New Zealanders’ confidence in their knowledge of KiwiSaver stumbles

• Investors seeking out more information as share market volatility see some KiwiSaver balances retreat.

• Majority of investors admit they aren’t saving enough for their retirement.

• Record number sign up to KiwiSaver, but it remains the poor cousin to property.

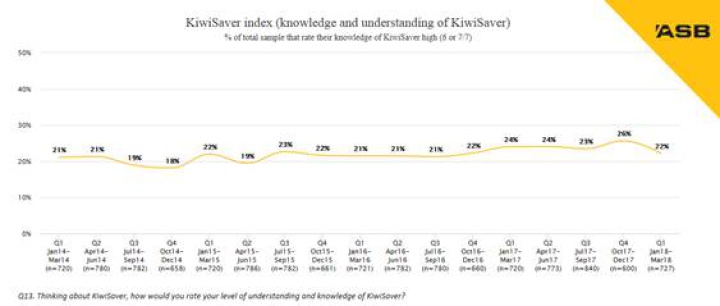

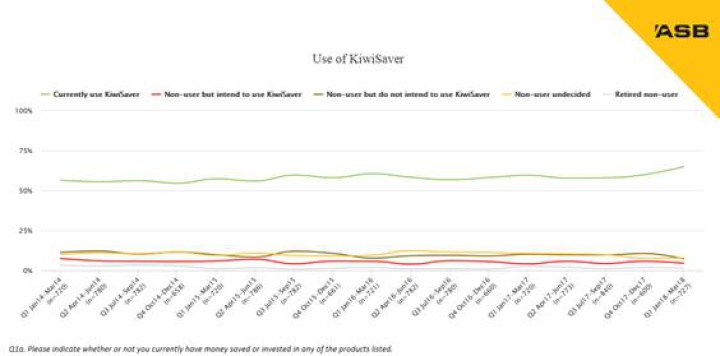

ASB’s latest KiwiSaver and Investor confidence surveys reveal a decline in the understanding of KiwiSaver, with just 22% of respondents indicating they have a high understanding of the retirement scheme, compared to 26% last quarter. (Chart A)

ASB senior wealth economist Chris Tennent-Brown says the decline could be for a couple of reasons, it could be a one-off, or perhaps it’s due to the fact it was a pretty volatile start to the year for investments.

“The difference between 2018 so far and 2017 has been the return of volatility in financial markets. It made the headlines back in February when investors suffered the worst day on the US Share market since 2011. Since then markets have recovered from their 2018 lows, but we’ve had some negative months as US interest rates rise, and the global trade concerns have unfolded as President Trump pursues his tariff plans. The volatility has impacted KiwiSaver balances. And in the times when the news headlines have been dramatic, it seems to have spurred more people to seek information about what’s going on.

“But whichever way you want to rationalise the decline in KiwiSaver understanding, the level of understanding is disappointingly low for a scheme that is 10 years old now, and for a scheme that is a key retirement savings vehicle for many people.”

On the flip side, Chris Tennent-Brown says ASB is witnessing positive changes in customers’ behaviour with an increasing number of people engaging with ASB about KiwiSaver.

“We have had over 60,000 in-depth conversations with New Zealanders in the last 12 months specifically about KiwiSaver. The vast majority want and take guidance from ASB when selecting their fund or deciding how much to contribute. For us, it’s also an opportunity to make sure they’re maximising the benefits of KiwiSaver as well. In particular, Member Tax Credits of up to $521 each year are available from the Government when people contribute enough into their KiwiSaver scheme. Understanding how employer contributions and first-home buyer benefits work are also important conversations with investors.

“Based on analysis of our existing members we know there are still a lot of members who will benefit from that same sort of help getting into a suitable fund and making contributions. Especially considering the survey reveals 60% of respondents admit they need to save more for their retirement,” Tennent-Brown says.

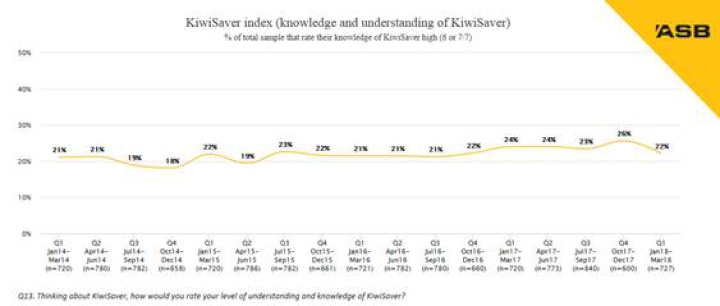

Nett investor confidence nudged higher from 20% to 21% this quarter and remains up significantly on the lows of 2016. (Chart B). “Investor confidence has been very stable, particularly when compared to business confidence which has fallen noticeably after last year’s election and consumer confidence which has also softened lately,” Tennant-Brown says.

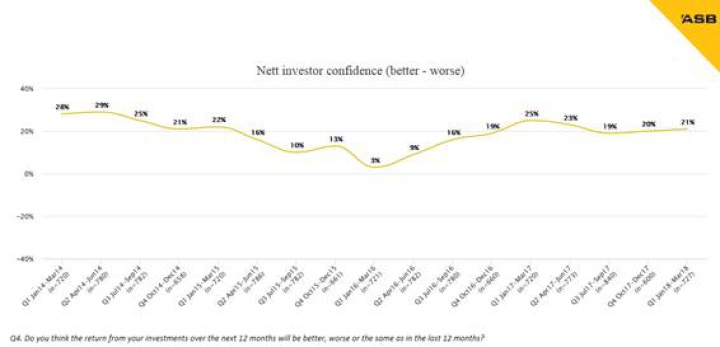

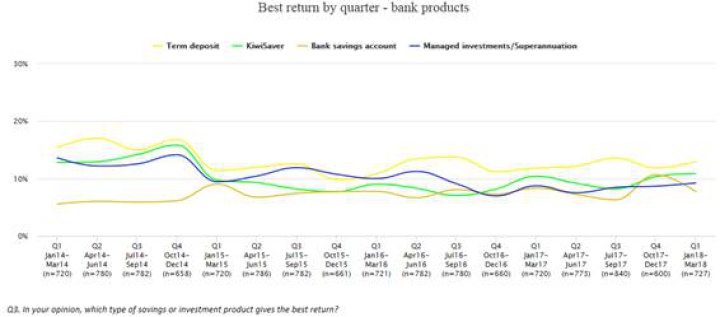

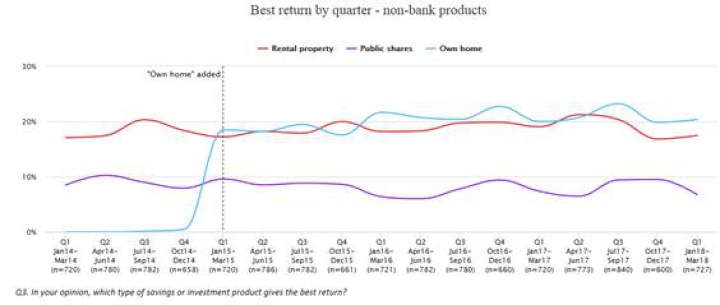

Also on the increase is the number of respondents who said they’re now using KiwiSaver to save for their retirement. Sitting at 65%, that’s the highest proportion in the survey’s history. (Chart C) Yet, despite that high usage, and KiwiSaver being the country’s main retirement scheme, across all ages personal homes (20%) and rental properties (17%) continue to be seen as the investments that provide the best returns. That’s well ahead of KiwiSaver at 11%. (Chart D & Chart E)

“With the strong returns posted by many KiwiSaver funds over recent years, it’s disappointing that many still favour term deposits over KiwiSaver when it comes to perception of providing the best return. Term deposit rates been between 1 and 4% over recent years, whereas many KiwiSaver funds will have posted far stronger returns, and it’s disappointing that the perceptions don’t reflect that.

“People’s confidence in property is unwavering. It’s understandable based solely on historical returns, but right now it’s somewhat surprising, considering all the uncertainty circling around property regarding the Government’s tax review, policy changes and lending restrictions impacting the market,” Tennant-Brown says.

ENDS

Vegetables New Zealand: Asparagus Season In Full Flight: Get It While You Still Can

Vegetables New Zealand: Asparagus Season In Full Flight: Get It While You Still Can  Bill Bennett: Download Weekly - How would NZ telecoms cope with another cyclone

Bill Bennett: Download Weekly - How would NZ telecoms cope with another cyclone NZ On Air: Firm Audience Favourites Lead NZ On Air Non-Fiction Funding

NZ On Air: Firm Audience Favourites Lead NZ On Air Non-Fiction Funding Insurance and Financial Services Ombudsman: Woman Gets $40k More After Disputing Insurer’s Decision

Insurance and Financial Services Ombudsman: Woman Gets $40k More After Disputing Insurer’s Decision BNZ: A Quarter Of Older NZers Fear Going Online Due To Scam Concerns

BNZ: A Quarter Of Older NZers Fear Going Online Due To Scam Concerns University of Auckland: Scientists Develop Tool To Monitor Coastal Erosion In Fine Detail

University of Auckland: Scientists Develop Tool To Monitor Coastal Erosion In Fine Detail