Kiwibank Announces Full Year Results To 30 June 2020.

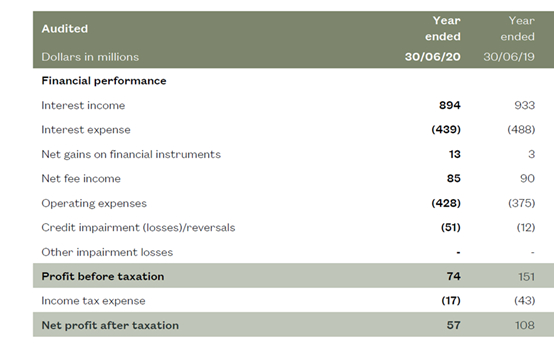

Kiwibank today announced a net profit after tax of $57 million for the 12 months to 30 June 2020, down from $108 million on the prior corresponding period.

“As expected, this result reflects the impact of COVID-19 and a lower interest rate environment on the bank,” said Kiwibank Chief Executive Steve Jurkovich.

“At the same time, we continued to increase our investment in good customer outcomes and our transformation to be an even better bank.”

Mr Jurkovich said the bank recognised $51 million in credit impairment provisions, up from $12 million on the prior corresponding period. The increase reflects the bank’s current view of the impact of COVID-19.

Operating expenses also increased, driven by an increase in investment to support the bank’s growth, good customer outcomes and transformation.

“Kiwibank continued to grow at a

faster rate than the market, with lending growth of 9% and

deposit growth of 13% in FY20. The market grew at a slower

pace of 5% and 9% respectively,” said Mr

Jurkovich.

“As a result, we are growing our lending and deposit rates faster than the market to help more New Zealanders into homes, more Kiwis to save, and support more businesses – living up to our purpose of Kiwis making Kiwis better off.”

COVID-19: supporting New Zealand’s recovery.

Mr Jurkovich said the bank

had taken a leadership role during lockdown, prioritising

the health and safety of its people and providing much

needed support for customers and suppliers. Highlights

included:

- Kiwibank’s Relief and Resilience programme provided support to more than 8,000 personal and business banking customers for loans totalling more than $2.6 billion.

- Supporting Kiwi businesses by moving from paying suppliers on the 20th of the month to paying accounts on a weekly basis.

- Taking a market-leading position on the fixed home-loan market and introducing a significant reset to variable home loan rates with a one percentage point drop. “This reset of the variable home loan market will save Kiwis $20 million in interest over the next year at a time when they need it most.”

- The temporary closure of bank branches during lockdown and redeployment of our people into areas where they could continue to support our customers.

- Supporting our Kiwibank whānau as they supported our customers, by making a commitment not to reduce jobs, hours, or pay rates.

“Looking

ahead, we will continue to play our role in New Zealand’s

economic recovery by offering a better banking alternative

that’s committed to being fair and easy for Kiwis, the

businesses they own, and for future generations,” said Mr

Jurkovich.

Sustainability update.

Kiwibank

continued to make strong progress against its sustainability

commitments in FY20.

Social and community.

- Building financial and digital capability: support provided to more than 37,000 community groups and individuals through our partnerships with Banqer, Ngā Tāngata Microfinance Trust, Aviva and Digital Inclusion Alliance Aotearoa.

- Supporting mental wellbeing: With the support of Kiwibank, the Mentemia mental wellbeing app has been made free for anyone to download until the end of September 2020 with more than 50,000 New Zealanders downloading the app as at 30 June.

People and culture.

- Diversity and Inclusion: our work to ensure that we have a diverse and inclusive culture achieved some significant milestones, with accreditation under the Living Wage programme and the Rainbow Tick.

- Supporting our people’s wellbeing with the introduction of life and health insurance and additional parental leave benefits for both primary and secondary carers.

Natural environment.

- Total carbon emissions reduced by 26% from our FY18 baseline, which puts us on track to meet our targeted reductions of 30% by FY22.

Summary of Key financial information.

Disclosure Statement – June 2020

PSGR: Has MBIE Short-Circuited Good Process In Recent Government Reforms?

PSGR: Has MBIE Short-Circuited Good Process In Recent Government Reforms? The Reserve Bank of New Zealand: RBNZ’s Five Year Funding Agreement Published

The Reserve Bank of New Zealand: RBNZ’s Five Year Funding Agreement Published Lodg: Veteran Founders Disrupting Sole-Trader Accounting in NZ

Lodg: Veteran Founders Disrupting Sole-Trader Accounting in NZ New Zealand Airports Association: Airports Welcome Tourism Marketing Turbocharge

New Zealand Airports Association: Airports Welcome Tourism Marketing Turbocharge Ipsos: New Zealanders Are Still Finding It Tough Financially; Little Reprieve Expected In The Next 12 Months

Ipsos: New Zealanders Are Still Finding It Tough Financially; Little Reprieve Expected In The Next 12 Months NZ Telecommunications Forum - TCF: Telecommunications Forum Warns Retailers About 3G Shutdown

NZ Telecommunications Forum - TCF: Telecommunications Forum Warns Retailers About 3G Shutdown