Kiwis use low interest rates to pay down mortgage debt

22 November 2018

Kiwis use low interest rates to pay down mortgage debt quicker

Westpac NZ home loan customers are making the most of low interest rates by paying their mortgage debt down faster, saving themselves thousands in interest payments, according to new data.

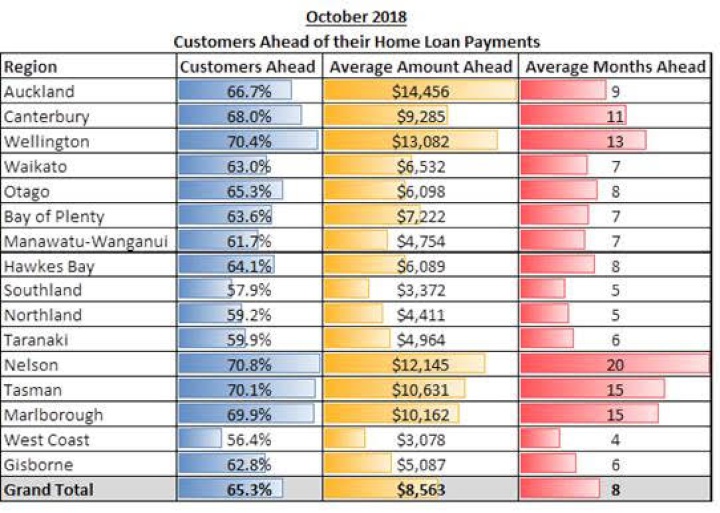

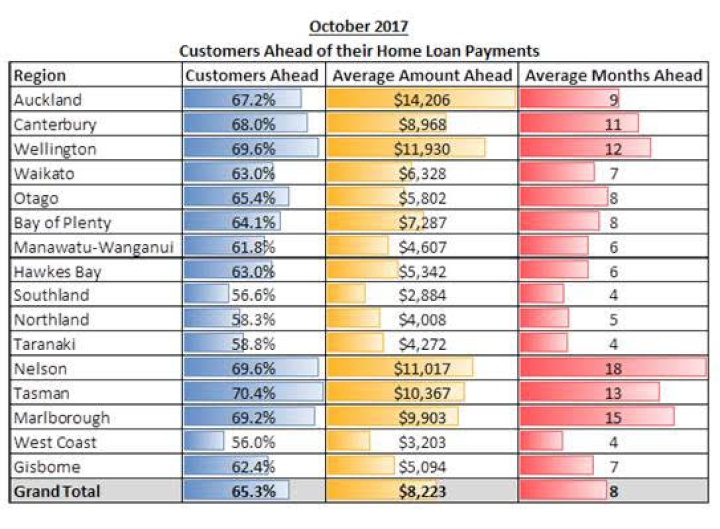

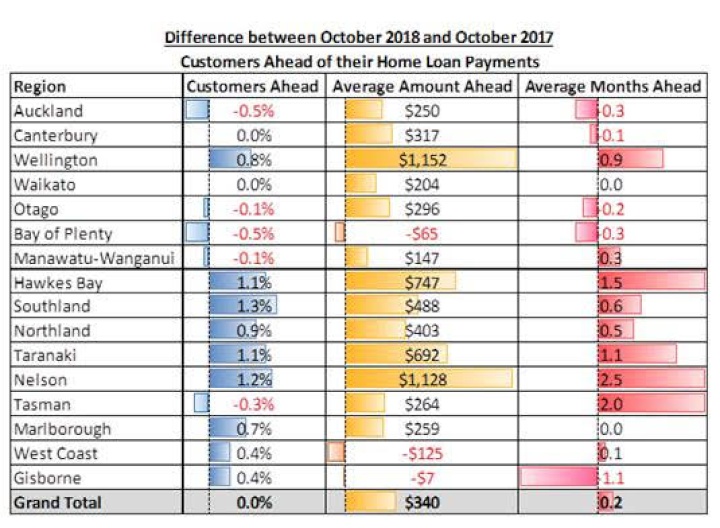

Two-thirds of Westpac customers are ahead in their mortgage repayments by a median average of eight months and $8,563, for the year ended 31 October 2018.

Westpac NZ’s general manager of consumer banking and wealth, Simon Power, said the bank was keen to support more customers to pay off their loans more quickly, as doing so could save them tens of thousands of dollars in interest payments over the lifetime of the mortgage.

“Westpac’s mission is to help our customers financially, to grow a better New Zealand. One of the clearest ways we can do that is to support our customers to save more by paying off their debt faster.

“And with many mortgage rates falling, in the past two weeks, to historic lows, it’s a great time for customers to get ahead by holding their repayments at the same level at which they have been paying,” Mr Power said.

He says many people have been making the most of low interest rates over the past few years, which reflected a good economy.

Mr Power said those living in Nelson were ahead the most at 20 months, followed by Tasman and Marlborough on 15 months, although Aucklanders had repaid a greater median amount at $14,456, followed by Wellingtonians ($13,082) and Nelsonians ($12,145) (*see tables below).

“If people are able to increase the amount they repay each fortnight or month by $50, $100 or even $200 when they re-fix, it can make a substantial difference to their overall interest savings.”

Mr Power gave the example of someone paying off a $500,000 mortgage over 30 years at an interest rate of 4.79%.

“If that customer pays the minimum $1,209 per fortnight it would take 30 years to pay off and cost just over $440,000 in interest.

“But if they can manage to pay off an extra $150 a fortnight, they could shave six years off the mortgage and reduce their total interest paid by more than $106,000. That’s a significant saving and a path to greater financial freedom.”

Mr Power said the bank had many tips to help people pay off their home loan faster and save money.

“It can be as simple as changing your repayments to fortnightly instead of monthly. You end up making two extra repayments per year, which reduces the amount owed and the interest paid.

“People could also consider increasing their regular loan repayments, shortening the term of their loan, and consider paying lump sums off their loans when it comes time to re-fix. Also, choosing to float a portion of their loan allows them the flexibility to pay off that part of their loan faster.

“Interest rates have fallen recently, so now is an excellent time to pay down some extra debt if you are re-fixing, as well as keeping your monthly repayments the same despite interest rates dropping, in order to pay off your loan faster,” Mr Power said.

*Note that these are median averages and are ordered by the number of customers in the region.

*Note that these are median averages and are ordered by the number of customers in the region.

*Note that these are median averages and are ordered by the number of customers in the region.

ends

The Conversation: NZ’s Glaciers Have Already Lost Nearly A Third Of Their Ice – As More Vanishes, Landscapes And Lives Change

The Conversation: NZ’s Glaciers Have Already Lost Nearly A Third Of Their Ice – As More Vanishes, Landscapes And Lives Change RBNZ: Reserve Bank Of New Zealand Welcomes The Release Of Te Ōhanga Māori 2023 Report

RBNZ: Reserve Bank Of New Zealand Welcomes The Release Of Te Ōhanga Māori 2023 Report Bill Bennett: Download Weekly - One NZ chooses Ericsson for core network update

Bill Bennett: Download Weekly - One NZ chooses Ericsson for core network update Mountains to Sea Conservation Trust: Orange Roughy Leads The Pack As Fish Of The Year Heats Up

Mountains to Sea Conservation Trust: Orange Roughy Leads The Pack As Fish Of The Year Heats Up Hugh Grant: Retail Crime Is Out Of Control – Why Business Owners Can’t Wait For Government Action

Hugh Grant: Retail Crime Is Out Of Control – Why Business Owners Can’t Wait For Government Action SkyCity Auckland: Sky Tower Glows For International Women’s Day

SkyCity Auckland: Sky Tower Glows For International Women’s Day