Kiwi Credit Card Holders Could Be Facing A $247 Million 'Loyalty Tax'

Kiwi credit card holders could be overpaying millions of dollars in interest over the next two years unless they switch to a lower rate, according to Finder, a financial research and credit card comparison website in New Zealand.

A new nationally representative Finder survey of 1,478 New Zealand credit card owners has revealed that the majority of cardholders (72%) – equivalent to almost 2 million people – have been with their credit provider for at least 5 years.

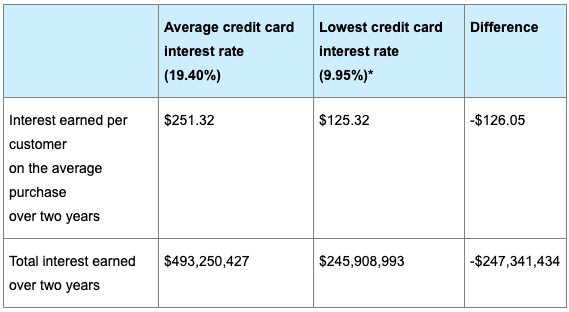

A Finder analysis of the latest RBNZ card data found that credit card owners are paying $247 million more in interest than they could be, with the average monthly credit card spend at $1,172.

According to the RBNZ, there are currently more than 2.7 million credit card holders in New Zealand, with the average credit card interest rate currently at 19.4%.

In comparison, the lowest rate available on Finder NZ is currently 9.95% (not including promotional rates).

If all of these loyal customers are on the average interest rate of 19.4%, and they switched to a low rate card, they could save over $247 million in interest over the next 2 years.

Kevin McHugh, Finder’s publisher in New Zealand, said that loyalty doesn’t always pay off when it comes to credit cards.

“If you’ve been with your credit card provider for a number of years and haven’t reviewed your rate, there’s a good chance you’re paying more interest than you could be elsewhere.

“By switching to a more competitive offer, you can lock in immediate savings.

“As we wrap up 2020, now is a good time to reassess your banking products and get on the financial front foot for the new year,” McHugh said.

McHugh said that for credit card holders who accrue festive debt during Christmas, a balance transfer can help them to pay it off quicker.

“They say Christmas is the most wonderful time of the year, but it’s also the most expensive, with many people relying on their credit card to get by.

“A balance transfer allows you to move existing debt from one card over to a new credit card with a 0% introductory interest rate for up to 6 months, or a low rate for the life of the balance.

“By paying low or no interest on your balance for a set period of time, you may be able to pay your festive debt off a lot faster than you otherwise would.

“As with any type of credit card product, fees and limits may apply, so it’s important to check the terms and conditions before signing up,” McHugh said.

Methodology

- This study was designed by Finder and conducted by Qualtrics, a SAP company.

- The online Finder survey was conducted using a nationally representative survey sample of 1,478 New Zealand credit card holders.

- Credit card interest was calculated using RBNZ data, and was based on the difference between the interest earned on the average purchase with the average rate over two years (19.40%), and the interest earned on the average purchase with the lowest rate on Finder NZ over two years (9.95%).

Brewers Association: Brewers Association Of New Zealand Supports Modernisation Of Alcohol Legislation

Brewers Association: Brewers Association Of New Zealand Supports Modernisation Of Alcohol Legislation Commerce Commission: ComCom Warns Of Pyramid Schemes After South Auckland Scammers Plead Guilty

Commerce Commission: ComCom Warns Of Pyramid Schemes After South Auckland Scammers Plead Guilty MBIE: MBIE Publish Mid-Point Review Of The Phase-Out Of The Low Fixed Charge (LFC)

MBIE: MBIE Publish Mid-Point Review Of The Phase-Out Of The Low Fixed Charge (LFC) Science Media Centre: Company Claims To Have “De-Extincted” The Dire Wolf – Expert Reaction

Science Media Centre: Company Claims To Have “De-Extincted” The Dire Wolf – Expert Reaction Stats NZ: Greenhouse Gas Emissions Fall 2.0 Percent In The December 2024 Quarter

Stats NZ: Greenhouse Gas Emissions Fall 2.0 Percent In The December 2024 Quarter The Reserve Bank of New Zealand: Christian Hawkesby Appointed As Governor Of The RBNZ

The Reserve Bank of New Zealand: Christian Hawkesby Appointed As Governor Of The RBNZ