More affordable properties attract first home buyers

More affordable properties attract first home buyers

Lower value, more affordable properties are selling at a faster rate, due to continued demand from first home buyers. Our analysis shows that most property transactions are taking place at the low-to-medium price bracket, a section of the market where value growth remains comparatively strong despite relatively static average house values across the country.

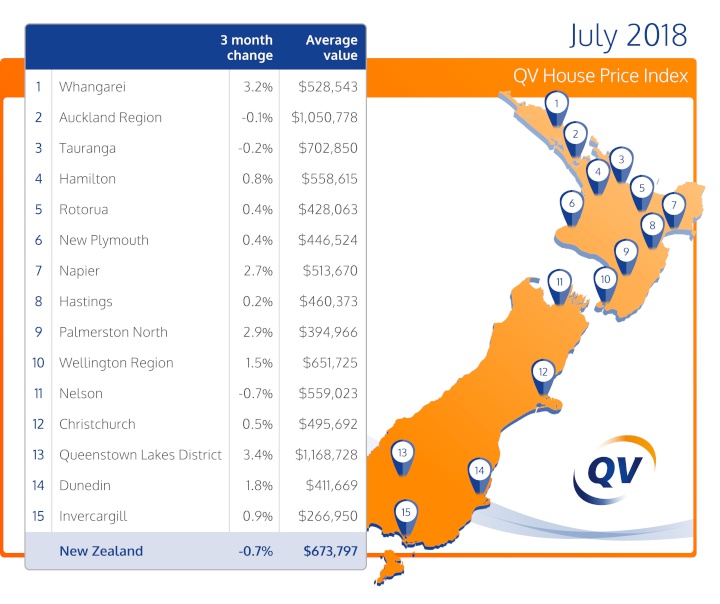

The latest monthly QV House Price Index shows nationwide residential property values for July increased 5.1% over the past year, while values dropped 0.7% over the past three months. The nationwide average value is now $673,797. When adjusted for inflation, the nationwide annual increase drops slightly to 3.5%.

Meanwhile, residential property value growth across the Auckland Region increased by 0.6% year on year although they dropped by 0.1% over the past quarter. The average value for the Auckland Region is now $1,050,778. When adjusted for inflation, values dropped 0.9% over the past year.

For a full breakdown of the QV House Price Index figures for July, please click here

QV General Manager, David

Nagel said, “We’re seeing a shift in the market across

many regions, with most of the market activity and value

growth taking place at the ‘lower-end’ of the market

where values are more affordable.”

“First home buyer activity remains relatively strong across most of New Zealand although we’re observing a drop in activity in some areas over the past few months. This could possibly be due to the fact that some buyers are holding off purchasing, hoping they’ll attain a KiwiBuild property in the ballot. We’ll be closely monitoring the impact of the government’s initiative over the coming months although its full impact won’t be felt for some time yet.”

“Dunedin continues to buck the trend, with investors accounting for a growing portion of buyers according to the latest Core Logic Buyer Classification data. With an average value of $411,669, investors are attracted by a relatively low values and strong yields. Investor activity has dropped over most our main centres, partly due to the bank’s LVR restrictions and a period of consolidation after recent growth.”

“With overall market conditions remaining strong, such as record low interest rates and strong local economies, I would anticipate that values will remain fairly stable for the remainder of winter.”

Auckland

Value

growth remains slow across Auckland's suburbs. North Shore

values rose 1.8% in the year to July 2018 although they

dropped 0.7% over the past three months. The average value

there is now $1,224,301.

The former Auckland City Council central suburbs rose 0.3% year on year and were 0.5% up over the past three months and the average value there is now $1,238,979. Waitakere values stayed relatively flat year on year but they decreased slightly by 0.1% over the past three months. Manukau increased by 0.3% year on year and 0.2% over the past three months; Papakura values rose 4.0% year on year although they were up 0.2% over the last quarter and the average value there is now $702,466; Franklin values increased 1.0% year on year and Rodney values were down slightly 0.2% year on year.

QV Auckland Senior Consultant, James Steele said, “A return to ‘normal’ market conditions continues as values remain stable under depressed levels of activity.”

“Despite the fact that investor activity has dropped, entry-level properties, especially those which are well presented and under $650,000, continue to transact in a market experiencing depressed levels of activity. This is understandable given the current affordability challenges and built-up demand from first home buyers. We’re continuing to see a high proportion of properties come to market as price by negotiation as opposed to auction, largely due to reduced demand created by stricter lending conditions.”

“With less demand, sellers are adjusting expectations and are more open to negotiation in order to get their property sold. In general, this has limited the value growth seen over the previous period and kept prices stable with some softening occurring in properties which have issues or are poorly presented.”

“Well-presented properties which offer a good family living environment or those which have straightforward development potential are still transacting at reasonable levels however demand is patchy and timing together with supply in any given suburb is playing a large part. The premiums paid prior to the 2016 LVR restrictions are rarely found under current conditions.”

“Over the coming months, we anticipate the continuation of the ‘normalised’ market conditions experienced over the past year, and expect minor fluctuations in price through the winter months coming from those under pressure to sell. At this stage any further downward pressure on property prices is likely to come from regulatory change or wider economic risks.”

Hamilton

Hamilton City home

values rose 0.8% over the past three months and values

increased 3.3% in the year to July. The average value in

Hamilton is now $558,615.

QV Hamilton Property Consultant Andrew Jaques said, “We’re continuing to see steady growth rates across most areas although the rate of growth has certainly dropped compared to this time last year.”

“Entry-level property, below approximately $500,000, continues to attract plenty of demand from first home buyers. Evidently, we’re seeing increased demand for property in Waikato’s outer suburbs, such as Paeroa and Ngatea, as prospective buyers seek out more affordable property still within a commutable distance to Hamilton, Tauranga and Auckland.”

Tauranga

Tauranga home

values rose 1.7% year on year although they dropped 0.2%

over the past three months. The average value in the city is

$702,850. The Western Bay of Plenty market rose 1.9% year on

year and dropped by 0.2% over the past three months. The

average value in the district is now $629,627.

Tauranga Property Consultant, Steven Dunn said, “The ‘top-end’ of the market continues to sell well. Vendors are still achieving good sales prices, with demand continuing to trend upwards as people seek a lifestyle change from larger centres such as Auckland.”

“Low property supply across most of Tauranga and Western Bay Of Plenty is also supporting value growth. The only exception to this is in Papamoa, where supply exceeds demand and value growth is subdued.”

“In saying this, the rate of growth has dropped when compared to this time last year. We’re seeing prices moderate, as many buyers consolidate after a period of sustained growth.”

Wellington

Values across

the whole Wellington Region rose 7.4% in the year to July

and increased 1.5% over the past quarter and the average

value is now $651,725.

Wellington City values increased 7.1% year on year and 1.9% over the past three months and the average value there is now $775,711. Meanwhile, values in Upper Hutt rose 8.9% year on year and 0.4% over the past three months; Lower Hutt rose 5.5% year on year and 0.6% over the past quarter; Porirua rose 9.9% year on year and increased by 3.0% over the past quarter. Finally, the Kapiti Coast rose 9.4% year on year and 0.9% over the past three months.

QV Wellington Senior Consultant, David Cornford said, “Overall, Wellington is currently seeing stable values and it’s now a much more balanced market after several years of strong growth”.

“Mid-winter has seen market activity fall away, which is a regular occurrence during the Wellington Winter. However, given the low number of current listings, we’re expecting greater buoyancy in Spring.”

“The lower-to-mid section of the market - those properties valued under $750,000 - have experienced the greatest value growth over the last 12 months. This is a result of strong activity from first home buyers, who are snapping up relatively affordable properties in Wellington’s outer areas such as Lower Hutt, Upper Hutt and Porirua. Porirua, in particular, has performed well with around 3% growth over the last 3 months”.

“There has been a noticeable drop in value growth at the upper end of the market– those priced above $1,000,000 – as affordability challenges effectively put the brakes on.”

“Much like Auckland, we’re seeing some higher value properties failing to sell at auction or tender and then selling several weeks later through negotiation. Multiple offer scenarios are now less commonplace, which is giving buyers the time to be more considered with their offer price and terms. Evidently, we’re seeing many buyers ask for building and LIM reports prior to purchasing. In these tighter market conditions, it’s the well-maintained and cleverly marketed properties that continue to sell well.”

“Market conditions appear stable, with low levels of listings and steady demand resulting in relatively modest growth in values. However, we’re also seeing record low interest rates, relatively strong inward migration and a buoyant local economy, so we’d expect these key market drivers to support value growth across some suburbs and segments of the market throughout Spring.”

“Over the medium-to-long term, the government’s KiwiBuild initiative – if successful – is likely to ease demand from first home buyers and free up rental stock although its impact won’t be felt for several years”.

Christchurch

Christchurch city values continue recent

trends, either remaining flat or seeing slight increases or

decreases in value. Values were slightly up year on year

although they increased by 0.5% over the past three months.

The average value in the city is now $495,692.

QV Christchurch Property Consultant Hamish Collins said, “The Christchurch market remains steady, with values levels remaining relatively flat or increasing slightly. Overall market activity is subdued, with listings down and prospective buyers – particularly investors – keeping pretty quiet due to modest value growth in recent months.”

“The recent discussions seen in the media around completing pre-checks on potential earthquake property damage might also be resulting in more cautious buyer behaviour, as people put off purchasing property until engineer inspections take place or independent advice is sought.”

“Certainly, from speaking with other property and banking professionals, requests for new lending for properties appear to be notably slow although this is something we expect during the usual winter slowdown.”

Dunedin

Values in Dunedin

continue their upward trend having increased 10.1% in the

year to July and 1.8% over the past three months. The

average value in the city is $411, 669.

QV Dunedin Property Consultant, Tim Gibson said, “The rate of value growth has certainly dropped, with quarterly growth much below the annual growth rates across most areas. We believe this is mostly to do with the usual winter slowdown and a period of consolidation after a sustained period of growth.”

“In saying this, low-to-mid value properties continue to attract plenty of demand. Interestingly, investor activity remains relatively high and it continues to grow which is different to most areas in New Zealand which is experiencing a drop in investor activity. We believe this is due to relatively low values and some great lifestyle properties on offer near the CBD or the beach.”

Nelson

Nelson residential

property values rose 5.1% in the year to July but dropped

0.7% over the last quarter. The average value in the city is

now $559,023. Meanwhile values in the Tasman District have

also continued to rise, up 7.5% year on year and 1.4% over

the past three months. The average value in the Tasman

district is now $573,760.

QV Nelson Property Consultant, Craig Russell said, “House values continue to level off after a period of growth. Properties in the middle to middle-upper price bracket, from $500,000 to $750,000 continue to attract plenty of interest with a number of well-located and/or modern homes in this price bracket. First home buyers continue to account for a good portion of buyers, particularly in more affordable suburbs such as Toi Toi, Washington Valley and Nelson South. The top-end of the market, those properties in above $1,000,000 are generally taking longer to sell due to the limited pool of buyers which exist at this price point and it being a more discerning market.”

“The section market in Nelson remains very strong with firm demand and what limited sections that are available sell well. Given the limited supply of freely available land not tied up with building companies, house and land packages have proved popular although there is currently pent up demand we will likely going forward see equilibrium between supply and demand as new homes are constructed.”

“Over the coming months, we’re anticipating a continuation of a stabilisation of the market. We also anticipate listings and activity to increase and we come into a Spring market.”

Hawkes Bay

Napier values

rose 14.2% year on year and 2.7% over the past three months.

The average value in the city is now $513,670. Hastings

values are also continuing to rise up 8.6% year on year

although they were up 0.2% over the past three months. The

average value there is now $460,373. The Central Hawkes Bay

has also seen values rise 13.4% year on year and 2.8% over

the past three months and the average value there is now

$324,646.

QV Hawkes Bay Property Consultant Nicola Waldon said, “Entry level properties, those in the range of $300,000 up to $450,000, continue to sell well with plenty of activity from both first home buyers and investors. In saying this, the rate of growth across the Hawkes Bay region is down. We believe this is due to challenges around affordability coupled with the usual winter slowdown.

“As value growth slows, we’re continuing to see challenges around managing sellers’ price expectations and many properties are being re-listed after failing to sell first time around.”

“The demand for rental properties remains high, with competition intense due to a lack of new listings. We’re seeing many examples of properties being let the same day they are first advertised to the market.”

“Over the coming months, we’d anticipate a lift in listing numbers, which have been down over the winter months (seasonal trend). We are likely to see values tracking slowly upward as they have been over the past few months, as we are really seeing no signs of a slowdown - demand is still at a high and out of town buyers moving to the region still making up a large proportion of sales.”

Provincial centres

In the

North Island, Waitomo increased the most over the past

quarter, up 9.5% followed closely by Tararua and Hauraki.

The greatest quarterly drop in value occurred in Opotiki,

down 16.1%. The rate of growth has dropped across many

regional areas, as the markets cools during the winter

months.

In the South Island, Buller led the way in quarterly growth, up 4.3% followed by Waimate and Queenstown Lakes. As anticipated, the winter chill has a major impact, with quarterly growth significantly below annual growth rates across many regions. The biggest drop in quarterly value was in Gore, down 4.0%.

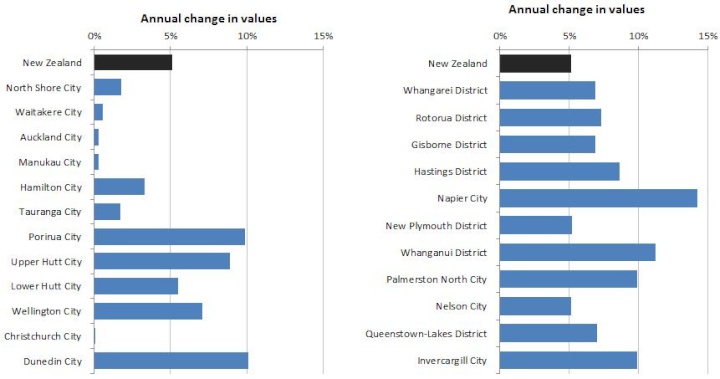

Annual Change in Values

Hugh Grant: How To Build Confidence In The Data You Collect

Hugh Grant: How To Build Confidence In The Data You Collect Tourism Industry Aotearoa: TRENZ 2026 Set To Rediscover Auckland As It Farewells Rotorua - The Birthplace Of Tourism

Tourism Industry Aotearoa: TRENZ 2026 Set To Rediscover Auckland As It Farewells Rotorua - The Birthplace Of Tourism NIWA: Students Representing New Zealand At The ‘Olympics Of Science Fairs’ Forging Pathway For International Recognition

NIWA: Students Representing New Zealand At The ‘Olympics Of Science Fairs’ Forging Pathway For International Recognition Coalition to End Big Dairy: Activists Protest NZ National Dairy Industry Awards Again

Coalition to End Big Dairy: Activists Protest NZ National Dairy Industry Awards Again Infoblox: Dancing With Scammers - The Telegram Tango Investigation

Infoblox: Dancing With Scammers - The Telegram Tango Investigation Consumer NZ: This Mother’s Day, Give The Gift Of Scam Protection And Digital Confidence

Consumer NZ: This Mother’s Day, Give The Gift Of Scam Protection And Digital Confidence