Global Economy Faces Gravest Threat Since The Crisis As Coronavirus Spreads

The coronavirus Covid-19 presents the global economy with its greatest danger since the financial crisis, according to the OECD’s latest Interim Economic Outlook.

Covid-19 is spreading from China to other regions causing human suffering and economic disruption. It is raising health concerns and the risk of wider restrictions on the movement of people, goods and services, falls in business and consumer confidence and slowing production.

The Interim Outlook presents both a best-case scenario in which the extent of the coronavirus is broadly contained and a “domino” prospect of contagion that is more widespread.

In both cases, the OECD calls on governments to act immediately to limit the spread of the coronavirus, protect people and businesses from its effects and shore up demand in the economy.

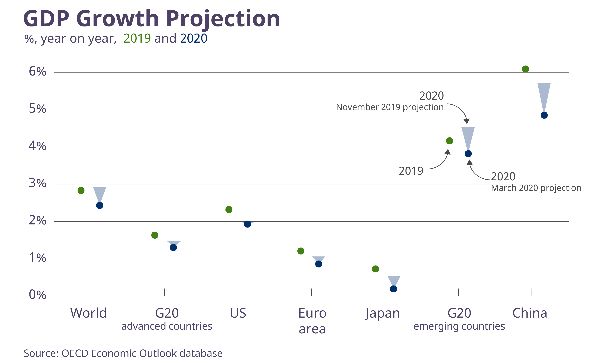

Even in the best-case scenario of limited outbreaks in countries outside China, a sharp slowdown in world growth is expected in the first half of 2020 as supply chains and commodities are hit, tourism drops and confidence falters. Global economic growth is seen falling to 2.4% for the whole year, compared to an already weak 2.9 % in 2019. It is then expected to rise to a modest 3.3% in 2021.

Growth prospects for China have been revised down sharply to below 5% this year after 6.1% in 2019.

But broader contagion across the wider Asia-Pacific region and advanced economies – as has happened in China - could cut global growth to as low as 1.5% this year, halving the OECD’s previous 2020 projection from last November. Containment measures and loss of confidence would hit production and spending and drive some countries into recession, including Japan and the euro area.

Presenting the Interim Outlook in Paris today, OECD Chief Economist Laurence Boone said: “The virus risks giving a further blow to a global economy that was already weakened by trade and political tensions. Governments need to act immediately to contain the epidemic, support the health care system, protect people, shore up demand and provide a financial lifeline to households and businesses that are most affected.”

The Outlook says that flexible working should be used to preserve jobs. Governments should implement temporary tax and budgetary measures to cushion the impact in sectors most affected by the downturn such as travel and tourism, and the automobile and electronic industries.

In the most affected countries, adequate liquidity needs to be provided to allow banks to help companies with cash-flow problems while containment measures are in force, it adds.

If the epidemic spreads widely, the G20 economies should lead an internationally co-ordinated framework for health care support, combined with co-ordinated fiscal and monetary stimulus to rebuild confidence, the Outlook adds.

NIWA: Students Representing New Zealand At The ‘Olympics Of Science Fairs’ Forging Pathway For International Recognition

NIWA: Students Representing New Zealand At The ‘Olympics Of Science Fairs’ Forging Pathway For International Recognition Coalition to End Big Dairy: Activists Protest NZ National Dairy Industry Awards Again

Coalition to End Big Dairy: Activists Protest NZ National Dairy Industry Awards Again Infoblox: Dancing With Scammers - The Telegram Tango Investigation

Infoblox: Dancing With Scammers - The Telegram Tango Investigation Consumer NZ: This Mother’s Day, Give The Gift Of Scam Protection And Digital Confidence

Consumer NZ: This Mother’s Day, Give The Gift Of Scam Protection And Digital Confidence NZ Airports Association: Airlines And Airports Back Visa Simplification

NZ Airports Association: Airlines And Airports Back Visa Simplification Netsafe: Statement From Netsafe About Proposed Social Media Ban

Netsafe: Statement From Netsafe About Proposed Social Media Ban