Winter chill moderates property values

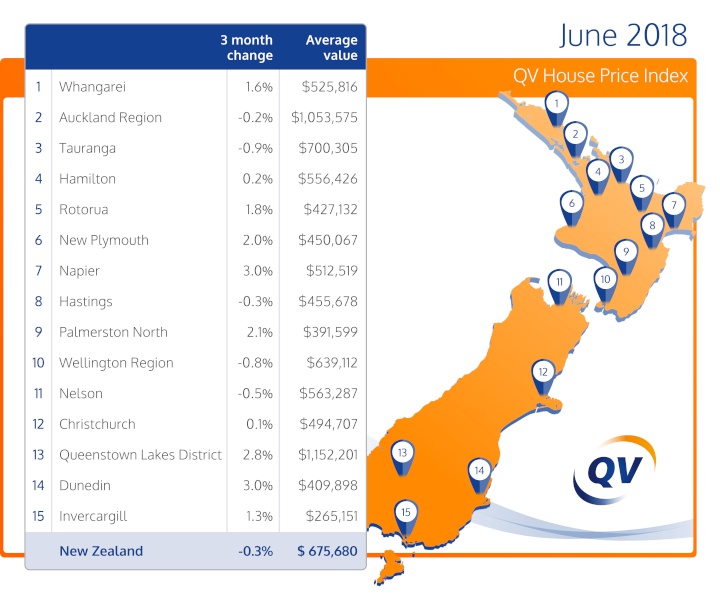

The latest monthly QV House Price Index shows nationwide

residential property values for June increased 5.7% over the

past year, while values dropped 0.3% over the past three

months. The nationwide average value is now $675,680. When

adjusted for inflation, the nationwide annual increase drops

slightly to 4.6%.

Meanwhile, residential property value growth across the Auckland Region increased by 0.8% year on year although they dropped by 0.2% over the past quarter. The average value for the Auckland Region is now $1,053,575. When adjusted for inflation, values dropped 0.3% over the past year.

For a full breakdown of

the QV House Price Index figures for June, please click

here.

QV General Manager, David Nagel said, “The data very much confirms what we’re seeing, with values continuing to moderate or drop after a sustained period of growth leading into winter. Our local Property Consultants are generally reporting a lower number of listings, which comes as no major surprise at this time of year.”

“Interestingly, we’re observing challenges around managing seller expectations on sales prices. After a sustained period of national value growth, sellers can sometimes have an inflated – even unrealistic - view of the value of their property. This is resulting in slower than usual average time to sell properties across some areas.”

“In this sense, it’s a buyer’s market. The Reserve Bank's LVR restrictions as well as new Government regulations, have reduced investor demand. This has had the effect of reducing competition, giving buyers more time to do their due diligence before purchasing. As a result, regions such as Auckland are seeing an increasing number of sales through negotiation as opposed to auction as vendors show more flexibility in order to sell their property in a less buoyant market.”

“Despite the slowdown in activity, there is still plenty going on. A great example of this is in Christchurch, where infrastructure improvements in the city appear to be contributing to demand for new builds in the CBD. With many positive city projects currently on the go, we may continue to see increased demand for city centre property in the coming months.”

“The growth of suburbs on the outskirts of our main cities continues. With high values remaining in most of our cities, more affordable suburbs on the outskirts continue to appeal particularly to first home buyers. This is a common theme across Auckland, Tauranga and Wellington in particular.”

“In the short term, I wouldn’t anticipate any significant changes to current market conditions. With no changes to the OCR rate likely until September next year at the earliest and investment demand either remaining constant or dropping across most areas – its likely values will remain fairly constant or steadily grow across most of New Zealand throughout winter.”

Auckland

Value growth

remains slow across Auckland's suburbs. North Shore values

rose 1.8% in the year to June 2018 although they dropped

0.9% over the past three months. The average value there is

now $1,224,965.

The former Auckland City Council central suburbs rose 1.2% year on year but they were 0.1% down over the past three months and the average value there is now $1,243,037. Waitakere values stayed relatively flat year on year but they increased slightly by 0.2% over the past three months. Manukau increased by 0.3% year on year and 0.1% over the past three months; Papakura values rose 3.7% year on year although they were down 0.1% over the last quarter and the average value there is now $702,677; Franklin values dropped 0.7% year on year and Rodney values were slightly up 0.1% year on year.

QV Auckland Senior Consultant, James Steele said, “Value growth remains flat, which comes at no major surprise as we progress through winter.”

“We’ve returned to ‘normal’ market conditions, with prices stabilising. Despite the fact that sales volumes are down – which often drives prices down - continued demand coupled with low supply has kept values stable.”

“We’re continuing to see a high proportion of properties come to market as price by negotiation as opposed to auction, largely due to reduced demand created by stricter lending conditions. With less demand, sellers are adjusting expectations and are more open to negotiation in order to get their property sold.”

“We’re seeing some developments struggling with off the plan sales although finished entry level stock within these developments remains in demand.”

Hamilton

Hamilton City home values rose 0.2% over the

past three months and values increased 3.2% in the year to

June. The average value in Hamilton is now $556,426.

QV Hamilton Property Consultant Andrew Jaques said, “Despite the fact that the rate of value growth has slowed, overall market conditions remain stable. Overall demand remains strong partly due to high levels of First Home Buyer activity and strong net migration. We continue to see the construction of duplex or townhouse style developments around the University in Chartwell and Hamilton East. These type of developments appeal to many, particularly First Home Buyers and young families, who seek relatively affordable, well-located properties.”

“In saying this, overall market activity remains fairly quiet. Buyers are increasingly taking more time and doing their due diligence before purchasing. This, coupled with changes to government policy impacting investor activity, means that the stable market conditions should prevail over the remaining winter months.”

Tauranga

Tauranga home

values rose 1.9% year on year although they dropped 0.9%

over the past three months. The average value in the city is

$700.305. The Western Bay of Plenty market rose 2.1% year on

year and dropped by 1.9% over the past three months. The

average value in the district is now $625,371.

Tauranga Property Consultant, Steven Dunn said, “As is typical for this time of year, the market is relatively quiet when compared to previous months. With the Kiwifruit sector winding down during the winter months, we’re also seeing sales volumes drop in Katikati.”

“In saying this, we do continue to see premium properties – those above one million – continue to sell well coupled with a good number of first home buyers purchasing entry-level property.”

“Tauranga’s surrounding suburbs, such as Omokorua, is seeing an increase in demand as people looking for more affordable housing outside of the city. As a result, we’re seeing the area change from an area predominantly favoured by retirees to one also appealing to families.”

Wellington

Values

across the whole Wellington Region rose 4.8% in the year to

June although dropped 0.8% over the past quarter and the

average value is now $639,112.

Wellington City values increased 4.3% year on year but dropped 1.3% over the past three months and the average value there is now $758,020. Meanwhile, values in Upper Hutt rose 9.7% year on year and 1.9% over the past three months; Lower Hutt rose 5.0% year on year and 0.6% over the past quarter; Porirua rose 10.8% year on year and increased by 2.8% over the past quarter. Finally, the Kapiti Coast rose 9.6% year on year and 1.4% over the past three months.

QV Wellington Senior Consultant, Paul McCorry said, “Value growth continues to moderate as we enter the winter months. Sales activity is subdued, with low listing numbers particularly in established inner city suburbs. Northern areas continue to lead the way, with almost a quarter of all Wellington City properties for sale located in the suburbs of Churton Park, Tawa, Johnsonville and Newlands. These suburbs continue to appeal due to their relative affordability and proximity to the city.”

“Demand remains high from first home buyers, with many taking advantage of less competition at open homes and auctions through winter. This is particularly evident in more affordable areas such as Hutt City and Porirua, where first home buyers account for 36% of all activity according to recent CoreLogic Buyer Classification data.”

“In the apartment market, demand remains steady and developer confidence will be buoyed by the recently announced changes to the Overseas Investment Amendment Bill. This change allows overseas investors to buy and hold apartments in developments with greater than 20 units, assisting in providing sufficient pre-sales to secure funding. In Wellington, sales and development activity is focused on one and two bedroom units in the central city, however we’re also seeing plenty of demand in the Hutt Valley. Petone, in particular, is proving popular due its access to strong transport links into the city.”

“Overall, despite a slowdown in the rate of value growth, market conditions remain strong with key indicators such as low interest rates, strong net migration and demand still far outweighing supply in terms of new development. With these factors prevailing, I would anticipate stable market conditions to remain over the quieter winter months.”

Christchurch

Christchurch city values continue recent

trends, either remaining flat or seeing slight increases or

decreases in value. Values were slightly down year on year

although they increased slightly by 0.1% over the past three

months. The average value in the city is now $494,707.

QV Christchurch Property Consultant Hamish Collins said, “Sales activity is slowing as the winter chill sets in, with agents indicating listings are down in comparison to the last few months. Overall, property values are staying level and these conditions are generally expected to continue due to easing migration into the wider Canterbury area, challenges managing seller’s high price expectations and a fear, from some, that interest rates may rise.”

“We’re seeing plenty of demand for new builds in and around the city centre, particularly townhouses, stand-alone houses, apartments and units. This can be partly attributed to people’s desire to move back into, or at least close to, the city-centre due to recent infrastructure improvements. With many key city projects being progressed- such as the Convention Centre, library, sports facilities and a potential new stadium – further migration into the inner-city suburbs is anticipated which may lead to capital growth.”

“In contrast, we’re observing a very different trend in some areas in the city’s periphery and fringe districts. An over-supply of land and developments in areas such as Halswell, Wigram, Prestons as well as the Selwyn and Waimakariri districts. We are seeing some developers offering new builds or recently constructed properties at discounts as a way to free up cash for their next project. This is having a flow-on effect on the overall value of new builds or existing properties in these areas.”

“Investor activity remains relatively quiet, largely due to the easing market, tighter lending criteria and some fearing interest rates rises. With recent investment property sales indicating higher expected returns than what was expected 12 to 24 months ago, it appears many investors are consolidating and allowing for these perceived risks.”

“Finally, we’re seeing developers adjust their risk models to allow for tighter lending criteria, additional council compliance and increased market volatility. This will see land values ease outside of the CBD.”

Dunedin

Values in Dunedin

continue their upward trend having increased 9.2% in the

year to June and 3.0% over the past three months. The

average value in the city is $409,898.

QV Dunedin Property Consultant, Aidan Young said, “Despite the fact that we’re seeing a lower number of property listings - something we expect in the winter months - the market remains busy. We continue to see buyers, particularly first home buyers and young families, snap up relatively affordable property in the sub-400,000 mark. Multi-offer scenarios are common for entry-level properties, particularly with less stock on the market during the winter months. This lower supply is enabling vendors to negotiate very competitive prices for their property within a short period of time. In this sense, winter can be a great time to sell.”

“Premium properties are continuing to generate good levels of interest. We’re observing that properties that are well maintained, located and marketed effectively are selling very well.”

"Finally, there is a lot of interest around the development of the hospital. During the construction period, this may result in an influx of workers, and their families, seeking accommodation. It’ll be fascinating to see whether this’ll have a substantial impact of housing demand over the coming months.”

Nelson

Nelson residential property

values rose 5.9% in the year to June but dropped 0.5% over

the last quarter. The average value in the city is now

$563,287. Meanwhile values in the Tasman District have also

continued to rise, up 7.3% year on year and 2.0% over the

past three months. The average value in the Tasman district

is now $574,000.

QV Nelson Property Consultant, Craig Russell said, “In a relatively subdued market, entry-level properties valued up to $500,000 continue to attract plenty of demand particularly from first home buyers. Multiple offer situations are now not as prevalent as they have been but contract prices still remain firm.”

“Inventory has dropped over the winter period with days to sell increasing slightly – something that’s not unusual during the winter period – ‘lifestyle’ properties continue to sell well. Properties less than two hectares are proving very popular, as they are considered more manageable and appeal to a wider market.”

“Stand-alone properties in Stoke and Richmond continue to attract plenty of interest, particularly from families whereas retirees prefer low maintenance townhouses or flats on smaller sections.”

“I would anticipate that inventory will increase over the coming months with values continuing to stabilise”

Hawkes Bay

Napier values

rose 15.7% year on year and 3.0% over the past three months.

The average value in the city is now $512,519. Hastings

values are also continuing to rise up 8.5% year on year

although they were down 0.3% over the past three months. The

average value there is now $455,678. The Central Hawkes Bay

has also seen values rise 13.7% year on year although they

did decrease by 2.5% over the past three months and the

average value there is now $319,700.

QV Hawkes Bay Property Consultant Nicola Waldon said, “We’re seeing a continued slowdown in the rate of value growth and market activity, with fewer listings during the usual winter slowdown period.”

“After a sustained period of growth, sellers - in some cases - are struggling to adjust their price expectations. We’re seeing many properties being re-listed with asking prices or specifying a minimum price offer. Our data supports this, with the average time taken to sell increasing compared to recent years.”

“Despite this, with overall annual value growth and rents remaining relatively high, investors and developers still appear to be achieving good returns. We’re still seeing keen interest from out of town buyers and from those looking to renovate existing properties with a view of achieving future capital gains.”

Provincial centres

In the

North Island, Ruapehu increased the most over the past

quarter, up 5.8% followed closely by Tararua and Kawerau.

We’re seeing the rate of growth slowdown in many

provincial centres over the past quarter, even for regions

such as Central Hawkes Bay and South Taranaki which show

strong annual value growth.

In the South Island, Waimate showed the strongest quarter growth, up 4.8%. Dunedin continues its strong growth, particularly southern, coastal and Peninsula areas which are up 3.7% over the past quarter on top of strong annual growth. The biggest drop in quarterly value was in Southland, down 10.6%.

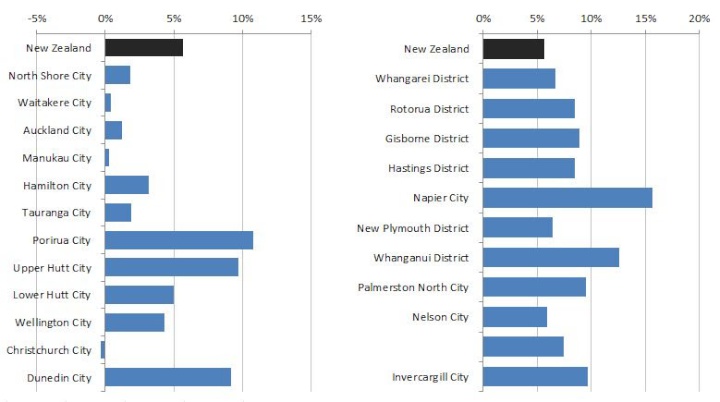

Annual Change in Values

New Zealand Airports Association: Airports Welcome Tourism Marketing Turbocharge

New Zealand Airports Association: Airports Welcome Tourism Marketing Turbocharge Ipsos: New Zealanders Are Still Finding It Tough Financially; Little Reprieve Expected In The Next 12 Months

Ipsos: New Zealanders Are Still Finding It Tough Financially; Little Reprieve Expected In The Next 12 Months NZ Telecommunications Forum - TCF: Telecommunications Forum Warns Retailers About 3G Shutdown

NZ Telecommunications Forum - TCF: Telecommunications Forum Warns Retailers About 3G Shutdown PSA: Worker Involvement Critical In Developing AI For The Good Of Aotearoa

PSA: Worker Involvement Critical In Developing AI For The Good Of Aotearoa MBIE: Easter Trading Laws - Your Rights And Responsibilities

MBIE: Easter Trading Laws - Your Rights And Responsibilities The Conversation: As More Communities Have To Consider Relocation, We Explore What Happens To The Land After People Leave

The Conversation: As More Communities Have To Consider Relocation, We Explore What Happens To The Land After People Leave