Heartland completes corporate restructure

Heartland completes corporate restructure and ASX Foreign Exempt Listing

1 November 2018

Heartland Group Holdings Limited (NZX/ASX:HGH) (Heartland Group) is pleased to announce that the corporate restructure has been completed. Shares in Heartland Group have been listed on both the NZX Main Board and the ASX (under a Foreign Exempt Listing), and will commence trading today under the ticker code HGH.

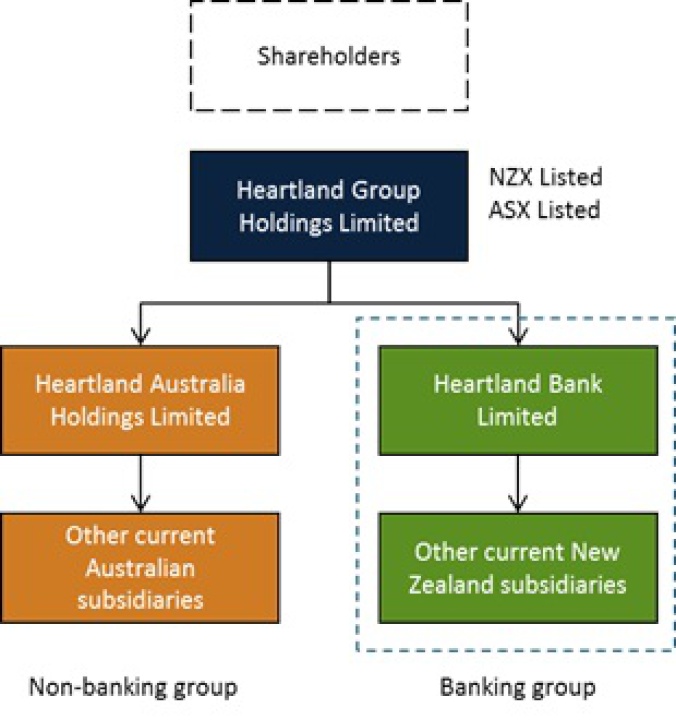

The corporate restructure took effect yesterday, 31 October, with all of the shares in Heartland Bank Limited (Heartland Bank) being exchanged for shares in Heartland Group Holdings Limited (Heartland Group) and Heartland Bank becoming a wholly-owned subsidiary of Heartland Group. In addition, the Australian group companies were transferred from Heartland Bank to Heartland Group.

A simplified diagram showing the new group structure is below.

The restructure and the ASX listing are significant milestones for the group and provide a more suitable platform for future growth. The restructure removes constraints on growth previously arising from Reserve Bank of New Zealand regulations, and will provide greater flexibility to explore and take advantage of future growth opportunities in New Zealand and Australia outside the banking group. A Foreign Exempt Listing on the ASX is expected to expand the capital sources available to Heartland Group in order to fund growth.

Heartland Bank became a registered bank in 2012, following the merger of four financial service entities. Its strategy is to operate in niche markets where it can provide the ‘best or only’ product and to increase its customer reach through online channels and its intermediary, partner and referrer networks. Heartland Bank’s core areas of focus are small business lending, reverse mortgages, motor vehicle finance, livestock finance and savings & deposits.

Heartland entered the Australian reverse mortgage market in 2014 with the acquisition of reverse mortgage provider, Australian Seniors Finance, which it subsequently rebranded to Heartland Seniors Finance. Since then, Heartland has achieved significant growth in this business, with net finance receivables growing from A$380m at acquisition to A$619m at the end of the 2018 financial year. This growth is not expected to slow down with 20,000 people turning 65 in Australia every month and other major providers of reverse mortgages recently exiting the market.

– Ends –

Mindful Money: Winners At The Mindful Money Annual Ethical & Impact Investment Awards 2025

Mindful Money: Winners At The Mindful Money Annual Ethical & Impact Investment Awards 2025 MBIE: Gas Supply Reducing Faster And Sooner Than Previously Forecast

MBIE: Gas Supply Reducing Faster And Sooner Than Previously Forecast Natural Hazards Commission: International Markets Show Unprecedented Confidence In NZ’s Natural Hazards Insurance Scheme

Natural Hazards Commission: International Markets Show Unprecedented Confidence In NZ’s Natural Hazards Insurance Scheme  ASB Bank: ASB Business Survey - The Impact Of Trump's Tariffs, According To Kiwi Businesses

ASB Bank: ASB Business Survey - The Impact Of Trump's Tariffs, According To Kiwi Businesses University of Auckland: Will Robots Help Older People Stay Sharp?

University of Auckland: Will Robots Help Older People Stay Sharp? Electricity Authority: Authority Confirms New Next-Gen Switching Service; Proposes Multiple Trading Relationships For Consumers

Electricity Authority: Authority Confirms New Next-Gen Switching Service; Proposes Multiple Trading Relationships For Consumers