Affordable regions continue strong growth

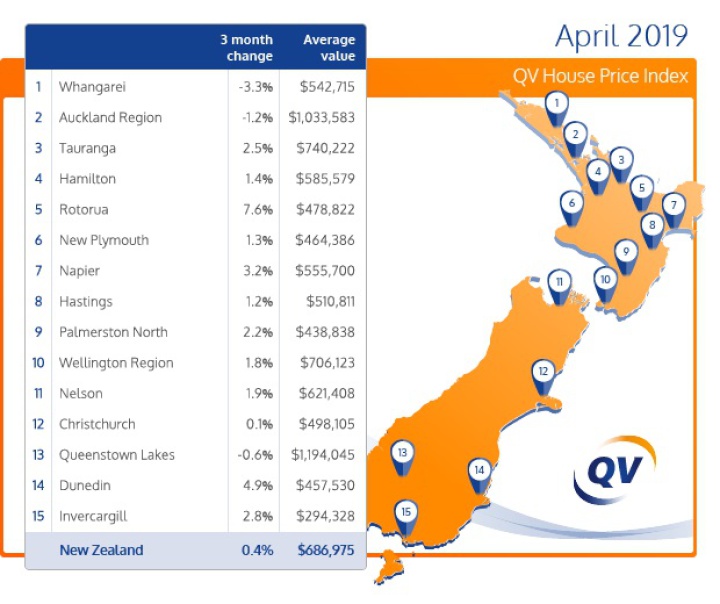

Value growth continues to slow nationally although some of New Zealand’s more affordable regions continue to see strong growth.

New Zealand’s annual rate of value growth dropped from 7.6% in April last year to 2.7% last month. The key market of Auckland continues to see a reduction in value levels, down 1.5% year on year across the region.

Much of regional New Zealand continues to see value growth, led by Gisborne, Horowhenua and Rotorua who experienced quarterly value growth of 8.7%, 8.0% and 7.6% respectively. The latest QV House Price Index shows nationwide residential property values have increased slightly by 0.4% in the three months to April.

Meanwhile, residential property value growth across the Auckland Region decreased by 1.2% over the past quarter. The average value for the Auckland Region is now $1,033,583.

For a full breakdown of the QV House Price Index figures for April please click here

QV General Manager,

David Nagel said, “Our latest figures show that while the

rate of national value growth continues to slow year on

year, our more affordable regions continue to attract plenty

of buyer demand resulting in solid value

growth.”

“Gisborne and Horowhenua have seen the strongest value growth across the country over the past quarter. With average values in between $350,000-370,000, these regions are great examples of New Zealand’s more affordable areas that continue to attract strong demand from both first home buyers and investors.”

“Dunedin continues to lead all other main centres in quarterly value growth, up 4.9%. Our local property consultants are reporting a good level of interest in properties up to the value of $500,000. It’s this affordability that is attracting a broad range of buyers across most of its suburbs.”

“Auckland continues to see values falling slightly, although not at the levels reported by some property commentators. We are starting to see a change in the type of properties selling with a general trend toward smaller, lower-value, one and two bedroom properties which is leading to a drop in median sales prices across the Auckland region recently.”

“Naturally, we’d expect the market activity to drop as we head into the chillier winter months. In saying this, the Reserve Bank’s indication that they will drop the OCR rate, coupled with the so called ‘rate wars’ taking place between banks, should mean that buyer demand remains steady.”

“Further to this, the government’s decision to rule out the Capital Gains Tax should give investors more certainty around their property decisions and may inject a bit of much needed energy into the market.”

Auckland

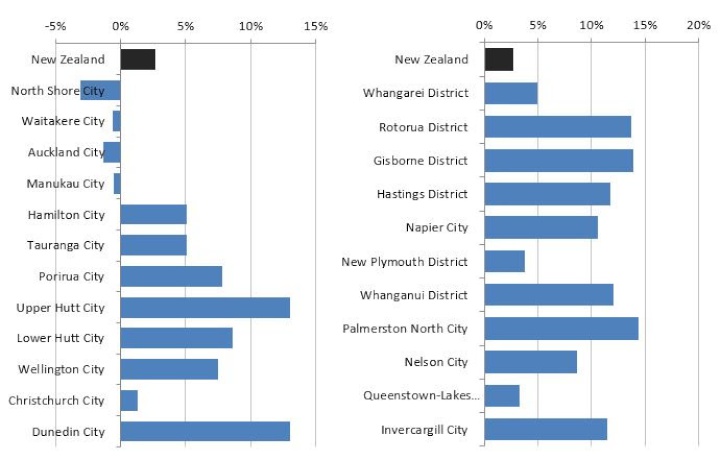

Value growth remains slow across Auckland's suburbs. North Shore values dropped 3.1% in the year to April and by 1.0% over the past three months. The average value there is now $1,189,915

The former Auckland City Council central suburbs dropped 1.3% year on year and by 1.4% over the past three months and the average value there is now $1,216,153. Waitakere values decreased by 0.6% year on year and by 0.3% over the past three months. Manukau values decreased by 0.5% year on year and by 1.0% over the past three months; Papakura values decreased 0.9% year on year and by 0.1% over the last quarter and the average value there is now $695,181; Franklin values stayed flat year on year and Rodney values were down 1.2% year on year.

QV Auckland Property Consultant James Steele said, “The soft market continues in Auckland with values decreasing slightly over the past year across almost the entire city.”

“The downward movement in prices across the board reflects the shift in power from sellers to buyers, and although there are more deals to be had I wouldn’t say we are at the point of a complete buyers’ market across the city.”

“Although there is downward pressure on prices, falling interest rates continue to support underlying demand therefore we expect the current trend to continue in the short term.”

“There may however be some deviation from this trend between suburbs and price brackets as buyers continue to be more selective and the effect of presentation and marketing continues to have a strong influence on prices.”

“There is a strong supply of new homes available across the city in both large subdivisions and infill developments with competition for buyers ramping up.”

QV Auckland Property Consultant Hugh Robson added, “The Waitakere area continues to see a market slow down. Properties appear to be taking longer to sell. In saying this, first home buyers appear active in this area.”

“The Central City West area is seeing steady activity but overall the market is still slowing down as well. There are not as many first time buyers in this area due to the higher priced central city real estate.”

“Agents are also reporting that buyers are doing more research as there is no real rush to buy at this time. On the other hand, investors are still buying although their activity appears to be reducing.”

Wellington

Values across the whole Wellington Region rose 8.2% in the year to April and increased 1.8% over the past quarter and the average value is now $706,123.

Wellington City values increased 7.5% year on year and by 1.7% over the past three months and the average value there is now $831,614. Meanwhile, values in Upper Hutt rose 13.0% year on year and 3.0% over the past three months; Lower Hutt rose 8.6% year on year and by 1.7% over the past quarter; Porirua rose 7.8% year on year and by 2.0% over the past quarter. Finally, the Kapiti Coast rose 7.3% year on year and 2.5% over the past three months.

QV Wellington Senior Consultant, David Cornford said, “The Wellington region continues to see value growth however it is clear that the rate of growth is slowing. There continues to be an under supply of property in the Wellington region and for this reason it remains a sellers’ market.”

“Upper Hutt continues to be the strongest performing locality with 13% growth recorded over the last year and 3% over the last three months. It offers greater affordability compared to other areas of the region and is popular with both first home buyers and investors.”

“The current Government has now ruled out a capital gains tax, this provides investors with more certainty around their property decisions and may inject a bit more confidence into the market however value impact is likely to be minimal.”

“As we move closer to Winter, we are likely to see the usual winter slowdown in sales activity. Finally, townhouse developments continue to sell well and are in high demand.”

Hamilton

Hamilton City home values increased by 1.4% over the past three months and by 5.1% in the year to April. The average value in Hamilton is now $585,579.

QV Property Consultant Andrew Jacques said, “The market remains steady throughout Hamilton, with minor increases to values across the board.”

“There is high demand in the under $500,000 bracket from first home buyers, with a shortage in supply currently”

“There is a steady supply of new build, town housing under construction across Hamilton, particularly in areas in close proximity to education facilities and Hospitals.”

“Selling periods remain around 30 days for an average property, where higher end generally takes longer and again the low end bracket is being snapped up.”

Tauranga and Western Bay of Plenty

Tauranga home values rose 5.1% year on year and by 2.5% over the past three months. The average value in the city is $740,222. The Western Bay of Plenty market rose 4.3% year on year and by 0.6% over the past three months. The average value in the district is now $655,088.

QV Tauranga Property Consultant, Alecia Dalzell, said, “The Tauranga region has stabilised throughout 2018 and early 2019 with some slight growth evident.”

“Investor stock has remained stable since the new LVR restrictions have been loosened and over the past few months, we have seen a slight increase in investor activity. First home buyer activity has increased over recent months as those priced out of the Auckland market continue to look at the Tauranga region as a good alternative to Auckland. There still appears to be a real shortage of listings across a number of price brackets.”

“The Bay of Plenty property market is showing steady growth although there are some parallels between the current market and that witnessed from 2005 to 2007. If there is significant, global event similar to the Global Financial Crises witnessed in 2008 to 2010 we could see could see a fall in property values similar to that experienced during the recession.

“The Bay of Plenty Region has shown an annual average price increase by 1.7% with results varied across the region and an overall average house value of $595,000. Kawerau seeing 46.5% increase, yet Opotiki saw a fall of -15.2% annually.”

Christchurch

It’s a continuation of recent trends for Christchurch City, with value growth remaining modest. Values are slightly up year on year and slightly increased by 0.1% over the past three months. The average value in the city is now $498,105.

Dunedin

Dunedin residential property

values are continuing to rise and have increased 13.0% in

the year to April and by 4.9% over the past three

months.

QV Dunedin Senior Consultant, David Paterson

said, “Dunedin residential property values are continuing

to rise, with the average value in the city is $457,530, up

from $451,199 last month.”

“Dunedin South area experienced strong growth, up 15.4% annually and 7.4% over the last quarter. The Taieri area has also experienced strong value growth, up 13% annually and 3.5 % over the past quarter. Growth in other parts of the city have eased back slightly on the previous month but is still very strong.“

“There is good demand across most sectors of the market, with the lower priced bracket under $500,000 making up the largest proportion of the sales. The upper price bracket is a small part of the market with only 6 residential dwelling and apartment sales over $1 million dollars notified for the calendar year to date. This compares to 12 for the same period last year and 25 for all of 2018.

“There is anecdotal evidence of is interest from out of town buyers looking in the lower to mid-price range as an investment. It is too early to say whether the decision not to proceed with a capital gains tax has impacted on this part of the market.”

Nelson

Nelson residential property values rose 8.7% in the year to April and by 1.9% over the past quarter. The average value in the city is now $621,408. Meanwhile, values in the Tasman District have also continued to rise, up 5.4% year on year and 1.0% over the past three months. The average value in the Tasman district is now $598,246.

Provincial centres North

Island

Gisborne leads the way in quarterly growth, up 8.7%, followed by Horowhenua (8.0%) and Rotorua (7.6%) In terms of annual growth, Kawerau leads the way, up 23.3%, followed by Tararua (20.1%) and Central Hawkes Bay (19.9%).

South Island

Dunedin (South) lead the way in quarterly growth, up 7.4%, followed by Clutha District (7.4%) and Southland District (7.0%). Dunedin (South) leads the way in annual growth, up 15.4% followed by Dunedin City (13.0%) and Dunedin (Taieri), up 13.0%.

Annual change in

values

ends

Brewers Association: Brewers Association Of New Zealand Supports Modernisation Of Alcohol Legislation

Brewers Association: Brewers Association Of New Zealand Supports Modernisation Of Alcohol Legislation Commerce Commission: ComCom Warns Of Pyramid Schemes After South Auckland Scammers Plead Guilty

Commerce Commission: ComCom Warns Of Pyramid Schemes After South Auckland Scammers Plead Guilty MBIE: MBIE Publish Mid-Point Review Of The Phase-Out Of The Low Fixed Charge (LFC)

MBIE: MBIE Publish Mid-Point Review Of The Phase-Out Of The Low Fixed Charge (LFC) Science Media Centre: Company Claims To Have “De-Extincted” The Dire Wolf – Expert Reaction

Science Media Centre: Company Claims To Have “De-Extincted” The Dire Wolf – Expert Reaction Stats NZ: Greenhouse Gas Emissions Fall 2.0 Percent In The December 2024 Quarter

Stats NZ: Greenhouse Gas Emissions Fall 2.0 Percent In The December 2024 Quarter The Reserve Bank of New Zealand: Christian Hawkesby Appointed As Governor Of The RBNZ

The Reserve Bank of New Zealand: Christian Hawkesby Appointed As Governor Of The RBNZ