The State Of Canterbury's Export Sector Before COVID-19 Took Hold

Canterbury Exports (January & February 2020)

Dr David Dyason and Dr Peter Fieger, ChristchurchNZ economists

March 2020

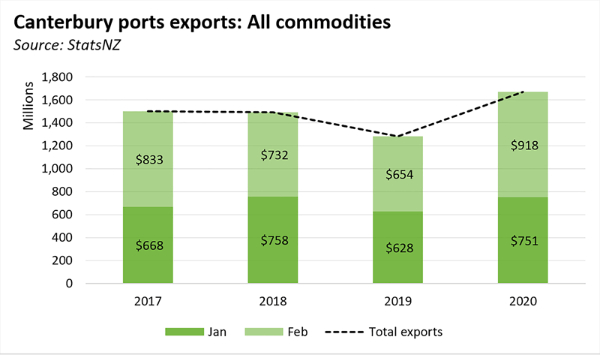

- The first two months of 2020 show strong export growth from Canterbury ports with growth of 30.2% in all exports compared to the same period in 2019. Dairy and meat exports continue to be the growth drivers.

- Growth is attributed to increased demand from other markets (USA for meat & Vietnam for mechanical equipment) while exports to China are lower.

- Exports via sea continue to be the main method of transport (70% of exports) – showing more resilience.

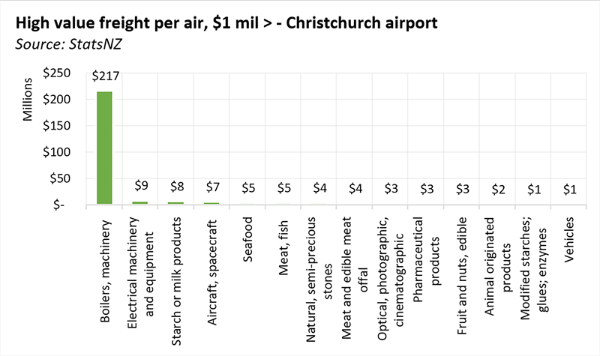

- Air freight accounts for 30% of exports from Canterbury for the first two months, with Vietnam the main destination and for one group of products ($170mil from $282mil or 75% of all air freight in Jan & Feb). Decreasing international air connections is likely to put increased constraints on air freight from March onwards.

- Preliminary March data shows lower export values in most products, except meat. This suggests lower export from New Zealand and possibly Canterbury.

- Port capacity and movement of goods are likely to be put under pressure during the lockdown period which could constrain exports and imports between ports.

Total exports from Canterbury ports

In January and February 2020, exports from Canterbury ports showed resilience to the international shock. They grew 30.2% compared to the same time in 2019, despite falling accessibility to China.

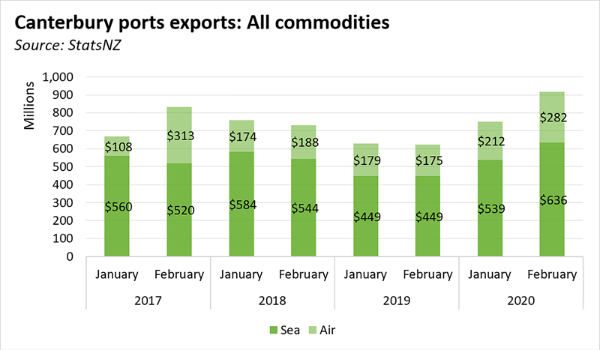

Export method

During January and February, 70 % of freight ($1.1B) was exported by sea, while air accounted for 30% or $494 million during the same period.

Since many international flights have been cancelled due to lower consumer demand, businesses whose products were primarily exported via air (in passenger planes) will most likely experience delays and short-term impacts on their ability to get their product to the international market.

Risk associated with air export:

Exports via air freight are dominated by one group of products namely boilers, machinery and mechanical appliances; parts thereof to Vietnam. This has seen Vietnam become one of the major trading partners within the Canterbury region.

At this stage the effect of decrease in air transport on the export of these goods in unknown.

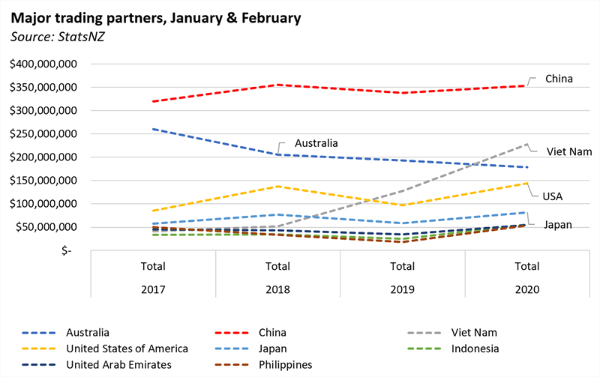

Major trading partner shifts

The value in exports to the major trading partners continues to show strong growth in January and February 2020 compared to the previous years. Export growth to the major trading partners from Canterbury ports for January and February of 2019 and 2020 is:

- China ($353m in value) – 4.4% growth from 2019

- Vietnam ($227m) – 78% growth from 2019

- Australia ($178m) – (-7.5%) decline from 2019

- USA ($143m) – 49% growth from 2019

- Japan ($82m) – 40% growth from 2019

Effect on Canterbury’s major export products

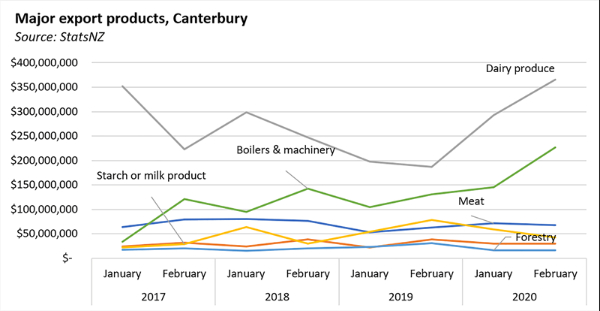

The major export products in value include dairy produce; boilers, machinery and mechanical appliances; meat; cereals, flour, starch or milk products; seafood and forestry.

The trend in exports for January and February in the region is summarised below.

Table: Major exports, Canterbury

| 2019 to 2020 growth | Total export value (Jan & Feb) | ||

| January | February | ||

| Meat | 33.0% | 7.9% | $139 mil |

| Seafood | 39.3% | -21.0% | $60 mil |

| Dairy produce | 48.1% | 95.0% | $657 mil |

| Starch or milk products | 7.4% | -45.4% | $101 mil |

| Forestry | -29.7% | -44.5% | $33 mil |

| Boilers & machinery parts | 39.8% | 73.4% | $372 mil |

Source: StatsNZ

The value of exports for all goods except forestry experienced growth in January 2020 compared to January 2019. In February, the effect of supply-chain restriction is visible in the negative growth for seafood, cereals and forestry from the region. Meat, dairy and boilers/machinery continued to grow.

Preliminary March data (first half of March)

Preliminary data on March exports for New Zealand shows a decrease of 10% in exports for the first half of March 2020 compared with 2019. This initial data suggests meat exports are currently the only growing export product, driven by increased exports to USA (+12%) while Australia (-22%) and China (-26%) are lower.

Total dairy export is lower by 4.5%, forestry by 39% and seafood by 6%.

Table: Preliminary March export data, New Zealand, 2020 vs. 2019

| China | USA | All countries | |

| All exports | -26% | +12% | -10% |

| Diary | -13% | -5% | |

| Seafood | -29% | -6% | |

| Meat | -25% | +22% | +4% |

| Forestry | -64% | -38% |

The March data is likely to show the first month of decreased overall export values compounded by the growing COVID-19 pandemic and as countries close their borders and international trade links start facing headwinds.

Export and import goods capacity at NZ ports are under pressure since imported goods are not being delivered which takes up storage space and limits availability of empty containers for goods to be exported[1]. Without goods being delivered to storage or clients, the capacity at ports will create bottlenecks during the lockdown period affecting our ability to export.

[1] https://www.stuff.co.nz/business/120585877/warning-nz-ports-may-start-to-seize-up-this-week-if-nonessential-freight-cant-be-moved

Hugh Grant: How Can Telehealth And Home Healthcare Solutions Be Helpful?

Hugh Grant: How Can Telehealth And Home Healthcare Solutions Be Helpful? New Zealand Merino Company: The New Zealand Merino Company Will Investigate PETA Claims

New Zealand Merino Company: The New Zealand Merino Company Will Investigate PETA Claims New Zealand Certified Builders: Building A Granny Flat? Four Things You Should Know

New Zealand Certified Builders: Building A Granny Flat? Four Things You Should Know Paul Scofield & George Young, The Conversation: The Discovery Of A Rare New Fossil Sheds Light On NZ’s Extinct Dolphin-like Reptiles

Paul Scofield & George Young, The Conversation: The Discovery Of A Rare New Fossil Sheds Light On NZ’s Extinct Dolphin-like Reptiles Spirits New Zealand: A Year Of Two Halves For The NZ Spirits Industry

Spirits New Zealand: A Year Of Two Halves For The NZ Spirits Industry MoneyHub: Comprehensive Guide To New Zealand Wage And Salary Distributions

MoneyHub: Comprehensive Guide To New Zealand Wage And Salary Distributions