New Zealand’s housing shortage is getting worse, not better

Property Insights: New Zealand’s housing shortage is getting worse, not better.

We’re now short 130,000 homes

• This time last year we showed a shortage of 100,000 homes across New Zealand. Our population growth has outstripped housing supply, again. We’re now short 130,000 homes.

• The construction sector has boomed. Supply of homes has increased sharply. But we’re still falling short. Kiwibuild has yet to have an impact.

• With housing in such short supply, material house price falls are unlikely from here. Material house price gains are also unlikely in aggregate. But the regions will continue to outperform the cities, for a while yet.

[View

PDF]

The shortage is worse but

should get better

In August 2018, we detailed

the severe shortage of housing in New Zealand (see here ). We developed a model that put

the shortage at 100,000. Most of the shortage is in

Auckland, where most migrants descend. Since then we have

seen a lower trend in net migration, and the construction

sector has started firing on all cylinders. Residential

building consents have hit multi-decade highs. But as we

said in last year’s report, the shortage was likely to get

worse before it gets better. And the shortage has worsened,

despite the industry’s best efforts to boost

supply.

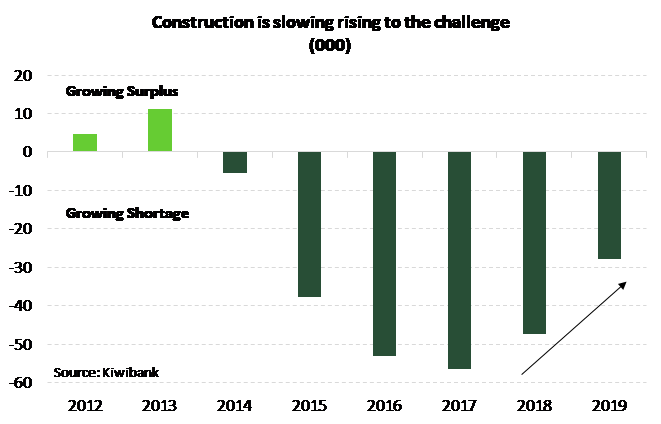

We’ve updated our model and our estimates now show a chronic shortage of around 130,000 affordable homes. If things continue the way they are, the shortage will balloon to 150,000 this time next year. However, the growth in the shortfall of housing in the last year was the lowest since 2014 (see chart below). So, things are getting worse, but at a better rate. Not really that comforting. But given the rising run-rate of building consents we expect to see a slightly smaller shortage next year.

The bulk of the housing shortage is in Auckland, but many of the regions are feeling the pinch too. Auckland’s property market has proved to be a reliable, but loose guide for the regions. The dramatic run up in Auckland house prices between 2012 and 2016 has filtered down into the regions. Because several cashed-up, or disheartened Aucklanders are moving for more affordable lifestyles. The great migration out of Auckland has boosted regional house prices. But the slowdown in Auckland will eventually feed into the regions.

Developments in the housing market have largely

played out as we anticipated. Auckland has cooled, but not

collapsed. Auckland house prices are down nearly 5% from the

peak with more downside expected near-term. House sales have

slowed across the country. And there has been a lack of

listed property. Nevertheless, we don’t expect a major

correction like that seen in Australia. Auckland’s housing

market is in payback for previous excesses but remains

fundamentally UNDER-supplied. A lack of housing supply is a

key feature across NZ.

Government policy has weighed on investor activity (including: banning foreign purchases, removal of the negative gearing tax loophole, tightening the bright-line test), and affordability constraints are ever present. Auckland and Queenstown are feeling the effects of the restriction in foreign buying. Foreign buying has been largely understated for years. But the abolition of the planned CGT has lifted a major concern for investors. When combined with further interest rate cuts, we expect the housing market to lift between 5-6% over 2020-21. The regions are the star performers for now. Beyond 2021, we expect a more evenly distributed appreciation in prices.

One rising risk on the horizon, is the ratcheting up of bank capital requirements. Should the financial system experience a rationing in credit, as in Australia, then the wind will come out of the sails.

To read more, please click here or open the pdf below.

[View

PDF]

Master Plumbers Gasfitters and Drainlayers NZ: New Consumer NZ Test Reveals Danger Of Unregulated Online Plumbing Products

Master Plumbers Gasfitters and Drainlayers NZ: New Consumer NZ Test Reveals Danger Of Unregulated Online Plumbing Products Mindful Money: Winners At The Mindful Money Annual Ethical & Impact Investment Awards 2025

Mindful Money: Winners At The Mindful Money Annual Ethical & Impact Investment Awards 2025 MBIE: Gas Supply Reducing Faster And Sooner Than Previously Forecast

MBIE: Gas Supply Reducing Faster And Sooner Than Previously Forecast Natural Hazards Commission: International Markets Show Unprecedented Confidence In NZ’s Natural Hazards Insurance Scheme

Natural Hazards Commission: International Markets Show Unprecedented Confidence In NZ’s Natural Hazards Insurance Scheme  ASB Bank: ASB Business Survey - The Impact Of Trump's Tariffs, According To Kiwi Businesses

ASB Bank: ASB Business Survey - The Impact Of Trump's Tariffs, According To Kiwi Businesses University of Auckland: Will Robots Help Older People Stay Sharp?

University of Auckland: Will Robots Help Older People Stay Sharp?