The eerie silence greeting the streets carried ominous signs of distress when New Zealand joined the bandwagon of countries observing lockdown. Girding its loins against Covid-19, the nation prepared for self-isolation. Since the infection rate skyrocketed to 205 last Wednesday, Prime Minister Jacinda Ardern promptly imposed a national lockdown of four weeks.

The Latest Stock Market Rally with some Sinusoidal Waves

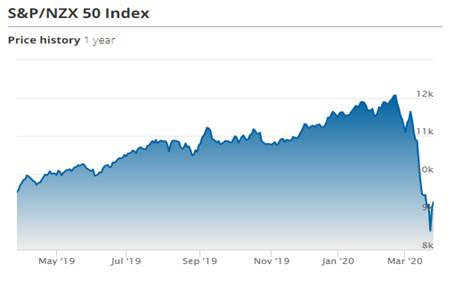

While the hustling business zones in the country looked deserted, the stock market reverberated positive vibes as the stock indices on the third consecutive day continued the rally (as at 26 March 2020). S&P/NZX 50 Index rose by over 368 points showing the intraday growth of 3.97%. The Australian Stock Exchange (ASX) also opened on a positive note, witnessing a surge of 2.30% in S&P/ASX 200 on 26 March 2020. While some sinusoidal waves again seeped in on 27 March 2020 with indices going slightly down.

Source: NZX

Growth trends in NZ market amidst such a hazy situation seems to suggest that the investors are not ditching their optimism entirely. While the stocks bumped against the market movement in the past few weeks amid coronavirus outbreak, early signs of the bullish trends continued to cascade gleaming hopes for the market. Few investors with high-risk appetite have already started cherry-picking the stocks, refuting the event-driven turmoil led by the pandemic.

Both mid-caps and small caps sent positive signals across the stock exchange on 26 March 2020. The S&P/NZX MidCap Index rose by 3.97% while the S&P/NZX SmallCap Index inched up by 3.59% on Thursday. However, the trend is to be monitored given the slight fall noted on 27 March 2020.

The Silver Lining in Times of Despair

The degree of resilience seems to majorly depend upon the duration of the epidemic, for which the necessary measures are undertaken worldwide. The New Zealand Government’s stimulus package of $12.1 billion seems to rekindle investor’s hope while the reserve bank through its rate cut measures strives to bolster the wavering economy. Although some have left the boat, some investors are eyeing to avail massive price bargains in the share market - taking cues from the famous quote by Warren Buffet -

“Widespread fear is your friend as an investor because it serves up bargain purchases.”

Many Sectors are Defying Covid-19 Trend

Some of the popular sectors in New Zealand seemed spellbound by the positive market movement with the stocks witnessing price appreciation (although the recovery frame is yet to be ascertained well – and one must watch this space). The Information technology and Communication Services sectors were at the forefront of the latest rally showcasing the index rise of 6.80% and 6.59%, respectively, on Thursday. The other sectors such as real estate, industrials and utilities also witnessed surge in their respective indices by over 4.5% on 26 March 2020.

Few sectors seem to be standing relatively cushioned against the epidemic due to their intrinsic nature. Utility sector amalgamated with the contingency supply planning is invested in providing the basic amenities that are unlikely to see a substantial drop in demand. Likewise, as the people are confined to their places, the telecommunication services remain as their prominent source of contact from the outside world.

As the impending doom of uncertainty hovers over the market, another interesting space is taken up by the dividend stocks that might emerge as the holy grail of the risk-averse investors. Meridian Energy Limited (NZX: MEL), Mercury NZ Limited (NZX: MCY) and Telstra Corporation Limited (NZX: TLS) demonstrate fair dividend yields (above 5%). The regular stream of dividend income coupled with the lucrative growth prospects amidst the ongoing stock market ride seems to be an investor’s ultimate guide to fruitful returns.

Bottomline

Uncertainty clouds the international markets as the world keenly awaits the halt of virus spread. Although no one can predict about the ultimate moment when the world would be liberated from the pandemic, a few wise decisions and long-term vision may help some to build their profit reaping investment portfolio

Waipa Networks: Cambridge Is Open For Business With $45M Energy Boost

Waipa Networks: Cambridge Is Open For Business With $45M Energy Boost Master Plumbers Gasfitters and Drainlayers NZ: New Consumer NZ Test Reveals Danger Of Unregulated Online Plumbing Products

Master Plumbers Gasfitters and Drainlayers NZ: New Consumer NZ Test Reveals Danger Of Unregulated Online Plumbing Products Mindful Money: Winners At The Mindful Money Annual Ethical & Impact Investment Awards 2025

Mindful Money: Winners At The Mindful Money Annual Ethical & Impact Investment Awards 2025 MBIE: Gas Supply Reducing Faster And Sooner Than Previously Forecast

MBIE: Gas Supply Reducing Faster And Sooner Than Previously Forecast Natural Hazards Commission: International Markets Show Unprecedented Confidence In NZ’s Natural Hazards Insurance Scheme

Natural Hazards Commission: International Markets Show Unprecedented Confidence In NZ’s Natural Hazards Insurance Scheme  ASB Bank: ASB Business Survey - The Impact Of Trump's Tariffs, According To Kiwi Businesses

ASB Bank: ASB Business Survey - The Impact Of Trump's Tariffs, According To Kiwi Businesses