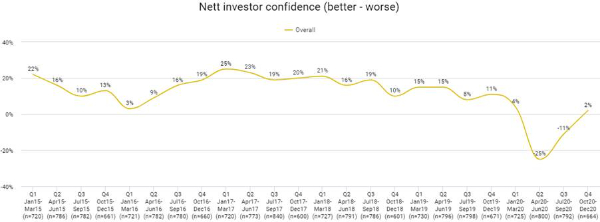

- Investor confidence continues to recover, sitting at nett 2% for Q4 2020, but has a way to go to return to pre-pandemic levels.

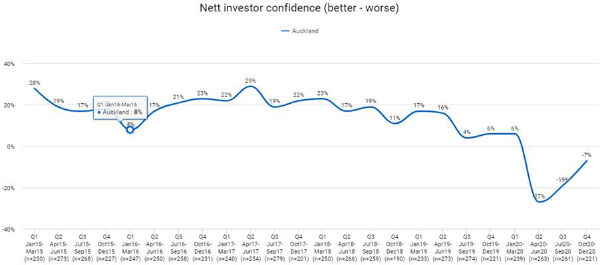

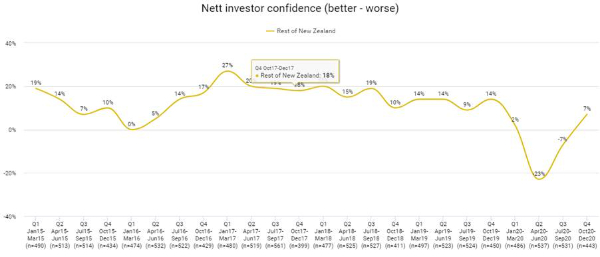

- Aucklanders remain less optimistic than elsewhere, with confidence at nett -7% compared with +7% for the rest of New Zealand.

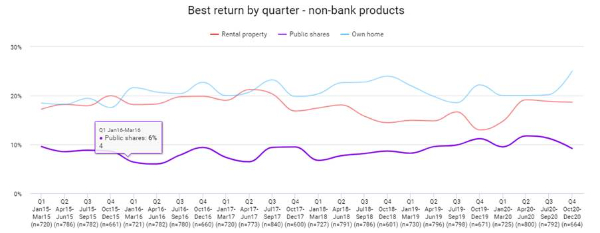

- A buoyant housing market means perceptions of the family home as the best investment for returns are at a record high.

- Ongoing regulatory changes for rental property seem to be weighing on investor perceptions.

Confidence among New Zealand investors continues to improve from the 2020 lows, as a recovering economy, low interest rates, a buoyant housing market and an impressive share market recovery influence sentiment about returns over the coming year.

The latest ASB Investor Confidence Survey shows nett investor confidence – the difference between those that think investment returns will improve versus worsen in the coming year – has lifted from -11% in Q3 to +2% for the three months to December. This follows an increase the previous quarter from a survey low of -25% in Q2.

ASB senior economist Chris Tennent-Brown says with all signs pointing to a solid economic recovery, and many investments performing well, it begs the question why confidence isn’t higher.

“It’s great to see confidence recovering, which is understandable given things are going so much better than we expected only six months ago. Financial markets are performing well, and that’s having a positive impact on investments like KiwiSaver and managed funds, as well as direct investments in the sharemarket. However, this is being tempered by concerns about low interest rates, the high valuation of property and shares, and uncertainty around COVID-19,” says Mr Tennent-Brown.

The housing market’s strength was reflected in this quarter’s survey, with 25% of respondents ranking the family home as providing the best return on investment – a record high. Meanwhile views of rental property providing the best return remained flat for the third consecutive quarter, which Mr Tennent-Brown attributes to the significant changes impacting landlords, making owning and running a rental property a more serious business.

“This goes back to the LVR restrictions which were implemented in 2013, as well as several changes introduced by both the National and Labour-led Governments. These are all challenges for property investors, which appear to be offsetting the confidence we’d expect to see from the general buoyancy in the housing market, and impacting return expectations,” says Mr Tennent-Brown.

Confidence in housing was split by region again this quarter, with 27% of those outside of Auckland viewing the family home as the best investment, compared with 21% of those in Auckland.

The survey shows general confidence is lower among those over 60-years-old, with those under 30 the most optimistic. Mr Tennent-Brown says this is likely a reflection of where the different age demographics tend to hold their assets.

“Generally those over 60 tend to have more income-focused investments, including term deposits, whereas the majority of under 30s are invested in KiwiSaver funds are likely to be the significant investment asset, and their own home if they have managed to get on the property ladder. It’s understandable they’re feeling confident given that KiwiSaver balances have recovered to pre-COVID levels, as well as the current strength of the property market and benefits of low borrowing costs.”

Mr Tennent-Brown says uncertainty around COVID-19 continues to affect overall sentiment, which is understandable.

“There is still a way to go for a full recovery in confidence, but it is good to see another quarter of significant improvement.

“As the long-term picture becomes clearer, we should see confidence for many investments continue to lift. However, offsetting forces include housing affordability, low interest rates impacting savers, and the continued impact of COVID-19, despite the hopes pinned on the roll-out of vaccines this year.”

ASB reports covering a range of commentary can be accessed at our ASB Economic Insights page.

Bill Bennett: Download Weekly - Review Of 2024

Bill Bennett: Download Weekly - Review Of 2024 Bill Bennett: One NZ scores worldwide first as Starlink direct-to-mobile launches

Bill Bennett: One NZ scores worldwide first as Starlink direct-to-mobile launches Hugh Grant: How To Reduce Network Bottlenecks

Hugh Grant: How To Reduce Network Bottlenecks Dominion Road Business Association: Auckland Transport's 'Bus To The Mall' Campaign: A Misuse Of Public Funds And A Blow To Local Businesses

Dominion Road Business Association: Auckland Transport's 'Bus To The Mall' Campaign: A Misuse Of Public Funds And A Blow To Local Businesses Parrot Analytics: A Very Parrot Analytics Christmas, 2024 Edition

Parrot Analytics: A Very Parrot Analytics Christmas, 2024 Edition Financial Markets Authority: Individual Pleads Guilty To Insider Trading Charges

Financial Markets Authority: Individual Pleads Guilty To Insider Trading Charges