Easter Highlights Spending Imbalance

The imbalance in the spending impact of Covid international travel restrictions was evident in the Easter spending pattern. Spending around Easter through Paymark amongst South Island Core Retail merchants was a mere 1.2% above Easter 2019 levels, before Covid impacts, while North Island merchant spending was up 6.7%. It is this spending growth imbalance that will likely change as more open travel resumes with Australia.

Spending through Paymark from Easter Thursday to Tuesday (inclusive) amongst Core Retailers was $720 million. This was up a massive 130% on Easter 2020, when Lockdown 4 was applied, but a more modest 5.1% on Easter 2019. The rebound from last year was largest in Marlborough (+196%).

The growth rate from 2019 was highest in Wairarapa (+15.1%) and lowest in Otago (-6.5%).

PAYMARK All Cards Data for 6 days ending 6 April 2021 (Easter 2021)for Core Retail merchants | |||

| Region | Value of transactions $millions | Underlying* annual % change on 2020 | Underlying* annual % change on 2019 |

| Auckland/Northland | 256.5 | 137.5% | 4.8% |

| Waikato | 57.0 | 120.5% | 7.8% |

| BOP | 57.9 | 188.1% | 6.8% |

| Gisborne | 7.4 | 111.0% | 11.5% |

| Taranaki | 16.1 | 136.0% | 9.1% |

| Hawke's Bay | 25.2 | 119.2% | 10.6% |

| Wanganui | 9.0 | 99.8% | 10.7% |

| Palmerston North | 20.3 | 124.3% | 11.8% |

| Wairarapa | 8.7 | 94.5% | 15.1% |

| Wellington | 68.8 | 102.6% | 7.7% |

| Nelson | 14.9 | 145.7% | 6.8% |

| Marlborough | 11.0 | 196.2% | 3.1% |

| West Coast | 6.0 | 159.3% | 1.8% |

| Canterbury | 77.9 | 118.6% | 4.3% |

| South Canterbury | 11.4 | 102.5% | 10.7% |

| Otago | 45.1 | 180.7% | -6.5% |

| Southland | 17.7 | 140.8% | -2.0% |

| New Zealand | 720.3 | 129.9% | 5.1% |

| * Underlying spending excludes large clients moving to or from Paymark | |||

Figure 1: All Cards NZ underlying spending through Paymark for core retail merchants by region around Easter (* Underlying spending excludes large clients moving to or from Paymark)

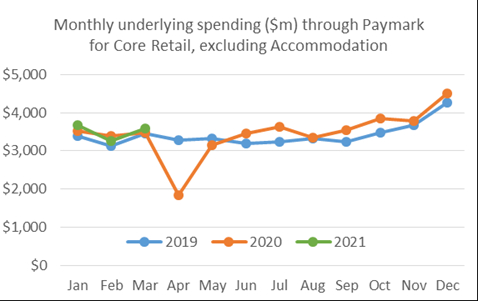

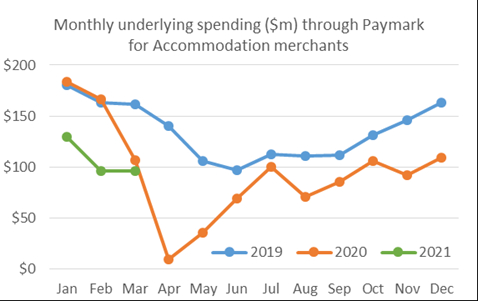

Looking back at spending patterns through Paymark over the last 12 months, the impact on spending has been understandably mixed since the first Covid-19 lockdown in March 2020. There was the sharp drop in total spending through Paymark in April 2020 for all Core Retail merchants with the exception of supermarkets. Come June 2020, the Core Retail group, now with the exception of Accommodation merchants, tracked around 7% above 2019 levels for the rest of the year. Meanwhile spending at Accommodation merchants remained well below 2019 levels.

By the March quarter of 2021, the national Accommodation sector spend at $415 million was down 29.7% on 2020 levels, when Covid impacts had already started, and more tellingly down 36.5% on 2019 levels. Spending through Paymark for the rest of the Core Retail sector at $10,546 million was up 1.5% in the March 2021 quarter on the same quarter in 2020 and up 5.9% on 2019.

|  |

Figure 2: All Cards NZ underlying spending through Paymark for core retail merchants (* Underlying spending excludes large clients moving to or from Paymark)

Paymark also processes payments for automotive and non-retail merchants. Here the patterns have also been mixed since the initial travel restrictions in March 2020, with spending amongst those merchants exposed to international travel still well below 2019 levels in the March quarter (figures withheld to preserve client confidentiality). These merchants, also, will welcome the imminent Australia-NZ travel bubble.

Bill Bennett: Download Weekly - Review Of 2024

Bill Bennett: Download Weekly - Review Of 2024 Bill Bennett: One NZ scores worldwide first as Starlink direct-to-mobile launches

Bill Bennett: One NZ scores worldwide first as Starlink direct-to-mobile launches Hugh Grant: How To Reduce Network Bottlenecks

Hugh Grant: How To Reduce Network Bottlenecks Dominion Road Business Association: Auckland Transport's 'Bus To The Mall' Campaign: A Misuse Of Public Funds And A Blow To Local Businesses

Dominion Road Business Association: Auckland Transport's 'Bus To The Mall' Campaign: A Misuse Of Public Funds And A Blow To Local Businesses Parrot Analytics: A Very Parrot Analytics Christmas, 2024 Edition

Parrot Analytics: A Very Parrot Analytics Christmas, 2024 Edition Financial Markets Authority: Individual Pleads Guilty To Insider Trading Charges

Financial Markets Authority: Individual Pleads Guilty To Insider Trading Charges