Xero Data Reveals COVID-19’s Initial Impact On NZ Small Business Sector

Xero - the global small business platform, today released analysis from its Small Business Insights program for March and April, revealing the initial impact of COVID-19, the importance of the wage subsidy and what small businesses will need as they move into the rebuild and recovery phase.

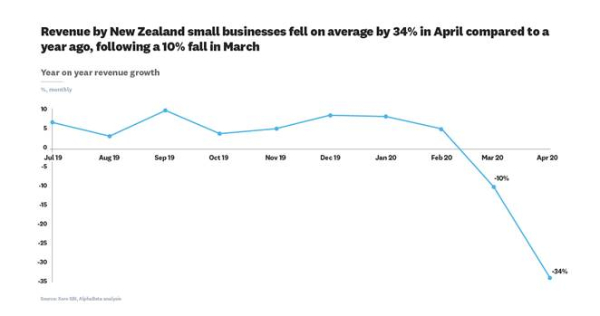

Year-on-year revenue for small business fell by 10% in March and 34% in April.

Craig Hudson, Xero Managing Director of New Zealand and the Pacific Islands, says revenue numbers began to fall after New Zealand recorded its first COVID-19 case.

“Revenue dropped through March to the end of April as the pandemic hit New Zealand and we entered Alert Level 4 restrictions.

“We all know small businesses are feeling the pain of the economic shock caused by COVID-19, and spending habits completely changed.

“Xero is currently processing Small Business Insights data for May which will show how the small business economy fared as the country moved out of Alert Level 4.

“There is still a lot of hardship ahead, but in May we look forward to seeing the results as parts of the economy open up again,” continues Hudson.

Job losses in the small business sector

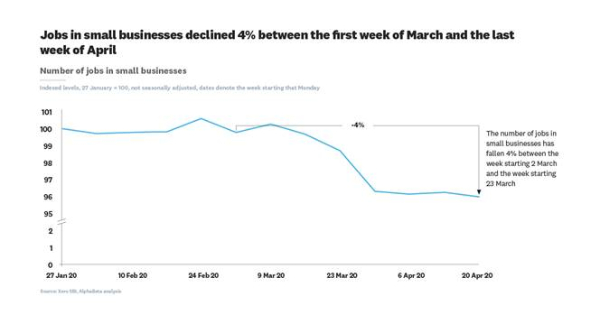

During the month of March, the number of jobs in small businesses dropped 4% or by approximately 24,000 employees.

The losses levelled out towards the end of March when the Government’s wage subsidy package began to be paid out to small businesses across the country.

Hudson says it’s clear the wage subsidy package was an important piece of the puzzle in order for small businesses to retain staff as we entered the lockdown period.

“As much as it’s easy to get lost in the numbers, every single job is precious. For those that can, shopping locally and paying invoices on time will be vital to our recovery. That’s how we’ll keep money circulating through the economy and give small businesses the confidence to employ again.”

Regional impacts

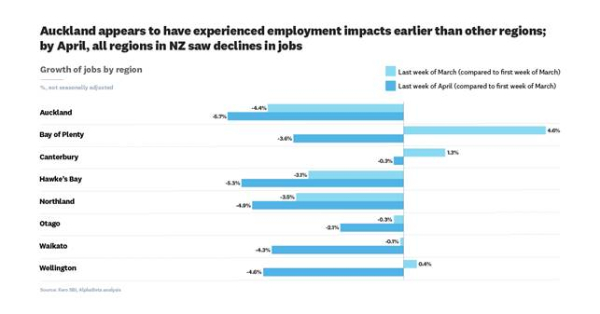

COVID-19’s impact on regional employment was varied. Auckland, Hawke’s Bay and Northland saw decreases in employment earlier than the rest of the country. In the last week of March, Auckland employment figures were down 4.4%, alongside Northland (-3.5%) and Hawke’s Bay (-3.1%).

However, by the time New Zealand had been in lock down for several weeks, these impacts were widespread across the country.

While Auckland saw the largest drop in job numbers in April (-5.7%) there were also reported declines in employment in Otago (-2.1%), the Bay of Plenty (-3.1%), Waikato (-4.3%), Wellington (-4.6%), Northland (-4.9%) and the Hawke’s Bay (-5.3%).

Hudson says: “Regardless of location, New Zealand’s small business sector has been hit hard by COVID-19. The sector will continue to need support in the tail end of this pandemic. Now more than ever, cash flow is important to small and medium businesses.

“To do your part to keep the New Zealand economy afloat and support the small business sector, the best thing to do is pay your bills promptly. If we can keep money circulating around the country, this will be one of the ways to help alleviate the economic shock of lockdown as we begin to reopen as a nation.

“Additionally, I encourage all Kiwis to get out and explore their own backyards and spend locally. Aotearoa is a country of wonder and a surge of domestic tourism would go a long way in supporting key regions that were hit hard and fast.”

Hugh Grant: How To Build Confidence In The Data You Collect

Hugh Grant: How To Build Confidence In The Data You Collect Tourism Industry Aotearoa: TRENZ 2026 Set To Rediscover Auckland As It Farewells Rotorua - The Birthplace Of Tourism

Tourism Industry Aotearoa: TRENZ 2026 Set To Rediscover Auckland As It Farewells Rotorua - The Birthplace Of Tourism NIWA: Students Representing New Zealand At The ‘Olympics Of Science Fairs’ Forging Pathway For International Recognition

NIWA: Students Representing New Zealand At The ‘Olympics Of Science Fairs’ Forging Pathway For International Recognition Coalition to End Big Dairy: Activists Protest NZ National Dairy Industry Awards Again

Coalition to End Big Dairy: Activists Protest NZ National Dairy Industry Awards Again Infoblox: Dancing With Scammers - The Telegram Tango Investigation

Infoblox: Dancing With Scammers - The Telegram Tango Investigation Consumer NZ: This Mother’s Day, Give The Gift Of Scam Protection And Digital Confidence

Consumer NZ: This Mother’s Day, Give The Gift Of Scam Protection And Digital Confidence