'Tis The Season For Scammers

As Kiwis gear up for pre-Christmas sales events such as Black Friday, credit cardholders are keeping a close eye on their statements, according to new research by Finder, a financial research and comparison site in New Zealand.

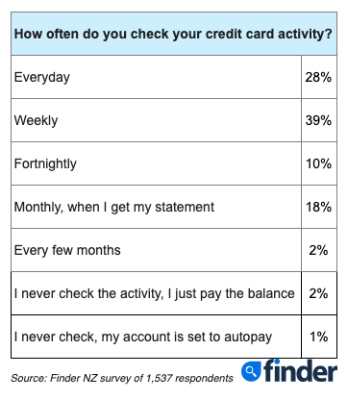

The Finder survey of 1,537 credit cardholders, has revealed that one in four (28%) New Zealanders are checking their credit card activity every day.

On the other hand, nearly one in five (18%) credit cardholders admitted to only checking their statement monthly when it comes in the mail.

This research comes as CERT NZ’s Quarter One (Q1) and Quarter Two (Q2) Report saw a 25% increase in phishing and credential harvesting, and a 229% increase in scams and fraud in Q2 of 2020 compared to the same period last year.

It is estimated that cyber security incidents like those mentioned above cost Kiwis $7.8 million in the first six months of 2020.

This period coincided with the COVID-19 lockdown which saw an increase in economic activity online. However, CERT NZ reported that 3% of reported scams during this time were COVID-19 themed.

Kevin McHugh, Finder’s publisher in New Zealand, has urged Kiwis to be vigilant with their finances in the lead up to the festive season.

“It’s encouraging to see so many New Zealanders proactively monitoring their credit card activity as we approach one of the busiest periods for online shopping with Black Friday and Christmas not too far off.

“As Christmas preparation sets in, many of us will be making more online payments, which leaves the potential for more online scams.

“Scammers are getting more sophisticated in their approach, so it might take a suspicious credit card transaction for you to realise that your information has been compromised.”

Millennials are the most vigilant when it comes to checking their statement with more than a third (35%) examining their charges every day, compared to only 19% of boomers logging on daily.

It’s concerning to see that a small amount of respondents (3%) confessed to never checking their statement.

A further 39% are looking at their statements once a week, while 10% review it fortnightly.

McHugh encouraged Kiwis to take advantage of all digital services offered by their bank to make it easier to stay on top of their finances.

“Once a scammer has access to your information, it doesn’t take long to start racking up charges.

“Waiting a month between activity checks could be detrimental to your finances as there might be a few nasty surprises when that monthly statement rolls around.

“Online banking means you can access your statements virtually anywhere at any time, and staying on top of your transactions is a great first step to protecting your money.”

If you are concerned about falling victim to an online scam, take a look at Finder’s COVID-19 scams guide to help minimise your risk: https://www.finder.com/nz/coronavirus-common-scams-to-watch-out-for

Methodology:

- This study was designed by Finder and conducted by Qualtrics, a SAP company.

- The online survey was conducted using a nationally representative survey sample of 2,001 New Zealand residents – of which, 1,537 were credit card holders.

Greenpeace: Taranaki - Greenpeace Activists Stop Unloading Of Palm Kernel Sourced From Indonesian Rainforests

Greenpeace: Taranaki - Greenpeace Activists Stop Unloading Of Palm Kernel Sourced From Indonesian Rainforests Seafood New Zealand: Seafood Situation Saved By A Sausage - New Plymouth Locals Innovate, Using Crayfish Bait

Seafood New Zealand: Seafood Situation Saved By A Sausage - New Plymouth Locals Innovate, Using Crayfish Bait Takeovers Panel: Takeovers Panel Convenes Meeting To Inquire Into The Acquisition Of Shares In NZME Limited

Takeovers Panel: Takeovers Panel Convenes Meeting To Inquire Into The Acquisition Of Shares In NZME Limited WorkSafe NZ: Conveyor Belt Death-Trap Was A Danger In Plain Sight

WorkSafe NZ: Conveyor Belt Death-Trap Was A Danger In Plain Sight Commerce Commission: 2degrees Fined $325,000 For Misleading Claims About ‘Free’ Aussie Business Roaming

Commerce Commission: 2degrees Fined $325,000 For Misleading Claims About ‘Free’ Aussie Business Roaming  Natural Hazards Commission: Hub Launched To Empower Architects And Engineers To Build Above Code

Natural Hazards Commission: Hub Launched To Empower Architects And Engineers To Build Above Code