Bitcoin - Dead Cat Bounce or Bottom In Place?

Bitcoin could be presenting the biggest opportunity for those who have been sitting on the sideline. It is difficult to differentiate between dead cat bounce and forming a bottom, but there are ways to make a better judgement

Is it still burning, or is there no more blood left to bleed? Bitcoin’s recent fall is a film we’ve seen before, with previous crashes in 2013 and 2014. Bitcoin is known for its volatility: when goes up, it makes your eyes pop, and when it drops, it makes your jaws drop.

Bitcoin plunged below 10K yesterday, tumbled all the way to $9,186, pushing the monthly rout beyond 50 per cent. There is no doubt that the cryptocurrency remains a very risky bet. One should only play with the money that one can afford to lose.

The massive drop in Bitcoin’s price could be blamed on a lot of things. Visa suddenly decided to shut down some of the cryptocurrency cards. Regulators decided it is time to flex their muscles. BitConnect announcing its plan to close its lending and exchange platform added further fuel to the fire in the crypto space.

The news from South Korea has also been an important factor: it may be difficult to see South Korea actually banning all its virtual currency exchanges, but if it does happen, remember it is already baked in the price. Countries, like Japan, which are favouring this market would benefit far more and it doesn’t necessarily mean that the market would die altogether — at least not yet.

But, I do believe anyone who says that he knows the exact reason for the massive fall would be fooling themselves. This is a market of speculators who are looking to become wealthy. However, the argument that the (present) adopted fiat and regulatory system is way behind the curve, is a correct, and hasn’t gone away.

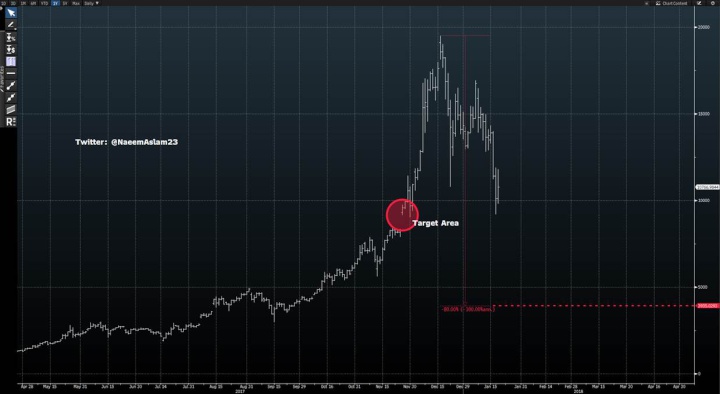

The bitcoin price is enormously oversold when you look at it from a technical perspective. Fear of missing out on the opportunity among investors is kicking in, and this could be the very reason that we are experiencing a dead cat bounce, if not a bottom for the Bitcoin price. The explosive move for the Bitcoin price back in November 24th (which started the stellar rally) could be the core area of support, if not then there is more pain to come. If history serves us correctly, bitcoin has the ability to fall as much as 80%, and that means that the price could drop all the way to $3935, from a high of $20k.

The advent of Bitcoin futures contracts late last year fuelled investors’ optimism. However, the expiry of these futures contracts this week is now a source of trepidation. The evolution of Bitcoin futures drove the Bitcoin price to record highs, thanks to a greater number of the bearish bets. Those bearish bets certainly made money this time (during this week's price meltdown), an opportunity which was not present back in 2013 and 2014. The important price levels which everyone is looking at in the market is your 100 and 200-day moving averages (SMA 100 @ $9943 and SMA 200 @ $6667). In order for us to have a clear confirmation that the downtrend is no longer a threat, the price needs to break the downward trend line and move above the $13K.

WorkSafe NZ: Dodgy Crane Safety Inflicts Misery For Teen Worker

WorkSafe NZ: Dodgy Crane Safety Inflicts Misery For Teen Worker Maritime New Zealand: Health And Safety Obligations Highlighted In Sentencing Of Former Port Chief Executive

Maritime New Zealand: Health And Safety Obligations Highlighted In Sentencing Of Former Port Chief Executive Adaptation Futures Conference: Adaptation Futures Conference To Bring Global Scholars And Leaders To Ōtautahi

Adaptation Futures Conference: Adaptation Futures Conference To Bring Global Scholars And Leaders To Ōtautahi Crown Infrastructure Delivery: Te Pae Christchurch Convention Centre Delivers $77 Million Boost To National Economy And Supports Over 690 Jobs

Crown Infrastructure Delivery: Te Pae Christchurch Convention Centre Delivers $77 Million Boost To National Economy And Supports Over 690 Jobs University of Auckland: Power Struggles: The Psychology Behind Workplace Energy Use

University of Auckland: Power Struggles: The Psychology Behind Workplace Energy Use Commerce Commission: Sharp Fine On The Way For Look Sharp After ComCom Investigation

Commerce Commission: Sharp Fine On The Way For Look Sharp After ComCom Investigation