RBNZ 'should' cut. Well they?

The RBNZ 'should' cut. It's the path of least regret. But will they?

• The RBNZ's

decision is in focus this week. A cut to 0.75% 'should' be

made. But conviction in the call has evaporated from a

certainty, to a coin toss.

• If the RBNZ don't cut this week, we will expect a cut in Feb. So why wait? They risk little to nothing in cutting again. But they risk undoing some of their earlier work if they don't. Lending rates will rise.

• The Kiwi labour market report confirmed the loss of hiring intentions, and weaker starting point.

VIEW PDF

Here’s our take on

current events

Global financial markets remain on a US-China trade deal induced high, despite jitters late last week on a Trump downer. President Trump denied reports that the US was willing to rollback tariffs on $112bn of Chinese imports as part of the "phase one" trade deal. An initial trade deal looks imminent, but with the recent APEC summit being scuppered, markets are waiting for a signing ceremony. Despite Trump's spanner, global equity markets and bond yields finished the week higher. Optimism in global markets looks to have given some central banks pause for thought including the US Fed. Last week the RBA kept the cash rate unchanged at 0.75%, as had been expected. But the bank made it clear that after 0.75bps of cuts, it waits ready to cut again. Market pricing is signalling a greater chance than not that the RBA will deliver another cut to 0.5%.

We don't believe it's time for the RBNZ to sit on its hands . This week, the RBNZ has the opportunity to 'surprise' markets, again, with a 25bp (not 50bp) cut to an RBA-equalling 0.75%. The element of surprise is important. Sentiment in financial markets (or risk appetite) has improved markedly. Global equity markets have been buoyed by mentions of a trade deal (phase I) between the US and China, a postponement of Brexit (and election), and continued central bank support. Thoughts of recession have receded, but remain. The sharp improvement in sentiment largely reflects re-positioning, and the amount of pessimism previously priced. The fundamental economic picture, however, is little changed. Economic growth is sub-par, and inflation is hard to find. Sentiment in markets has gone from too pessimistic, to arguably a little too optimistic in a matter of weeks. The economic reality is somewhere in-between. New Zealand's economic reality is warm, far from hot, and cooling. Goldilocks would cut rates, given her bearish surroundings.

If the RBNZ keeps the OCR unchanged on Wednesday, we can expect to see higher lending rates by the end of the week. Wholesale rates have already risen with the rise in global risk appetite - see our chart of the week - and will be passed on to lenders with another pop higher (on an RBNZ pause). The Kiwi currency would also lift with the relative rise in Kiwi interest rates, impacting the export sector. That's fine and good if we truly believe the worst is behind us. But not believe that.

There was a sense in the 3Q labour market report that the tide may have finally turned in the jobs market. The labour market might be near enough to full employment, for now, but it is unlikely to last. The unemployment rate rebounded to 4.2% from the 11-year low of 3.9% last quarter. Because there was a continued slowing in employment growth and a surprisingly large rise in the unemployed. All part of the slight lift in the participation rate. Looking ahead, the labour market is likely to cool further. Firms' hiring intentions are tracking well below averages, and economic growth is likely to slow further. The trajectory of economic growth and hiring intentions are reinforcing.

Wage growth in contrast was solid in the third quarter. The private sector Labour Cost Index (LCI) - the RBNZ's preferred measure - lifted 0.6%qoq, which followed the 0.8%qoq minimum wage induced jump in Q2. On an annual basis, the LCI was 2.3%yoy, well above the 1.5%yoy rise in the CPI over the same period. The big gains came from the public sector. The public sector LCI jumped 1.3%qoq to 3.0%yoy. The recent pay settlements for police staff, nurses and teachers were picked up in the third quarter. Wages growth running well above inflation is very supportive for the consumer, so long as they keep their jobs.

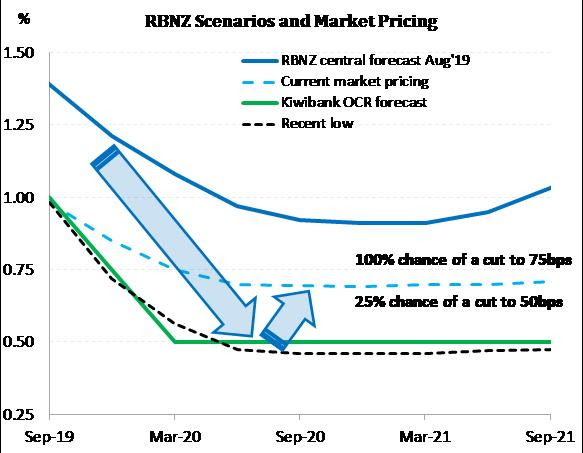

Our chart of the week: RBNZ pricing.

Financial markets have moved a lot in the last month. The pivotal 2-year swap rate (used by banks to hedge 2-year fixed rate mortgage flow) has bounced from a low of 0.8% to 1.06% in the last month. The 26bp move, has effectively removed a full rate cut from the market's expected trajectory for the RBNZ. Our chart of the week shows the recent low in market expectations (a terminal rate of 46bps) for the RBNZ - the black dotted line. The market low was in line with our central view (green line). We think the RBNZ will ultimately be forced to cut to 0.5%. Current market pricing - the light blue dotted line - shows a terminal rate of 73bps. We should be there on Wednesday. Market pricing is a little light in our opinion.

The big move that will take place on Wednesday, is the RBNZ's own forecast OCR track. The current track, from the August MPS, is the dark blue line. The trough in the RBNZ's OCR track is 0.91%. We expect the RBNZ's OCR track to drop to ~0.65-to-0.7%. If the RB cut, as expected, the bank's staff should give us a probability of another cut, if things deteriorate, to 0.5%. An OCR track falling to 0.65-to-0.7% (or close to), will give us a 20-to-40% chance of another cut to 0.5%. That's important. We believe the RBNZ has an opportunity to keep the pedal to the metal, given the balance of risks offshore and at home.

Cutting the OCR to 0.75% on Wednesday is the path of least resistance, and least regret. And a cut is needed to stop lending rates from rising. Because the rapid rise in wholesale rates over the last month will need to be passed on at some stage. A cut on Wednesday must be followed up with a 'chance' of another cut down the road. In doing so, markets will need to price a terminal rate around 0.6%. Such an outcome will keep lending rates under downward pressure. And the currency will glide lower also.

Financial Markets

The comments below were provided by Kiwibank traders. Trader comments may not reflect the view of the research team.

In rates, lower is more

likely.

"US-China trade optimism continues to drive yields higher, with a big lurch higher in US yields on Friday (again) on the back of possible tariff roll-backs. Back in NZ, yields have risen and are now sitting just under recent highs, the 2-year swap touched 1.10% last week which enticed the receivers back in ahead of the RBNZ this week. It feels like we have found a base level in choppy OIS pricing ahead of Wednesday's RBNZ announcement with a 65% chance of a -25bp cut being priced. RBNZ market pricing has a total of -26bp priced into mid next year which will effect market movements on the central view for a -25bp cut with dovish guidance. The RBNZ should deliver another cut to cement August's -50bp reduction, supporting waning growth while ensuring consistency of message as to not unwind the good work already done i.e. the lower NZD. The rates market will rally on another cut and the curve steepen, the magnitude of which will be dictated by future RBNZ forward guidance, which should be skewed towards further stimulus. That should take short end yields back towards the middle of recent trading ranges, the 2 year swap back to around 0.90-0.95%. However, with global optimism continuing to build aided by year-end feel good factor the NZ curve is likely to continue its recent steepening theme. The moving events for rates on the week will clearly be the RBNZ on Wednesday, Aussie Jobs on Thursday, and the US Fed head Powell's testimony to congress on Friday." - Ross Weston, Senior Portfolio Manager

In FX,

the Kiwi is a little lower.

"Last week we saw the New Zealand dollar trend haphazardly lower, declining by a little more than a cent from Monday's peak to touch a Saturday morning low of $0.6322. US-China headlines continued to be the primary driver of Kiwi price action, though domestic data, notably a mild up-tick in the unemployment rate, assisted at the margin. This week, while US-China headlines will still carry weight, it will be the actions and words of the Reserve Bank on Wednesday that will serve as the pace setter for the NZD and it's crosses. With the odds of a cut currently sitting at ~65%, there is the potential for plenty of positioning-led volatility in the lead-up to Wednesday's 2pm announcement and 3pm press conference. With so much riding on one mid-week event, defining an expected range for the NZD is a tough ask. On the balance, we view the risks to the NZD as being skewed fairly significantly to the downside. Among the Kiwi-crosses, NZDAUD and NZDGBP will be the ones to watch this week. The Kiwi-Aussie has to contend with Aussie employment data just a day after the RBNZ announcement (0.9200 the level to keep an eye on there) and Kiwi-Pound will remain subject to volatility from Brexit-related headlines, something there is no shortage of at present." - Mike Shirley, Senior Trader, Financial Markets.

VIEW PDF

Kind Regards,

Kiwibank

Economics

Team

Ipsos: New Zealanders Are Still Finding It Tough Financially; Little Reprieve Expected In The Next 12 Months

Ipsos: New Zealanders Are Still Finding It Tough Financially; Little Reprieve Expected In The Next 12 Months NZ Telecommunications Forum - TCF: Telecommunications Forum Warns Retailers About 3G Shutdown

NZ Telecommunications Forum - TCF: Telecommunications Forum Warns Retailers About 3G Shutdown PSA: Worker Involvement Critical In Developing AI For The Good Of Aotearoa

PSA: Worker Involvement Critical In Developing AI For The Good Of Aotearoa MBIE: Easter Trading Laws - Your Rights And Responsibilities

MBIE: Easter Trading Laws - Your Rights And Responsibilities The Conversation: As More Communities Have To Consider Relocation, We Explore What Happens To The Land After People Leave

The Conversation: As More Communities Have To Consider Relocation, We Explore What Happens To The Land After People Leave Bill Bennett: Satellite TXT expands, how Egmont Village got a fibre network

Bill Bennett: Satellite TXT expands, how Egmont Village got a fibre network