Rural Market Remains Steady

23 April 2021

Data released today by the Real Estate Institute of New Zealand (REINZ) shows there were 113 more farm sales (+40.8%) for the three months ended March 2021 than for the three months ended March 2020. Overall, there were 390 farm sales in the three months ended March 2021, compared to 445 farm sales for the three months ended February 2021 (-12.4%), and 277 farm sales for the three months ended March 2020.

1,549 farms were sold in the year to March 2021, 27.3% more than were sold in the year to March 2020, with 123.7% more Dairy farms, 8.7% less Dairy Support, 51.9% more Grazing farms, 41.4% more Finishing farms and 41.2% less Arable farms sold over the same period.

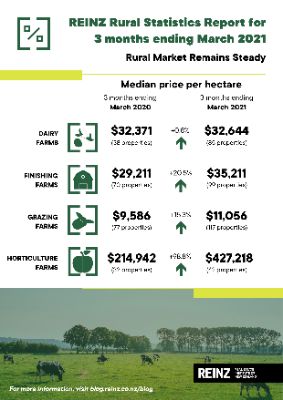

The median price per hectare for all farms sold in the three months to March 2021 was $25,665 compared to $22,660 recorded for three months ended March 2020 (+13.3%). The median price per hectare increased 0.3% compared to February 2021.

The REINZ All Farm Price Index decreased 0.6% in the three months to March 2021 compared to the three months to February 2021. Compared to the three months ending March 2020 the REINZ All Farm Price Index rose 5.9%. The REINZ All Farm Price Index adjusts for differences in farm size, location, and farming type, unlike the median price per hectare, which does not adjust for these factors.

Ten of the 13 regions recorded an increase in the number of farm sales for the three months ended March 2021 compared to the three months ended March 2020, with the most notable being Waikato (+37) and Taranaki (+14). Gisborne/Hawke’s Bay recorded the most notable decline in sales (-8). Compared to the three months ended February 2021, two regions recorded an increase in sales, namely Otago (+8) and Wellington (+3).

Brian Peacocke, Rural Spokesman, at REINZ says: “Sales figures for the three month period ending March 2021 reflect solid activity within the rural sector, albeit most categories experienced a slight easing in numbers from the previous three months. Horticulture and forestry were the exceptions with horticulture maintaining par and forestry recovering from a previous decline.

“Autumn conditions in a number of areas have been the best in many years with production in the dairy provinces achieving levels that will ensure tax payments will be added to the many issues farmers currently deal with. Regrettably, some of the regions on the East Coast of the North Island in particular are suffering from a serious shortage of rain.

“Product prices are variable with the dairy and horticultural sectors likely to achieve results which rank amongst the best for a good while, whilst beef and lamb prices reflect the normal seasonal constraints.

“The retention of the official cash rate at its current level as determined recently by the Reserve Bank was reassuring with the net result being a holding of interest rates for now.

Morale in the rural sector is generally good, influenced by stability in the financial sector as demonstrated by both the current level of the official cash rate that impacts on interest rates, plus the strength of the dairy price in particular in the face of a strong NZ dollar.

“It is also of note that all the trading banks are now more active within the rural sector than has been the case in recent years, this being a significant factor relating to sales activity within the rural property market,” he concludes.

Points of Interest around New Zealand include:

• Auckland/Northland - an easing of sales of dairy and grazing units but solid prices paid for finishing properties in Northland, this pricing being carried through into the Auckland region

• Waikato/King Country/Bay of Plenty - similarly, an easing in the numbers of dairy farm sales but high prices paid for the best of the finishing properties with Taupo district featuring strongly; several strong sales of kiwifruit blocks at prices almost equivalent to the Bay of Plenty were a feature within the Waikato; steady horticulture activity throughout the Bay of Plenty but slower in the Rotorua district in other categories.

• Gisborne/Hawke’s Bay - generally quiet in the eastern regions apart from several strong horticultural sales in Gisborne and Hawke’s Bay

• Taranaki - strong activity across the full price range of dairy units backed up by solid sales of good dairy support, finishing and grazing properties

• Wanganui/Manawatu/Tararua - good activity across the board with again, strong prices paid for finishing properties; several forestry sales were noted

• Wellington/Wairarapa - negligible results in the southern sector of the North Island

• Nelson/Marlborough - a quieter period in the upper South with lighter activity, mainly in the pastoral sector

• Canterbury/West Coast - in tandem with its northern neighbor, a passive period with lighter results, albeit steady prices in each of the pastoral categories; moderate activity on the West Coast

• Otago - a good level of activity throughout the province with solid prices paid for dairy and grazing units, and as has been the case in other regions, strong prices for finishing properties were the notable feature

• Southland - buoyant activity and good prices in the dairy sector reinforced by good sales of dairy support, finishing and grazing units.

Grazing farms accounted for the largest number of sales with a 30% share of all sales over the three months to March 2021, Finishing farms accounted for 25%, Dairy accounted for 22% and Horticulture accounted for 11% of all sales. These four property types accounted for 88% of all sales during the three months ended March 2021.

Dairy Farms

For the three months ended March 2021, the median sales price per hectare for dairy farms was $32,644 (85 properties), compared to $33,830 (89 properties) for the three months ended February 2021, and $32,371 (38 properties) for the three months ended March 2020. The median price per hectare for dairy farms has increased 0.8% over the past 12 months. The median dairy farm size for the three months ended March 2021 was 144 hectares.

On a price per kilo of milk solids basis the median sales price was $34.49 per kg of milk solids for the three months ended March 2021, compared to $35.48 per kg of milk solids for the three months ended February 2021 (-2.8%), and $32.55 per kg of milk solids for the three months ended March 2020 (+6.0%).

The REINZ Dairy Farm Price Index increased 0.6% in the three months to March 2021 compared to the three months to February 2021. Compared to March 2020, the REINZ Dairy Farm Price Index rose 16.1%. The REINZ Dairy Farm Price Index adjusts for differences in farm size and location compared to the median price per hectare, which does not adjust for these factors.

Finishing Farms

For the three months ended March 2021, the median sale price per hectare for finishing farms was $35,211 (99 properties), compared to $35,711 (133 properties) for the three months ended February 2021, and $29,211 (70 properties) for the three months ended March 2020. The median price per hectare for finishing farms has increased 20.5% over the past 12 months. The median finishing farm size for the three months ended March 2021 was 37 hectares.

Grazing Farms

For the three months ended March 2021, the median sales price per hectare for grazing farms was $11,056 (117 properties), compared to $11,550 (136 properties) for the three months ended February 2021 and $9,586 (77 properties) for the three months ended March 2020. The median price per hectare for grazing farms has increased 15.3% over the past 12 months. The median grazing farm size for the three months ended March 2021 was 135 hectares.

Horticulture Farms

For the three months ended March 2021, the median sales price per hectare for horticulture farms was $427,218 (42 properties), compared to $325,000 (39 properties) for the three months ended February 2021 and $214,942 (32 properties) for the three months ended March 2020. The median price per hectare for horticulture farms has increased 98.8% over the past 12 months. The median horticulture farm size for the three months ended March 2021 was 6 hectares.

Consumer NZ: Despite Low Confidence In Government Efforts, People Want Urgent Action To Lower Grocery Bills

Consumer NZ: Despite Low Confidence In Government Efforts, People Want Urgent Action To Lower Grocery Bills NZ Banking Association: Banks Step Up Customer Scam Protections And Compensation

NZ Banking Association: Banks Step Up Customer Scam Protections And Compensation The Reserve Bank of New Zealand: CoFR Seeking Feedback On Access To Basic Transaction Accounts

The Reserve Bank of New Zealand: CoFR Seeking Feedback On Access To Basic Transaction Accounts 2Degrees: Stop The Pings - Half Of Kiwis Overwhelmed By Notifications

2Degrees: Stop The Pings - Half Of Kiwis Overwhelmed By Notifications Electricity Networks Association: How Many More Trees Need To Fall On Power Lines Before The Rules Change?

Electricity Networks Association: How Many More Trees Need To Fall On Power Lines Before The Rules Change? Parrot Analytics: Netflix Earnings - Price Hikes With Minimal Churn | Will Netflix Be A Bright Spot For Markets?

Parrot Analytics: Netflix Earnings - Price Hikes With Minimal Churn | Will Netflix Be A Bright Spot For Markets?