Is The Property Market Headed For A Recession?

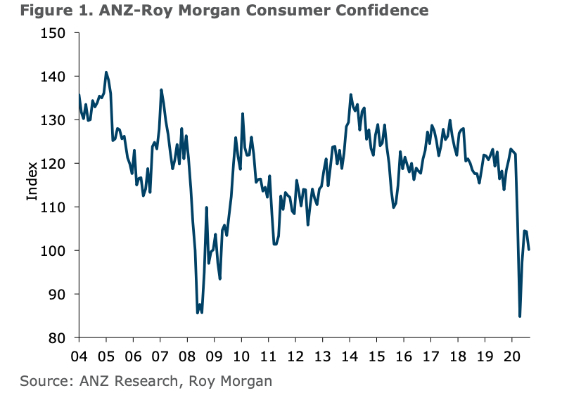

Recession Indicators - Consumer Confidence is Down to 2009 Levels

The ANZ-Roy Morgan Consumer Confidence Rating analyses the data in the percentage of respondents (a random telephone sample of over 1,000 people) who give favourable and those who give unfavourable answers to five key questions (our answers in italics):

Q1: Would you say you and your

family are better-off financially or worse off than you were

at this time last year? (could have done 5 more flips if

not for lockdown, but since flips give me a chunk of money

each time, much the same maybe slightly better

off)

Q2: This time next year, do you and your

family expect to be better-off financially or worse off than

you are now? (no more lockdowns and we will be better

off!)

Q3: Thinking of economic conditions in

New Zealand (or Australia) as a whole. In the next 12

months, do you expect we’ll have good times financially,

bad times or some good and some bad? (personally I feel

we as a whole are up for a rough patch with job losses,

entire industries shutting down and fewer jobs available

getting more applicants..)

Q4: Looking ahead,

what would you say is more likely, that in New Zealand (or

Australia) as a whole, we’ll have continuous good times

during the next five years or so — or we’ll have bad

times — or some good and some bad? ( 24 months of

recovery followed by a few years of good depending on

government policy? The property market seems to be more or

less resilient.)

Q5: Generally, do you think

now is a good time — or a bad time — for people to buy

major household items? (Do you really need that 72" flat

screen TV? Personally, my only expenditure moving forward is

to invest in property and my business. No

toys.)

What does this all mean?

'The net proportion of households who think it’s a good time to buy a major household item gave up another 3 points, falling to a recessionary -3%'.. The verdict is in, we are technically there but no one wants to break the news.

What Should You Do?

Since we can't travel, don't be tempted to buy that luxury item, watch, car, motorbike that you may not actually use. Do however increase your knowledge and investigate where you can put your money as a hedge to inflation.

Need to talk to chat with someone who knows what they are on about? Book a call with Tom Faye here.

Tom Faye founded House Flipping NZ, a property investment and education business based in Auckland, New Zealand. The business provides solutions to the marketplace such as educating investors on how to find their own properties and then buy, renovate, and revalue off market properties; giving sellers the benefit of quick sales cycles without the hassle of expensive and sometimes excessive marketing campaigns.

Canterbury Museum: Mystery Molars Lead To Discovery Of Giant Crayfish In Ancient Aotearoa New Zealand

Canterbury Museum: Mystery Molars Lead To Discovery Of Giant Crayfish In Ancient Aotearoa New Zealand Ngā Pae o te Māramatanga: Māori Concerns About Misuse Of Facial Recognition Technology Highlighted In Science

Ngā Pae o te Māramatanga: Māori Concerns About Misuse Of Facial Recognition Technology Highlighted In Science Retail NZ: Retailers Call For Flexibility On Easter Trading Hours

Retail NZ: Retailers Call For Flexibility On Easter Trading Hours WorkSafe NZ: Worker’s Six-Metre Fall Prompts Industry Call-Out

WorkSafe NZ: Worker’s Six-Metre Fall Prompts Industry Call-Out PSGR: Has MBIE Short-Circuited Good Process In Recent Government Reforms?

PSGR: Has MBIE Short-Circuited Good Process In Recent Government Reforms? The Reserve Bank of New Zealand: RBNZ’s Five Year Funding Agreement Published

The Reserve Bank of New Zealand: RBNZ’s Five Year Funding Agreement Published