Gisborne still the place to be

It has been Gisborne’s year, and the region comes out tops on our regional rankings for the fourth successive quarter. Like everywhere, question marks are about the COVID-19 impact on the future.

“Gisborne is significantly exposed to the impact of COVID-19,” says ASB chief economist Nick Tuffley.

“The forestry sector was initially hit hard hit by the disruptions caused by coronavirus, and the meat sector has been impacted too. China’s ongoing recovery from its COVID-19 disruption will help to drive a similar recovery in fortunes for these key sectors as well,” says Tuffley.

The region went into the crisis with plenty of momentum. Housing market strength saw house price growth top the nationwide ranks over the quarter. Retail trade and new car registrations also grew more here than anywhere else.

Hawke’s Bay yo-yo’s across the year

The Hawke’s Bay has been on a yo-yo ride in the ASB Scoreboard, courtesy of some lumpy growth data. This quarter it moved in the right direction, up to third place. The pipeline of both residential and non-residential consents was healthy at the end of Q1, and retail sales activity has been solid.

“Confidence in Hawke’s Bay and Gisborne has been interesting – in early 2019 it was lower than nationwide, but in more recent surveys it has bounced back, which is encouraging for the region,” says Tuffley.

Just like the other “Bay”, Hawke’s Bay is well positioned to capture a good slice of domestic tourism while the borders are closed.

“It seems in some cases that joy may be short-lived as the coronavirus outbreak and local drought combine to send rural incomes back to earth, at least temporarily,” says Tuffley.

Tide turns for Taranaki

Taranaki has climbed dramatically up the rankings, from mid-pack to 2nd place. The result reflects a good pipeline of construction work, house price growth and solid retail sales growth over the past year.

“Consumer confidence has taken a knock this year, but is still holding up better than average, and the unemployment rate was lower than elsewhere as we went into lockdown. That all bodes well for the future as the economy emerges from the COVID-19 crisis,” says Tuffley.

Domestic Tourism and regional economic activity

Missing tourists is a theme for many regions that suddenly find themselves in a completely different environment than what we imagined only six months ago. The tourism sector is perhaps the most visible casualty from COVID-19, and it impacts each region by quite varying amounts. Due to the loss of international tourism, New Zealand’s GDP will be 3-5% lower than it would otherwise be. The return to pre-COVID-19 levels of free cross-border movement looks to be years, rather than months away. Domestic tourism within New Zealand is already 40% larger than inbound tourism, and the switch towards domestic tourist experiences for New Zealanders will lessen the economic hit while we wait for borders to re-open.

Our overview of tourism is attached, and this quarter’s ASB Regional Scoreboard highlights some of the regional attractions we encourage New Zealanders to consider for their bucket list of domestic tourism.

The full ASB Regional Economic Scoreboard, along with other recent ASB reports covering a range of commentary, can be accessed at our ASB Economic Insights page: https://www.asb.co.nz/documents/economic-insights.html

About the ASB Regional Economic Scoreboard

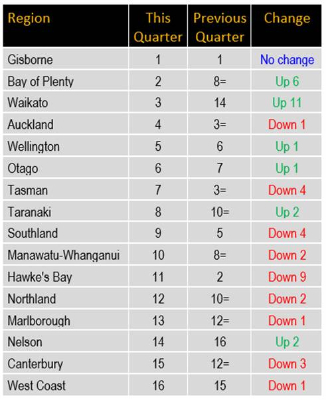

The NZ Regional Economic Scoreboard takes the latest quarterly regional statistics and ranks the economic performance of New Zealand’s 16 Regional Council areas. The fastest growing regions gain the highest ratings, and a good performance by the national economy raises the ratings of all regions. Ratings are updated every three months, and are based on 11 measures, including employment, construction, retail trade, and house prices.

Financial Markets Authority: FMA Seeks Clarity From High Court On Use Of Eligible Investor Certificates In Wholesale Investment Sector

Financial Markets Authority: FMA Seeks Clarity From High Court On Use Of Eligible Investor Certificates In Wholesale Investment Sector Scion: Scion’s Novel Internship Model Connects Talent With Industry

Scion: Scion’s Novel Internship Model Connects Talent With Industry Financial Markets Authority: Westpac Admits To Misleading Representations That Resulted In $6.35m In Overcharges

Financial Markets Authority: Westpac Admits To Misleading Representations That Resulted In $6.35m In Overcharges Bill Bennett: Download Weekly - Review Of 2024

Bill Bennett: Download Weekly - Review Of 2024 Bill Bennett: One NZ scores worldwide first as Starlink direct-to-mobile launches

Bill Bennett: One NZ scores worldwide first as Starlink direct-to-mobile launches Hugh Grant: How To Reduce Network Bottlenecks

Hugh Grant: How To Reduce Network Bottlenecks