How To Trade 29th March When Theresa May Triggers Brexit

It is all about trading the event and timing is very

important when it comes to it. The 29th of March is the day

when the British Prime Minister, Theresa May will invoke the

Article 50 and the UK will be entered in divorce

negotiations of leaving the European Union. It may appear

that the date is still far, but it is important as an

investor that you are prepared for it. It is of vital

importance that you know which markets and asset classes

could see the potential impact on this event on that

specific date.

I have always said, so far we have

only seen a trailer of the Brexit film and the actual film

will only be in cinemas after the Article 50 is triggered.

It is only then, that we will start to see the concussions

on the UK’s economy, consumer health, consumer confidence,

housing market and the UK’s job market. There is no doubt

that all these areas have performed relatively well. But,

now it is time to get ready and brace real changes which are

going to hit the economy.

The essential element is

to know your risk profile before you jump into trading this

upcoming event. You need to ask yourself a question; are you

a passive investor – a trader who likes to wait for the

trend to be established first and then trade it? OR are you

an active investor, a trader who likes to get in first

before the trade becomes crowdy?

Nonetheless, there

are four asset classes which could see the potential impact

of Theresa May’s action on the 29th of

March

· Currency

-Sterling

· Equity Market -FTSE

100

· Fixed Income- The UK’s Guilt

market

· Precious Metal –

Gold

Source:

Bloomberg

Since the Brexit vote, it has been very

clear that any weakness in the currency has pushed the

equity market higher. The fixed income market- the UK

Guilts, has been very much dependent on the actions of the

Bank of England. Inflation in the UK has accelerated far

more than many economists have predicted. For the first time

in three-year, the inflation data released for the month

of February has confirmed that the BOE’s inflation target

has been breached. Higher inflation is keeping a constant

pressure on the BOE and the bank needs to increase their

ultra-low-interest-rate to combat this. However, the BOE has

fought back and maintained its position that they can

increase or decrease the interest rate.

So far the

bank has been very accommodating to Brexit woes. After the

29th of March, the bank may have to do more if the economy

slows more than their forecast. The bank can lower their

interest rate or increase the asset purchase programme and

that could potentially push the sterling lower. In the fixed

income market, it means the yields could move lower on the

UK gilts.

As for the equity market, the UK FTSE,

the current relationship with sterling could change. The

firms will be under pressure of higher input costs, but at

the same time, they may be reluctant to pass those higher

prices to consumers. Therefore, the balance sheets of these

firms could have damaging shocks which could pull the FTSE

100 lower.

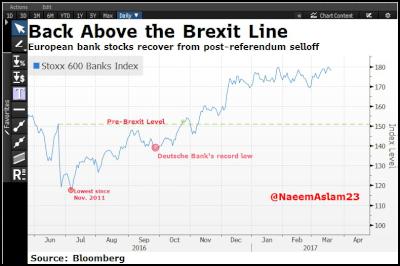

Within the FTSE 100, the sector which

gained the most amount of attention at the time of Brexit

vote was the European banking sector, particularly, the

UK’s bank. The below chart clearly shows that how

investors sold the sector on the back of Brexit referendum

outcome news. Although, we have popped back up and have made

new highs, but a number of investment firms and banks

leaving the UK could only have a negative impact for the

FTSE. The passporting right for investment firm is one of

the biggest challenges for Theresa May which she will have

to fight.

China, the world’s

second biggest economy of the world, is a very important

trading partner for the UK. The UK’s export has fallen the

most among China’s top trading partner and this is going

to make a detrimental impact on the UK’s GDP.

Finally, the

risk-adverse mode is clearly seen when the precious metal

starts to rise. It is highly possible that we may not see

that much of an impact on the 29th of March, but the

consequences of Brexit and negotiation process is going to

create enough headlines which is going to make investors

very

anxious.

Nicola Gaston, The Conversation: NZ Budget 2025 - Science Investment Must Increase As A Proportion Of GDP For NZ To Innovate And Compete

Nicola Gaston, The Conversation: NZ Budget 2025 - Science Investment Must Increase As A Proportion Of GDP For NZ To Innovate And Compete Maritime Union of New Zealand: Maritime Union Condemns Threatened Job Losses On Aratere Ferry

Maritime Union of New Zealand: Maritime Union Condemns Threatened Job Losses On Aratere Ferry Science Media Centre: Proposed Increase To Glyphosate Limits – Expert Reaction

Science Media Centre: Proposed Increase To Glyphosate Limits – Expert Reaction Electricity Authority: Welcomes Plan For Boosting Consumer-Supplied Flexibility

Electricity Authority: Welcomes Plan For Boosting Consumer-Supplied Flexibility University of Auckland: How Can Finance Be Harnessed For Good?

University of Auckland: How Can Finance Be Harnessed For Good? Michael Ryan, The Conversation: NZ Budget 2025 - Economic Forecasting Is Notoriously Difficult, But Global Uncertainty Is Making It Harder

Michael Ryan, The Conversation: NZ Budget 2025 - Economic Forecasting Is Notoriously Difficult, But Global Uncertainty Is Making It Harder