Strong finish to a mixed year

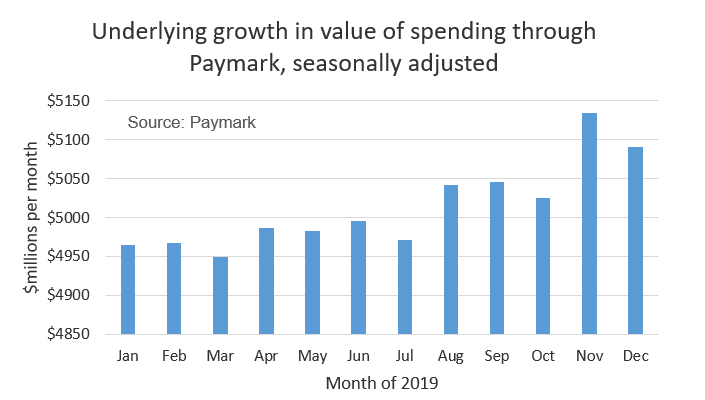

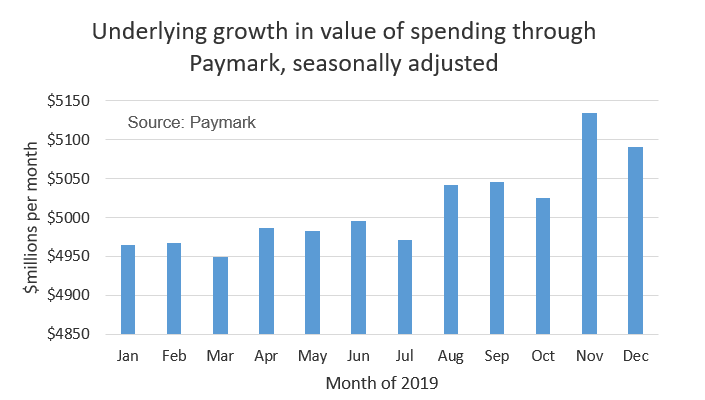

Paymark figures point to a stronger finish to 2019, at least for many merchants, but generally 2019 was a year of modest growth and mixed fortunes.

Spending through the Paymark network reached a new monthly high of $6,084 million in December 2019. In seasonally adjusted underlying terms, the December total is $5,090 million, a 0.9% decline on November 2019 but November had been particularly strong, in large part due to the Black Friday three-day weekend. Both months in seasonally adjusted terms were above the comparable totals of the previous 10 months.

Figure

1: Paymark All Cards seasonally adjusted underlying

transaction data for the months of 2019

The two months

combined give a more complete picture of the busy Christmas

spending period. The spending total through Paymark for two

months totaled $11,617 million in unadjusted terms,

representing an underlying annual growth rate of 4.1% on

November-December 2018.

The regional pattern for the

two months remains similar to that of earlier months in the

year, namely Auckland/Northland (+2.6%) was amongst the

slower growing regions, although West Coast (+0.9%) was

slowest, and smaller regions such as Palmerston North

(+9.8%) and Gisborne (+9.6%) grew fastest.

| PAYMARK All Cards Data (Nov-Dec 2019 versus same months 2018) | ||||

| Volume | Underlying* | Value | Underlying* | |

| Region | transactions millions | Annual % change | transactions $millions | Annual % change |

| Auckland/Northland | 91.55 | 0.9% | $4,639.3 | 2.6% |

| Waikato | 18.19 | 4.5% | $849.1 | 5.4% |

| BOP | 16.76 | 5.5% | $804.9 | 5.8% |

| Gisborne | 2.47 | 8.8% | $105.5 | 9.6% |

| Taranaki | 5.03 | 2.7% | $226.7 | 4.3% |

| Hawke's Bay | 7.33 | 5.9% | $339.7 | 7.4% |

| Wanganui | 2.78 | 4.2% | $115.6 | 5.4% |

| Palmerston North | 7.63 | 3.6% | $406.2 | 9.8% |

| Wairarapa | 2.48 | 6.7% | $111.8 | 8.4% |

| Wellington | 24.45 | 1.9% | $1,073.5 | 4.6% |

| Nelson | 4.50 | 2.4% | $225.2 | 2.0% |

| Marlborough | 2.96 | 5.1% | $152.4 | 5.7% |

| West Coast | 1.51 | 3.6% | $77.0 | 0.9% |

| Canterbury | 25.97 | 3.6% | $1,252.1 | 4.1% |

| South Canterbury | 3.42 | 3.5% | $176.3 | 5.8% |

| Otago | 13.33 | 4.4% | $666.1 | 3.7% |

| Southland | 5.35 | 4.7% | $279.4 | 7.2% |

| New Zealand | 237.44 | 2.7% | $11,617.0 | 4.1% |

| * Underlying spending excludes large clients moving to or from Paymark |

Figure 2: Paymark All Cards transaction data (November-December 2019 versus November-December 2018)

The busy end of the year brought the underlying growth rate for the 12 months up to 3.7%. Spending through Paymark was $62,647 million in 2019.

On the positive side, this represents the 10th

consecutive year of spending growth since the global

financial crisis, but the growth rate of 2019 was modest and

marks the third year in a row that the growth rate has

declined.

Figure

3: Paymark All Cards underlying transaction data for the

calendar years 2007 to 2019

In dollar terms, spending with scheme credit and debit cards in 2019 grew fastest at 6.0%. These cards constituted 52% of spending. The traditional bank debit card made up the bulk of the remaining transactions and was up 1.3% in 2019. The market share split is different in terms of the number of transactions, the scheme card share dropping to 41%. The average scheme card transaction in 2019 was $59.11 and the average bank debit card transaction was $37.99.

While total spending may be increasingly only moderately, Paymark figures point to very mixed experiences between merchants, as well as the already noted mixed fortunes between regions.

Taking the busy two months of November/December and combining groups of core retail merchants but excluding food, liquor and hospitality merchants, there were merchants representing around two-thirds of spending who experienced increases through Paymark over the last two months of 2019, compared with the same ending months of 2018. Their combined annual underlying growth was 7.4%. Interestingly, spending of this combined group increased considerably on the Black Friday weekend (+28.0% on the Black Friday weekend of 2018) but also sustained increased spending through the other days of the period, albeit at a more modest average of 6.3% p.a. Within this group were a mixed bunch of merchants selling goods such as hardware, sporting goods, books and jewellery and general department stores.

Conversely, the combined total spending of the remaining core non-food and non-hospitality retailers was still up on the Black Friday weekend (+8.0%) but spending was otherwise down on other days of the two months, including during the busy 5 days before Christmas and on Boxing Day. Again these merchants were varied but shops selling clothing and footwear were prominent amongst this group.

Looking across the network,

the spending momentum and the ability of a large group of

merchants to generate strong growth are reasons to be

positive for 2020 but the annual spending deceleration and

generally mixed experiences of 2019 suggests merchants need

to be very alert to changing patterns during the year and

the actions of their

competitors.

Property Council New Zealand: Hiwa Recreation Centre Takes Top Award At 2025 Property Industry Awards

Property Council New Zealand: Hiwa Recreation Centre Takes Top Award At 2025 Property Industry Awards Great Journeys New Zealand: Scenic Plus Winter Menu Launched

Great Journeys New Zealand: Scenic Plus Winter Menu Launched Tourism New Zealand: Tourism New Zealand Invites The World To Find Their 100% Pure New Zealand In New Global Campaign

Tourism New Zealand: Tourism New Zealand Invites The World To Find Their 100% Pure New Zealand In New Global Campaign Bill Bennett: Comcom warns 2degrees over satellite marketing

Bill Bennett: Comcom warns 2degrees over satellite marketing Transpower: Major Electricity Development For Western Bay Of Plenty A Step Closer

Transpower: Major Electricity Development For Western Bay Of Plenty A Step Closer Alcohol Beverages Council: Turning The Tide - New Zealanders Unite To Curb Harmful Drinking

Alcohol Beverages Council: Turning The Tide - New Zealanders Unite To Curb Harmful Drinking