Highest Annual Growth In 7 Years As NZ’s Smartphone Market Bounces Back In 2021Q1, Says IDC New Zealand

The New Zealand (NZ) smartphone market rebounded sharply from a year ago as it recorded its highest quarter of annual growth since 2013Q4. According to the latest IDC Asia/Pacific Quarterly Mobile Phone Tracker, New Zealand smartphone shipments increased 30.1% YoY in the first quarter of 2021 to reach 319,000 units. This compares to 245,000 units in 2020Q1, as the pandemic began to restrict the supply of shipments to NZ. When measured against 2019’s first quarter figure of 305,000 units, the result was also up 4%.

"As the reliance on devices such as smartphones and PCs has grown post-pandemic, consumers have naturally looked to upgrade and refresh their devices at an increasing rate," says Maxim Wilson, Associate Market Analyst for the New Zealand Mobile Devices Market. Kiwis continued to allocate their discretionary spend to smartphones, in particular, flagship models. This increased buying saw YoY revenue growth of 34% in the first quarter of 2021, as the ultra-premium segment (US$1000+) accounted for 30% of shipments in Q1.

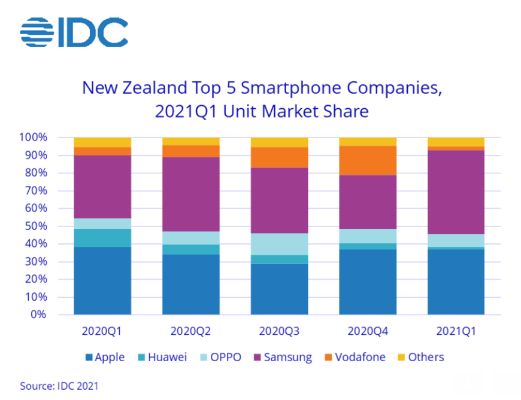

Apple and Samsung accounted for 84% of the smartphone market in Q1, a record combined share in New Zealand. Premium models, the iPhone 12 and Galaxy S21 (released in January 2021) exceeded expectations, as Kiwi consumers flocked in numbers to buy the new flagship devices. The supply of these models also held up despite strong demand for the high-end phones.

The record combined market share from Apple and Samsung shows the gap Huawei has left in the market, as the Chinese vendor pivots away from smartphones. This has presented an opportunity for other competitors, particularly in the Android space. Motorola has introduced more competitive smartphone offerings in the lower-end segment, as it seeks to compete with Samsung and OPPO, while Vodafone has been gaining share in the sub-NZ$150 price band. Xiaomi, the third largest smartphone vendor globally, has a minute share in the Australia/New Zealand market. Its success in Europe, however, highlights untapped potential in the Oceania region.

The growth in 5G handset shipments was a key trend in 2021Q1. Vendors began the year releasing a variety of 5G devices, including OPPO's Find X3 range and Samsung’s Galaxy S21 range. As a result, 46% of total smartphone shipments were 5G capable, a whopping 424% increase from a year ago. Wilson notes the push globally from larger vendors as they deploy 5G devices across geographies. "The NZ mobile network operators have had greater focus on 5G fixed wireless broadband rather than mobile services. However, with several 5G devices launching in the market and greater expansion of 5G coverage, we expect to see stronger adoption for 5G smartphones in the coming quarters.’

IDC anticipates 5G capable share to pass 50% in 2021Q2, as Android vendors launch devices in the mid-range price bands. ‘The Average Selling Price (ASP) for 5G capable devices was NZ$1550 in the first quarter. IDC expects this to drop by at least 20% in 2021Q2.’

Hugh Grant: How To Build Confidence In The Data You Collect

Hugh Grant: How To Build Confidence In The Data You Collect Tourism Industry Aotearoa: TRENZ 2026 Set To Rediscover Auckland As It Farewells Rotorua - The Birthplace Of Tourism

Tourism Industry Aotearoa: TRENZ 2026 Set To Rediscover Auckland As It Farewells Rotorua - The Birthplace Of Tourism NIWA: Students Representing New Zealand At The ‘Olympics Of Science Fairs’ Forging Pathway For International Recognition

NIWA: Students Representing New Zealand At The ‘Olympics Of Science Fairs’ Forging Pathway For International Recognition Coalition to End Big Dairy: Activists Protest NZ National Dairy Industry Awards Again

Coalition to End Big Dairy: Activists Protest NZ National Dairy Industry Awards Again Infoblox: Dancing With Scammers - The Telegram Tango Investigation

Infoblox: Dancing With Scammers - The Telegram Tango Investigation Consumer NZ: This Mother’s Day, Give The Gift Of Scam Protection And Digital Confidence

Consumer NZ: This Mother’s Day, Give The Gift Of Scam Protection And Digital Confidence