Embargoed Media Release

ASB Housing Confidence

Survey

EMBARGOED until 0500 Monday, May 15, 2017

Price expectations continue to fall across New Zealand

· House price expectations continue to fall across New Zealand

· More than half of respondents expect interest rates to rise

· Pessimism grows in all regions but Auckland

Pessimism about buying a house is

deepening across New Zealand, but Auckland is bucking the

trend in sentiment, the ASB Housing Confidence Survey

finds.

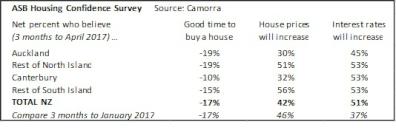

Overall, the May quarter report finds sentiment steady, as a net 17 per cent of people think it’s a bad time to buy a house.

A regional breakdown reveals that while pessimism has increased in the regions in the three months to April, it eased in Auckland, where a net 19% think it’s a bad time to buy a house, compared to 27% last year.

ASB chief economist Nick Tuffley says historically-high house prices, higher deposit requirements and expectations for further interest rate increases are likely to be weighing on sentiment generally.

“The fact that the number of homes available for sale in the Auckland property market has lifted recently might explain its reduced degree of pessimism this quarter,” Tuffley says.

Fewer people are expecting house price gains

Continued pessimism about house-buying comes as price expectations continue to fall across New Zealand to the lowest level in five years.

A net 42% expect higher prices in the three months to April (compared to 46% last quarter).

Expectations eased in all regions, but were most pronounced in Christchurch, where the drop from 44% to 32% is likely to reflect rebalancing after the supply surge that followed the earthquakes, Tuffley says.

“The overall drop in respondents expecting house price gains likely reflects the recent tightening of lending standards, which has slowed housing market activity in many regions.

“In Christchurch, higher levels of residential construction have more than made up for the housing shortage caused by the earthquakes and as a result, Christchurch house price growth has been tepid recently.”

Higher interest rates on the horizon

For the first time since October 2014, more than half of the respondents (51%) expect interest rates to rise (up from 37% last quarter).

“As we saw in last quarter’s results, mortgage and term deposit rates have lifted off their lows recently. In the US, the election of Donald Trump and recent rate hikes by the US Federal Reserve have seen US interest rates lift, which has lifted New Zealand’s longer term interest rates,” Tuffley says.

“We expect the RBNZ to leave the OCR on hold until late 2018, which should provide an anchor to short-term rates. However, funding issues and offshore rate increases have seen interest rates creep higher over the past six months.”

Results at a glance

Note: The ASB Housing Confidence Survey is constructed from data received from 2835 individual respondents.

The full housing confidence report for the three months to April 2017 is attached and will be available online at www.asb.co.nz tomorrow.

ENDS

Vegetables New Zealand: Asparagus Season In Full Flight: Get It While You Still Can

Vegetables New Zealand: Asparagus Season In Full Flight: Get It While You Still Can  Bill Bennett: Download Weekly - How would NZ telecoms cope with another cyclone

Bill Bennett: Download Weekly - How would NZ telecoms cope with another cyclone NZ On Air: Firm Audience Favourites Lead NZ On Air Non-Fiction Funding

NZ On Air: Firm Audience Favourites Lead NZ On Air Non-Fiction Funding Insurance and Financial Services Ombudsman: Woman Gets $40k More After Disputing Insurer’s Decision

Insurance and Financial Services Ombudsman: Woman Gets $40k More After Disputing Insurer’s Decision BNZ: A Quarter Of Older NZers Fear Going Online Due To Scam Concerns

BNZ: A Quarter Of Older NZers Fear Going Online Due To Scam Concerns University of Auckland: Scientists Develop Tool To Monitor Coastal Erosion In Fine Detail

University of Auckland: Scientists Develop Tool To Monitor Coastal Erosion In Fine Detail