Rabobank commentary - GDT Event 15 May 2018

Rabobank commentary - GDT Event 212 | 15 May 2018

Rabobank dairy analyst Emma Higgins on the latest GDT Event –

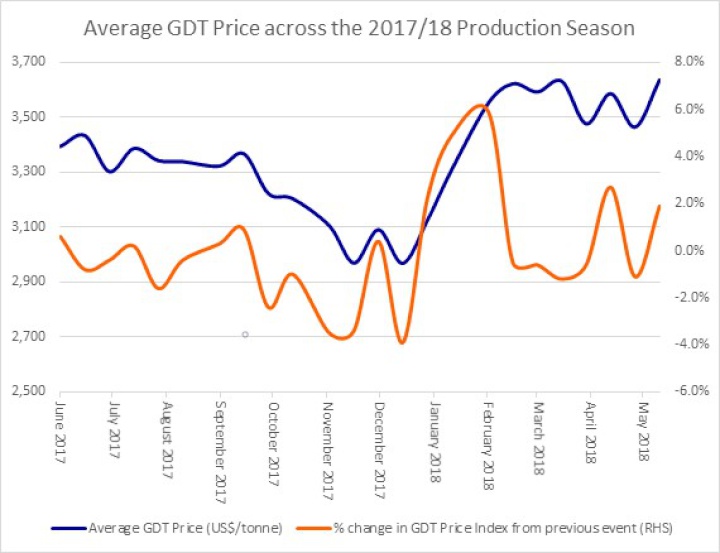

The final GDT Event for the 2017/18 production season ended with the GDT Price Index up almost 2% to USD 3,637/tonne.

SMP cracked the USD 2K mark (USD 2,047/tonne) and WMP results were slightly up (+0.2% to USD 3,226/tonne). Oceania SMP still priced ahead of US and EU priced product. Fats continue to fly high, with AMF up almost 6% to USD 6,354/tonne and butter 2.4% to USD 5,787/tonne. Europe is short on fats with a delay in spring production and so low volume is helpful for Oceania price support.

As we flagged last GDT Event, we are moving into the quieter months for NZ production and therefore fresh product for the GDT. Any major price movements will be influenced by the urgency of buyers looking to obtain product prior to the new season.

Some factors for the New Zealand dairy

sector to consider as we move into the new production season

include:

• Competitive currency changes in the

Euro. With European spring production starting to lift in

places, a weaker Euro will be helpful for EU exporters to

looking to offload product. German milk production has

moved ahead for 2018 v 2017, while French milk production is

struggling to gain traction on last year.

• The

recent weakness in the Kiwi dollar is also helpful for

exporters. In terms of impact on the milk price, the weaker

currency will have a greater effect on next season’s milk

price (2018/19) than this season's. Our milk price forecast

of NZD 6.40/kgMS is based on 72c (spot at the time of

calculating).

• Another EC SMP tender of

intervention product has been held. Hopefully the results

(once released, potentially on Friday) show more aged

product moving out of warehouses, which will help to see the

gap between fresh SMP and old continue.

• Brexit

will see some changes to the EU budget and so there could be

a resulting change to the support payments that EU farmers

receive. At this stage, there is a proposal for a cut of 4%

to direct payments for EU farms for the period

2021-2027.

The Conversation: NZ’s Glaciers Have Already Lost Nearly A Third Of Their Ice – As More Vanishes, Landscapes And Lives Change

The Conversation: NZ’s Glaciers Have Already Lost Nearly A Third Of Their Ice – As More Vanishes, Landscapes And Lives Change RBNZ: Reserve Bank Of New Zealand Welcomes The Release Of Te Ōhanga Māori 2023 Report

RBNZ: Reserve Bank Of New Zealand Welcomes The Release Of Te Ōhanga Māori 2023 Report Bill Bennett: Download Weekly - One NZ chooses Ericsson for core network update

Bill Bennett: Download Weekly - One NZ chooses Ericsson for core network update Mountains to Sea Conservation Trust: Orange Roughy Leads The Pack As Fish Of The Year Heats Up

Mountains to Sea Conservation Trust: Orange Roughy Leads The Pack As Fish Of The Year Heats Up Hugh Grant: Retail Crime Is Out Of Control – Why Business Owners Can’t Wait For Government Action

Hugh Grant: Retail Crime Is Out Of Control – Why Business Owners Can’t Wait For Government Action SkyCity Auckland: Sky Tower Glows For International Women’s Day

SkyCity Auckland: Sky Tower Glows For International Women’s Day