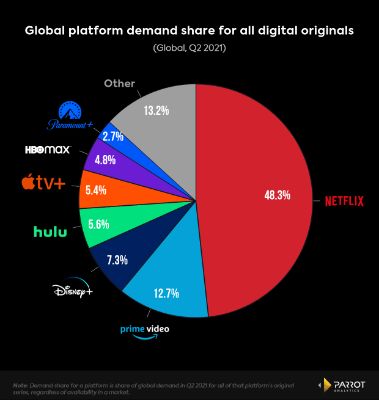

As Netflix prepares to announce its latest round of earnings, Parrot Analytics data reveals the streaming giant’s share of digital original audience demand has sunk to record lows, dropping to 48.3% globally and just 46% in the US in Q2 2021.

- This is the first quarter Parrot has ever measured showing Netflix’s digital original demand share below 50% globally.

- The 48.3% share is down from 50.1% in Q1 2021, and down from 54.9% Q2 2020.

- Meanwhile, Disney+ grew from 6.0% to 7.3% share globally on the back of its original Marvel content.

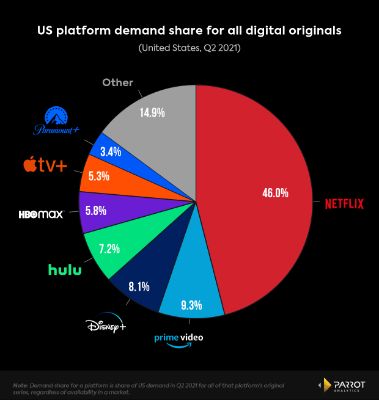

- Netflix’s 46% US share is also a record low for a quarter.

- This represents a 2.1% drop from Q1 2021, and a 5.3% drop from Q2 2020.

- Disney+ grew from 7.0% to 8.1% in the US due to the success of Marvel hits The Falcon And The Winter Soldier and Loki.

Streaming Competition Up, Netflix Trending Down

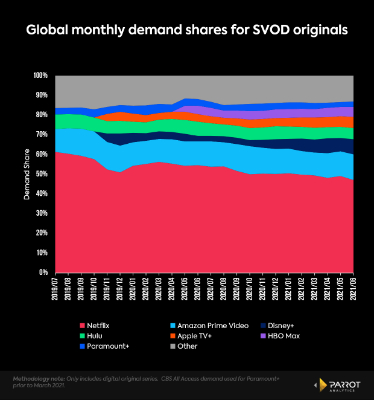

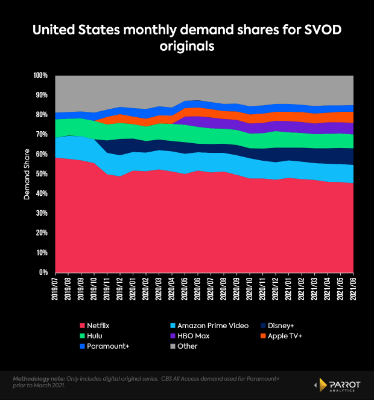

These latest numbers follow a steady trend of shrinking dominance for Netflix in the industry, that was spurred on by the launches of Disney+ and Apple TV+ in November 2019.

These platforms, along with HBO Max, Paramount+ and more, continue to establish themselves with consumers and grow their subscriptions numbers by releasing highly in-demand original content.

Netflix has struggled to push out breakthrough original content in the last few quarters - with the exception of season three of Cobra Kai - and likely won’t have another massive original hit until Q4 with season two of The Witcher.

- As seen in the Global and US trend charts, Netflix first saw a big hit to its demand share in Q4 2019 just as Disney+ and Apple TV+ debuted.

- The streamer was able to bounce back in Q1 and Q2 of 2020 as the COVID pandemic forced consumers indoors, and monster sleeper hit Tiger King kept Americans glued to their Netflix accounts.

- The recent lack of new highly in-demand originally programming is hurting Netflix’s demand share. One obvious big miss in Q2 2021 was Jupiter’s Legacy.

- Meanwhile it’s been two years since new Stranger Things content, and 18 months since The Witcher season one release.

Bottom Line

Netflix is still the global leader in the streaming space, but its lack of new hit original programming and the increased competition from other streamers is going to ultimately have a negative impact on subscriber growth and retention.

Parrot Analytics: Netflix Earnings - Price Hikes With Minimal Churn | Will Netflix Be A Bright Spot For Markets?

Parrot Analytics: Netflix Earnings - Price Hikes With Minimal Churn | Will Netflix Be A Bright Spot For Markets? Canterbury Museum: Mystery Molars Lead To Discovery Of Giant Crayfish In Ancient Aotearoa New Zealand

Canterbury Museum: Mystery Molars Lead To Discovery Of Giant Crayfish In Ancient Aotearoa New Zealand Ngā Pae o te Māramatanga: Māori Concerns About Misuse Of Facial Recognition Technology Highlighted In Science

Ngā Pae o te Māramatanga: Māori Concerns About Misuse Of Facial Recognition Technology Highlighted In Science Retail NZ: Retailers Call For Flexibility On Easter Trading Hours

Retail NZ: Retailers Call For Flexibility On Easter Trading Hours WorkSafe NZ: Worker’s Six-Metre Fall Prompts Industry Call-Out

WorkSafe NZ: Worker’s Six-Metre Fall Prompts Industry Call-Out PSGR: Has MBIE Short-Circuited Good Process In Recent Government Reforms?

PSGR: Has MBIE Short-Circuited Good Process In Recent Government Reforms?