties sold under the hammer the highest percentage of auctions for a June month since records began; and Waikato with 21.7% (149) properties sold under the hammer the highest percentage of auctions for a June month since records began. Additionally, Northland had its highest ever percentage of properties sold via auction and the West Coast had its second auction of the year.

Dire shortage of houses available for sale – second lowest level of inventory ever

The total number of properties available for sale in New Zealand decreased by 33.3% in June to 13,861 down from 20,772 in June 2020 – 6,911 fewer properties compared to 12 months ago. This is the second lowest level of inventory we’ve ever seen in New Zealand (the lowest was in December 2020 with 12,932).

For the third month in a row, only one region saw an annual uplift in inventory levels – Gisborne with a 30.8% increase in inventory levels from the same time last year (from 65 to 85 properties – 20 additional houses).

Regions with the largest percentage decrease in total inventory levels were Nelson -57.9% (from 411 to 173 – 238 fewer properties), Canterbury -48.5% (from 2,773 to 1,428 – 1,345 fewer properties), Northland -47.7% (from 1,092 to 571 – 521 fewer properties) and Bay of Plenty -47.5% (from 1,382 to 726 – 656 fewer houses).

$1m+ properties still holding strong

The number of homes sold for less than $500,000 across New Zealand fell from 30.8% of the market (2,132 properties) in June 2020 to 15.5% of the market (1,140 properties) in June 2021. This was a minor uplift from May where only 15.0% of properties sold for less than $500,000.

The number of properties sold in the $500,000 to $750,000 bracket fell from 32.5% (2,247 properties) to 27.1% (1,992 properties).

At the top end of the market, the percentage of properties sold for $1 million or more increased from 17.8% (1,233 properties) in June 2020 to 34.5% (2,537 properties) in June 2021 – the second highest percentage of $1 million plus properties sold ever.

Waipa Networks: Cambridge Is Open For Business With $45M Energy Boost

Waipa Networks: Cambridge Is Open For Business With $45M Energy Boost Master Plumbers Gasfitters and Drainlayers NZ: New Consumer NZ Test Reveals Danger Of Unregulated Online Plumbing Products

Master Plumbers Gasfitters and Drainlayers NZ: New Consumer NZ Test Reveals Danger Of Unregulated Online Plumbing Products Mindful Money: Winners At The Mindful Money Annual Ethical & Impact Investment Awards 2025

Mindful Money: Winners At The Mindful Money Annual Ethical & Impact Investment Awards 2025 MBIE: Gas Supply Reducing Faster And Sooner Than Previously Forecast

MBIE: Gas Supply Reducing Faster And Sooner Than Previously Forecast Natural Hazards Commission: International Markets Show Unprecedented Confidence In NZ’s Natural Hazards Insurance Scheme

Natural Hazards Commission: International Markets Show Unprecedented Confidence In NZ’s Natural Hazards Insurance Scheme  ASB Bank: ASB Business Survey - The Impact Of Trump's Tariffs, According To Kiwi Businesses

ASB Bank: ASB Business Survey - The Impact Of Trump's Tariffs, According To Kiwi Businesses