The Brave New Landscape of the NZ IT Services Market

The Brave New Landscape of the New Zealand IT Services Market

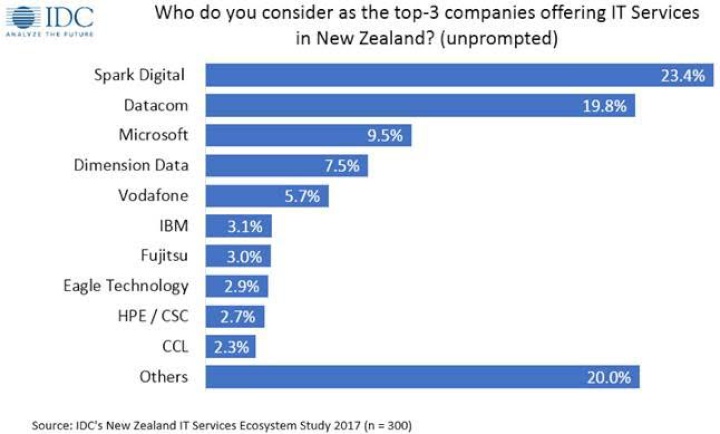

AUCKLAND, December 4th, 2017 – The New Zealand IT landscape is being reshaped with new realities. The position of the traditional juggernauts of the IT services market, Datacom and Spark, is challenged by cloud providers such as Microsoft, which are now emerging as incumbent service providers.

The inclusion of cloud vendors to the assembly of leading IT services providers reflects the changes in not only how firms structure their outsourcing agreements, but also in their approach to external engagement. IDC's New Zealand IT Services Ecosystem Study 2017 revealed that the general preference of the market is now a mix of internal/external sourcing with a multi-provider strategy.

"Largely, the desire to engage with multiple parties that includes a cloud provider is driven by the shift of New Zealand organisations towards an Information-as-an-Asset strategy. Through this approach the organisation's data becomes a tool for extracting value from Digital Transformation, allowing it to place the customer in the centre of business efforts," says Donnie Krassiyenko, IDC's Senior Market Analyst for New Zealand IT Services. "As the embedment of data-driven insights into the organisation's processes requires a platform, firms are challenged with factors of how, when and where to put their data from a hybrid/multi-cloud perspective. To achieve this, organisations seek help from cloud providers".

Despite the

overall strong intention to continue external engagement for

fulfillment of internal IT needs, outsourcing preference

varies across service categories. For

example:

• Desktop services have the highest level of

in-house implementation with 47% of New Zealand

organisations choosing to do it themselves. Conversely,

datacentre services have the highest level of external use

with 69% using either a mix of external/internal or

external-only type of consumption.

• A reasonable rate

of market churn associated with market fluidity and a lack

of customer service is expected to occur during 2018-2019

period as a number organisations are looking to insource or

change providers. This sentiment is expressed for networking

services (20%), cloud implementation (19%), and security

services (17%). Thus, insourcing remains to be the largest

threat to an otherwise thriving service provider

market.

The service provider market is also becoming highly fragmented outside of the large providers, which is an indication of the end-user's willingness to work with niche providers. Higher maturity of technology adoption has enabled organisations to become more aware of the provider capabilities as well as what service excellence should look like. As the result, when engaging with service providers, organisations buy based on such characteristics as industry-specific use-cases, strong ecosystem of partners, and professional services.

However, the most sought attribute is the provider's ability to deliver consistently against expectations; and if satisfaction with the aforementioned criteria is reasonably high, it is somewhat underwhelming with deliverability. For the market to reap the rewards in a more coherent manner, there is a need to close this gap.

The challenges do not end there. As more complex architectures naturally result in a greater exposure to cyberthreat, security is one of the key drivers for choosing a primary provider. “Security has the highest stated importance from an investment perspective,” Krassiyenko adds, “the task for organisations is to have a clear understanding that security is a business risk, not an IT issue. Firms that recognise the unattainability of absolute security work across both their own organisation and the wider supply chain in order to ensure representation of the most robust security posture. After all, a chain is only as strong as its weakest link. To be ready for a security threat, it is as crucial to hold the right business conversation about risk as to have security policies and training programmes. The greatest danger lurks where it cannot be seen".

-Ends-

About

IDC

International Data Corporation (IDC) is the

premier global provider of market intelligence, advisory

services, and events for the information technology,

telecommunications, and consumer technology markets. With

more than 1,100 analysts worldwide, IDC offers global,

regional, and local expertise on technology and industry

opportunities and trends in over 110 countries. IDC's

analysis and insight helps IT professionals, business

executives, and the investment community to make fact-based

technology decisions and to achieve their key business

objectives. Founded in 1964, IDC is a subsidiary ofIDG, the

world's leading technology media, research, and events

company. To learn more about IDC, please visit www.idc.com.

Follow IDC on Twitter at @IDC

Electricity Authority: Authority Confirms New Next-Gen Switching Service; Proposes Multiple Trading Relationships For Consumers

Electricity Authority: Authority Confirms New Next-Gen Switching Service; Proposes Multiple Trading Relationships For Consumers Mānuka Charitable Trust: Mānuka Charitable Trust Warns Global Buyers Of Misleading Australian Honey Claims

Mānuka Charitable Trust: Mānuka Charitable Trust Warns Global Buyers Of Misleading Australian Honey Claims  Engineering New Zealand: NZ Building System Needs Urgent Improvement

Engineering New Zealand: NZ Building System Needs Urgent Improvement GNS Science: Bioshields Could Help Slow Tsunami Flow

GNS Science: Bioshields Could Help Slow Tsunami Flow Transport and Infrastructure Committee: Inquiry Into Ports And The Maritime Sector Opened

Transport and Infrastructure Committee: Inquiry Into Ports And The Maritime Sector Opened Netsafe: Netsafe And Chorus Power Up Online Safety For Older Adults

Netsafe: Netsafe And Chorus Power Up Online Safety For Older Adults